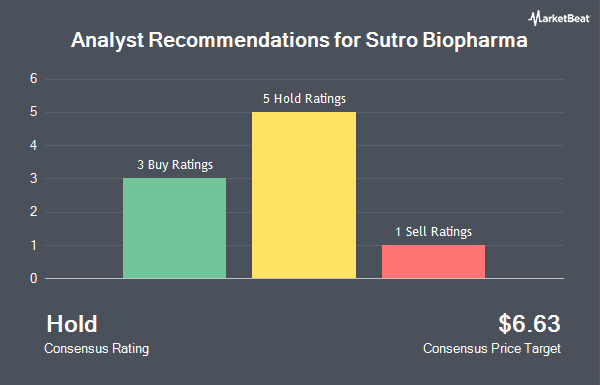

Shares of Sutro Biopharma, Inc. (NASDAQ:STRO - Get Free Report) have earned a consensus rating of "Buy" from the eight analysts that are currently covering the stock, MarketBeat reports. Eight investment analysts have rated the stock with a buy rating. The average 12 month target price among brokers that have covered the stock in the last year is $12.13.

Several equities analysts have commented on the stock. Piper Sandler reissued an "overweight" rating and set a $11.00 target price on shares of Sutro Biopharma in a research report on Friday, October 11th. JMP Securities restated a "market outperform" rating and issued a $17.00 target price on shares of Sutro Biopharma in a report on Monday, September 16th. Truist Financial lowered their price target on Sutro Biopharma from $18.00 to $15.00 and set a "buy" rating on the stock in a report on Friday, August 16th. Finally, HC Wainwright restated a "buy" rating and issued a $12.00 price objective on shares of Sutro Biopharma in a research note on Friday, October 11th.

View Our Latest Stock Analysis on STRO

Sutro Biopharma Stock Performance

Shares of Sutro Biopharma stock traded up $0.30 during trading on Friday, hitting $3.55. 1,242,789 shares of the stock traded hands, compared to its average volume of 425,350. The stock has a market cap of $290.96 million, a P/E ratio of -1.94 and a beta of 1.17. The company has a fifty day moving average price of $3.87 and a two-hundred day moving average price of $3.81. Sutro Biopharma has a twelve month low of $2.01 and a twelve month high of $6.13.

Sutro Biopharma (NASDAQ:STRO - Get Free Report) last posted its earnings results on Tuesday, August 13th. The company reported ($0.59) EPS for the quarter, topping the consensus estimate of ($0.79) by $0.20. The company had revenue of $25.71 million during the quarter, compared to the consensus estimate of $26.28 million. Sutro Biopharma had a negative net margin of 73.48% and a negative return on equity of 102.06%. On average, equities research analysts expect that Sutro Biopharma will post -2.96 EPS for the current fiscal year.

Institutional Trading of Sutro Biopharma

Several hedge funds and other institutional investors have recently bought and sold shares of the stock. Point72 Asset Management L.P. grew its position in Sutro Biopharma by 1,606.1% during the second quarter. Point72 Asset Management L.P. now owns 4,447,634 shares of the company's stock worth $13,032,000 after buying an additional 4,186,938 shares in the last quarter. Jacobs Levy Equity Management Inc. increased its position in shares of Sutro Biopharma by 214.3% during the first quarter. Jacobs Levy Equity Management Inc. now owns 1,069,522 shares of the company's stock valued at $6,043,000 after purchasing an additional 729,239 shares during the period. Acadian Asset Management LLC raised its stake in shares of Sutro Biopharma by 30.8% in the second quarter. Acadian Asset Management LLC now owns 1,574,958 shares of the company's stock valued at $4,613,000 after purchasing an additional 370,705 shares in the last quarter. AQR Capital Management LLC lifted its position in Sutro Biopharma by 691.5% in the second quarter. AQR Capital Management LLC now owns 283,516 shares of the company's stock worth $831,000 after purchasing an additional 247,694 shares during the period. Finally, Renaissance Technologies LLC boosted its stake in Sutro Biopharma by 48.1% during the second quarter. Renaissance Technologies LLC now owns 719,497 shares of the company's stock worth $2,108,000 after buying an additional 233,700 shares in the last quarter. 96.99% of the stock is currently owned by institutional investors and hedge funds.

About Sutro Biopharma

(

Get Free ReportSutro Biopharma, Inc operates as a clinical-stage oncology company. The company develops site-specific and novel-format antibody drug conjugates (ADCs) that enables its proprietary integrated cell-free protein synthesis platform, XpressCF and XpressCF+. Its product candidates include STRO-002, an ADC directed against folate receptor-alpha, which is in Phase II/III clinical trials for patients with ovarian and endometrial cancers; VAX-24 and Vax-31 pneumococcal conjugate vaccine candidates that is in Phase II/III clinical trials for the treatment of invasive pneumococcal disease; and MK-1484, a distinct cytokine derivative molecule that is in Phase I clinical study for the treatment of cancer.

See Also

Before you consider Sutro Biopharma, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sutro Biopharma wasn't on the list.

While Sutro Biopharma currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.