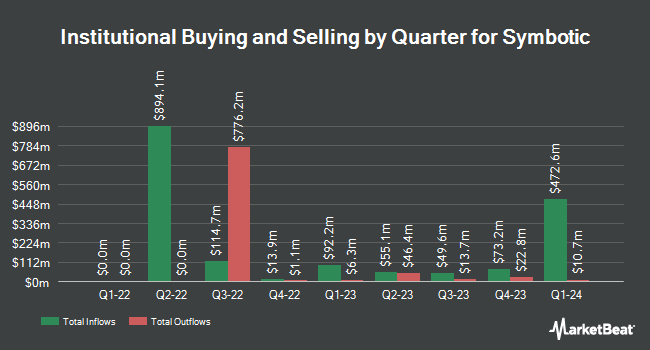

International Assets Investment Management LLC lifted its holdings in shares of Symbotic Inc. (NASDAQ:SYM - Free Report) by 1,273,060.0% in the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 63,658 shares of the company's stock after acquiring an additional 63,653 shares during the quarter. International Assets Investment Management LLC's holdings in Symbotic were worth $1,553,000 as of its most recent filing with the Securities & Exchange Commission.

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in the business. RiverPark Advisors LLC purchased a new position in shares of Symbotic in the 1st quarter valued at approximately $37,000. Castleview Partners LLC lifted its position in Symbotic by 50.0% during the third quarter. Castleview Partners LLC now owns 1,500 shares of the company's stock valued at $37,000 after buying an additional 500 shares during the period. RFP Financial Group LLC boosted its holdings in shares of Symbotic by 22.4% during the 2nd quarter. RFP Financial Group LLC now owns 1,692 shares of the company's stock valued at $59,000 after buying an additional 310 shares in the last quarter. Quarry LP bought a new position in shares of Symbotic in the 2nd quarter worth about $65,000. Finally, Natixis Investment Managers International bought a new stake in Symbotic during the first quarter worth about $90,000.

Wall Street Analysts Forecast Growth

A number of brokerages have weighed in on SYM. KeyCorp decreased their target price on shares of Symbotic from $55.00 to $40.00 and set an "overweight" rating for the company in a research note on Tuesday, July 30th. TD Cowen cut their target price on Symbotic from $55.00 to $43.00 and set a "buy" rating on the stock in a research note on Tuesday, July 30th. Citigroup lowered their price target on Symbotic from $62.00 to $49.00 and set a "buy" rating for the company in a research report on Tuesday, July 30th. The Goldman Sachs Group cut their price objective on shares of Symbotic from $40.00 to $30.00 and set a "neutral" rating on the stock in a research report on Wednesday, July 31st. Finally, Robert W. Baird dropped their target price on shares of Symbotic from $53.00 to $41.00 and set an "outperform" rating on the stock in a research note on Wednesday, July 31st. One analyst has rated the stock with a sell rating, three have given a hold rating and ten have given a buy rating to the stock. According to MarketBeat.com, Symbotic currently has a consensus rating of "Moderate Buy" and a consensus target price of $43.23.

Read Our Latest Stock Analysis on Symbotic

Symbotic Price Performance

Symbotic stock traded up $0.09 during mid-day trading on Monday, reaching $28.53. 461,740 shares of the stock traded hands, compared to its average volume of 1,580,677. Symbotic Inc. has a 12-month low of $17.11 and a 12-month high of $59.82. The business's 50-day moving average is $24.43 and its 200-day moving average is $31.65. The stock has a market capitalization of $16.71 billion, a PE ratio of -150.16 and a beta of 1.81.

Insider Buying and Selling at Symbotic

In other Symbotic news, insider William M. Boyd III sold 8,826 shares of the stock in a transaction that occurred on Monday, October 28th. The shares were sold at an average price of $28.33, for a total value of $250,040.58. Following the transaction, the insider now directly owns 23,012 shares in the company, valued at approximately $651,929.96. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. In related news, Director Todd Krasnow sold 2,000 shares of the stock in a transaction that occurred on Tuesday, October 1st. The shares were sold at an average price of $23.96, for a total value of $47,920.00. Following the completion of the sale, the director now directly owns 2,000 shares of the company's stock, valued at approximately $47,920. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, insider William M. Boyd III sold 8,826 shares of Symbotic stock in a transaction that occurred on Monday, October 28th. The shares were sold at an average price of $28.33, for a total transaction of $250,040.58. Following the transaction, the insider now directly owns 23,012 shares in the company, valued at $651,929.96. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 25,057 shares of company stock worth $660,860 in the last three months. 38.30% of the stock is currently owned by company insiders.

Symbotic Profile

(

Free Report)

Symbotic Inc, an automation technology company, engages in developing technologies to improve operating efficiencies in modern warehouses. The company automates the processing of pallets and cases in large warehouses or distribution centers for retail companies. Its systems enhance operations at the front end of the supply chain.

Further Reading

Before you consider Symbotic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Symbotic wasn't on the list.

While Symbotic currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.