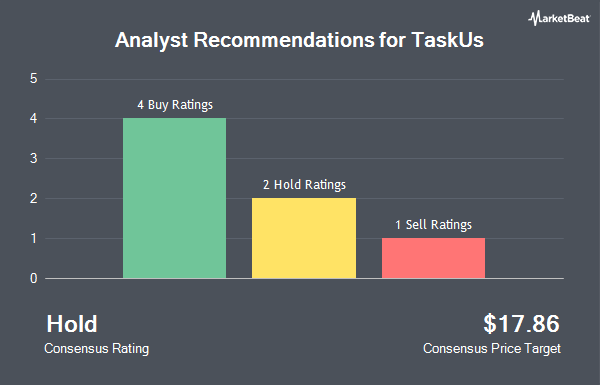

TaskUs, Inc. (NASDAQ:TASK - Get Free Report) has been assigned an average recommendation of "Hold" from the eight ratings firms that are presently covering the firm, MarketBeat reports. One analyst has rated the stock with a sell recommendation, five have assigned a hold recommendation and two have assigned a buy recommendation to the company. The average 12 month price objective among brokerages that have issued ratings on the stock in the last year is $15.38.

Several equities analysts have commented on the stock. JPMorgan Chase & Co. dropped their target price on shares of TaskUs from $17.00 to $15.00 and set a "neutral" rating on the stock in a research report on Friday, September 6th. Citigroup lifted their target price on shares of TaskUs from $18.00 to $19.00 and gave the stock a "buy" rating in a research report on Monday, August 12th. Bank of America raised shares of TaskUs from an "underperform" rating to a "neutral" rating and lifted their target price for the stock from $12.00 to $18.00 in a research report on Monday, July 22nd. Robert W. Baird lifted their target price on shares of TaskUs from $14.00 to $16.00 and gave the stock an "outperform" rating in a research report on Thursday, July 11th. Finally, The Goldman Sachs Group initiated coverage on shares of TaskUs in a report on Monday, June 24th. They issued a "sell" rating and a $12.00 price target on the stock.

View Our Latest Stock Analysis on TASK

Institutional Investors Weigh In On TaskUs

Institutional investors have recently made changes to their positions in the stock. Lord Abbett & CO. LLC boosted its stake in TaskUs by 26.5% in the 1st quarter. Lord Abbett & CO. LLC now owns 744,222 shares of the company's stock worth $8,670,000 after purchasing an additional 155,751 shares during the period. Jacobs Levy Equity Management Inc. boosted its stake in TaskUs by 145.3% in the 1st quarter. Jacobs Levy Equity Management Inc. now owns 120,920 shares of the company's stock worth $1,409,000 after purchasing an additional 71,621 shares during the period. Janney Montgomery Scott LLC boosted its stake in TaskUs by 53.2% in the 1st quarter. Janney Montgomery Scott LLC now owns 107,950 shares of the company's stock worth $1,258,000 after purchasing an additional 37,505 shares during the period. LSV Asset Management bought a new position in TaskUs in the 2nd quarter worth about $990,000. Finally, Dimensional Fund Advisors LP boosted its stake in TaskUs by 15.2% in the 2nd quarter. Dimensional Fund Advisors LP now owns 392,504 shares of the company's stock worth $5,224,000 after purchasing an additional 51,935 shares during the period. Hedge funds and other institutional investors own 44.64% of the company's stock.

TaskUs Stock Down 0.1 %

TASK stock traded down $0.01 during mid-day trading on Friday, reaching $12.11. 129,687 shares of the company traded hands, compared to its average volume of 220,465. The stock has a market cap of $1.07 billion, a price-to-earnings ratio of 22.04, a P/E/G ratio of 3.33 and a beta of 2.29. The company has a quick ratio of 3.23, a current ratio of 3.23 and a debt-to-equity ratio of 0.54. TaskUs has a fifty-two week low of $8.25 and a fifty-two week high of $17.97. The firm's 50 day moving average price is $12.87 and its 200 day moving average price is $13.41.

TaskUs (NASDAQ:TASK - Get Free Report) last released its quarterly earnings results on Thursday, August 8th. The company reported $0.20 earnings per share (EPS) for the quarter, meeting analysts' consensus estimates of $0.20. TaskUs had a return on equity of 16.93% and a net margin of 5.44%. The business had revenue of $237.93 million during the quarter, compared to the consensus estimate of $231.15 million. As a group, equities research analysts predict that TaskUs will post 0.84 EPS for the current fiscal year.

About TaskUs

(

Get Free ReportTaskUs, Inc provides digital outsourcing services for companies in Philippines, the United States, India, and internationally. It offers digital customer experience that consists of omni-channel customer care services primarily delivered through non-voice digital channels; and other solutions, including experience and customer care services for new product or market launches, and customer acquisition solutions.

Read More

Before you consider TaskUs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TaskUs wasn't on the list.

While TaskUs currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.