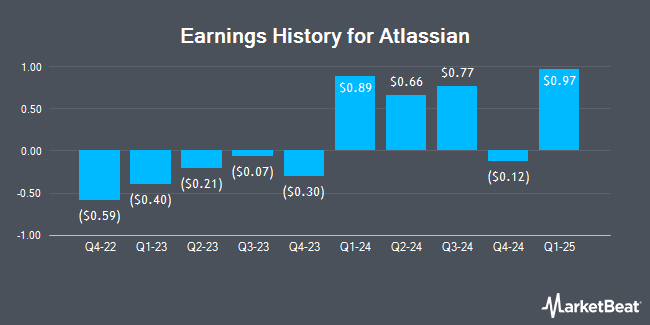

Atlassian (NASDAQ:TEAM - Get Free Report) posted its quarterly earnings results on Thursday. The technology company reported $0.77 earnings per share for the quarter, beating the consensus estimate of $0.64 by $0.13, Briefing.com reports. Atlassian had a negative net margin of 8.59% and a negative return on equity of 23.38%. The firm had revenue of $1.19 billion during the quarter, compared to the consensus estimate of $1.16 billion. During the same period in the previous year, the firm posted ($0.07) earnings per share. The business's revenue was up 21.5% compared to the same quarter last year. Atlassian updated its FY 2025 guidance to EPS and its Q2 2025 guidance to EPS.

Atlassian Stock Performance

Shares of NASDAQ TEAM traded up $35.81 during midday trading on Friday, hitting $224.35. The company's stock had a trading volume of 9,591,126 shares, compared to its average volume of 1,914,822. The stock has a fifty day moving average price of $173.30 and a 200 day moving average price of $171.13. Atlassian has a one year low of $135.29 and a one year high of $258.69. The company has a current ratio of 1.18, a quick ratio of 1.18 and a debt-to-equity ratio of 0.95. The firm has a market capitalization of $58.34 billion, a price-to-earnings ratio of -147.60 and a beta of 0.71.

Insider Activity

In other news, CEO Scott Farquhar sold 7,948 shares of the business's stock in a transaction that occurred on Wednesday, August 7th. The shares were sold at an average price of $140.54, for a total value of $1,117,011.92. Following the sale, the chief executive officer now owns 294,076 shares of the company's stock, valued at $41,329,441.04. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. In related news, President Anutthara Bharadwaj sold 760 shares of the company's stock in a transaction that occurred on Friday, September 20th. The shares were sold at an average price of $163.11, for a total transaction of $123,963.60. Following the sale, the president now owns 143,966 shares of the company's stock, valued at approximately $23,482,294.26. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Also, CEO Scott Farquhar sold 7,948 shares of the company's stock in a transaction that occurred on Wednesday, August 7th. The stock was sold at an average price of $140.54, for a total transaction of $1,117,011.92. Following the sale, the chief executive officer now directly owns 294,076 shares in the company, valued at $41,329,441.04. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 230,185 shares of company stock valued at $39,155,661 over the last quarter. Company insiders own 38.55% of the company's stock.

Wall Street Analyst Weigh In

A number of brokerages have recently issued reports on TEAM. Oppenheimer lifted their price objective on shares of Atlassian from $230.00 to $270.00 and gave the company an "outperform" rating in a report on Friday. Robert W. Baird lifted their price objective on shares of Atlassian from $175.00 to $200.00 and gave the company a "neutral" rating in a report on Friday. Piper Sandler lifted their price objective on shares of Atlassian from $225.00 to $265.00 and gave the company an "overweight" rating in a report on Friday. StockNews.com cut shares of Atlassian from a "buy" rating to a "hold" rating in a report on Friday, July 12th. Finally, Wells Fargo & Company lifted their price objective on shares of Atlassian from $250.00 to $300.00 and gave the company an "overweight" rating in a report on Friday. Nine equities research analysts have rated the stock with a hold rating and fourteen have issued a buy rating to the company. According to MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $243.16.

Read Our Latest Research Report on TEAM

Atlassian Company Profile

(

Get Free Report)

Atlassian Corporation, through its subsidiaries, designs, develops, licenses, and maintains various software products worldwide. Its product portfolio includes Jira Software and Jira Work Management, a project management system that connects technical and business teams so they can better plan, organize, track and manage their work and projects; Confluence, a connected workspace that organizes knowledge across all teams to move work forward; and Trello, a collaboration and organization product that captures and adds structure to fluid and fast-forming work for teams.

Featured Articles

Before you consider Atlassian, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Atlassian wasn't on the list.

While Atlassian currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.