Tenable (NASDAQ:TENB - Get Free Report)'s stock had its "buy" rating reissued by Needham & Company LLC in a report issued on Tuesday, Benzinga reports. They currently have a $50.00 price target on the stock. Needham & Company LLC's price objective points to a potential upside of 19.62% from the company's previous close.

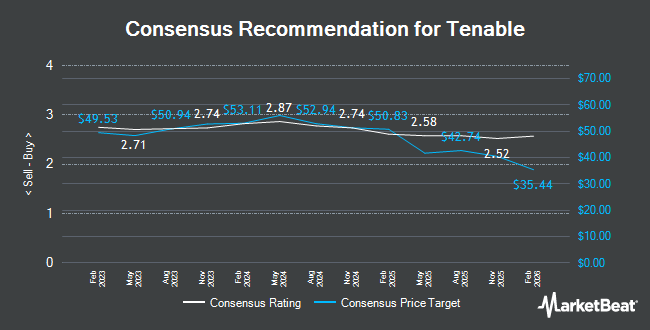

A number of other research firms have also issued reports on TENB. Scotiabank reduced their price target on shares of Tenable from $47.00 to $44.00 and set a "sector perform" rating for the company in a research report on Thursday, August 1st. Truist Financial reissued a "buy" rating and issued a $55.00 price target (down from $60.00) on shares of Tenable in a research report on Thursday, August 1st. Canaccord Genuity Group reduced their price target on shares of Tenable from $57.00 to $53.00 and set a "buy" rating for the company in a research report on Thursday, August 1st. Stifel Nicolaus cut their price objective on shares of Tenable from $54.00 to $52.00 and set a "buy" rating on the stock in a research report on Thursday, August 1st. Finally, Wells Fargo & Company cut their price objective on shares of Tenable from $60.00 to $50.00 and set an "overweight" rating on the stock in a research report on Thursday, August 1st. Five analysts have rated the stock with a hold rating, eleven have assigned a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $51.38.

View Our Latest Research Report on TENB

Tenable Trading Up 2.8 %

Shares of TENB traded up $1.15 during midday trading on Tuesday, hitting $41.80. The stock had a trading volume of 1,387,759 shares, compared to its average volume of 902,605. Tenable has a fifty-two week low of $33.85 and a fifty-two week high of $53.50. The business has a 50-day simple moving average of $40.83 and a two-hundred day simple moving average of $42.32. The firm has a market cap of $4.98 billion, a P/E ratio of -74.28 and a beta of 0.83. The company has a current ratio of 1.21, a quick ratio of 1.21 and a debt-to-equity ratio of 0.98.

Tenable (NASDAQ:TENB - Get Free Report) last announced its earnings results on Wednesday, July 31st. The company reported ($0.05) EPS for the quarter, topping the consensus estimate of ($0.08) by $0.03. The company had revenue of $221.24 million during the quarter, compared to analysts' expectations of $218.41 million. Tenable had a negative net margin of 7.77% and a negative return on equity of 7.63%. As a group, equities analysts forecast that Tenable will post -0.06 EPS for the current year.

Insider Transactions at Tenable

In other news, COO Mark C. Thurmond sold 3,383 shares of the firm's stock in a transaction on Monday, August 26th. The shares were sold at an average price of $41.66, for a total value of $140,935.78. Following the sale, the chief operating officer now owns 34,079 shares in the company, valued at approximately $1,419,731.14. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. In other Tenable news, CEO Amit Yoran sold 5,673 shares of Tenable stock in a transaction on Monday, August 26th. The shares were sold at an average price of $41.75, for a total transaction of $236,847.75. Following the sale, the chief executive officer now owns 39,309 shares in the company, valued at $1,641,150.75. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, COO Mark C. Thurmond sold 3,383 shares of Tenable stock in a transaction on Monday, August 26th. The stock was sold at an average price of $41.66, for a total transaction of $140,935.78. Following the sale, the chief operating officer now owns 34,079 shares in the company, valued at $1,419,731.14. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 12,469 shares of company stock worth $520,276. Insiders own 4.30% of the company's stock.

Institutional Investors Weigh In On Tenable

Several institutional investors and hedge funds have recently made changes to their positions in TENB. Champlain Investment Partners LLC boosted its stake in shares of Tenable by 59.5% in the 1st quarter. Champlain Investment Partners LLC now owns 1,591,147 shares of the company's stock valued at $78,650,000 after purchasing an additional 593,529 shares in the last quarter. William Blair Investment Management LLC boosted its stake in shares of Tenable by 20.2% in the 1st quarter. William Blair Investment Management LLC now owns 3,491,301 shares of the company's stock valued at $172,575,000 after purchasing an additional 585,559 shares in the last quarter. Mackenzie Financial Corp boosted its stake in shares of Tenable by 12.7% in the 2nd quarter. Mackenzie Financial Corp now owns 4,191,935 shares of the company's stock valued at $182,685,000 after purchasing an additional 471,126 shares in the last quarter. The Manufacturers Life Insurance Company boosted its stake in shares of Tenable by 37.7% in the 2nd quarter. The Manufacturers Life Insurance Company now owns 719,012 shares of the company's stock valued at $31,335,000 after purchasing an additional 196,810 shares in the last quarter. Finally, Renaissance Technologies LLC acquired a new stake in shares of Tenable in the 2nd quarter valued at $7,740,000. Institutional investors and hedge funds own 89.06% of the company's stock.

About Tenable

(

Get Free Report)

Tenable Holdings, Inc provides cyber exposure solutions for in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan. Its platforms include Tenable Vulnerability Management, a cloud-delivered software as a service that provides organizations with a risk-based view of traditional and modern attack surfaces; Tenable Cloud Security, a cloud-native cloud security solutions for security teams to continuously assess the security posture; Tenable Identity Exposure, a solution to secure Active Directory environments; Tenable Web App Scanning, which provides scanning for modern web applications; Tenable Lumin Exposure View, a measurement tool; Tenable Attack Surface Management, an external attack surface management solution; Tenable Security Center, an on-premises solution that provides a risk-based view of an organization's IT, security and compliance posture; and Tenable OT Security, an operational technology security solution which provides threat detection, asset tracking, vulnerability management, and configuration control capabilities.

Featured Articles

Before you consider Tenable, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tenable wasn't on the list.

While Tenable currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report