TG Therapeutics (NASDAQ:TGTX - Get Free Report) is set to announce its earnings results before the market opens on Monday, November 4th. Analysts expect the company to announce earnings of $0.04 per share for the quarter. Parties that wish to register for the company's conference call can do so using this link.

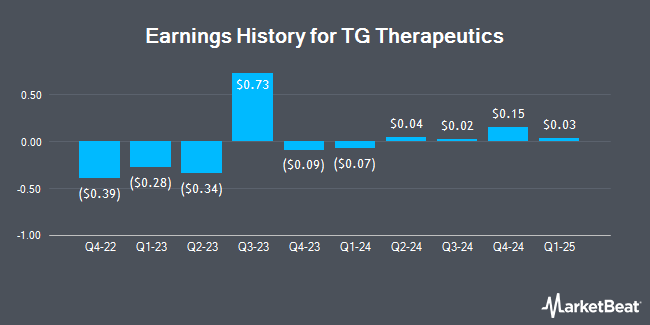

TG Therapeutics (NASDAQ:TGTX - Get Free Report) last posted its earnings results on Tuesday, August 6th. The biopharmaceutical company reported $0.04 earnings per share for the quarter, topping analysts' consensus estimates of ($0.04) by $0.08. TG Therapeutics had a net margin of 27.60% and a return on equity of 57.73%. The business had revenue of $73.47 million for the quarter, compared to analyst estimates of $65.92 million. During the same quarter in the prior year, the firm posted ($0.34) EPS. TG Therapeutics's revenue was up 357.0% on a year-over-year basis. On average, analysts expect TG Therapeutics to post $0 EPS for the current fiscal year and $1 EPS for the next fiscal year.

TG Therapeutics Price Performance

NASDAQ:TGTX traded up $1.84 during trading hours on Friday, hitting $26.90. The stock had a trading volume of 5,726,750 shares, compared to its average volume of 3,619,056. The company has a 50 day simple moving average of $23.51 and a two-hundred day simple moving average of $20.01. The firm has a market capitalization of $4.16 billion, a price-to-earnings ratio of 44.10 and a beta of 2.21. The company has a debt-to-equity ratio of 0.58, a current ratio of 3.58 and a quick ratio of 2.83. TG Therapeutics has a one year low of $9.81 and a one year high of $26.99.

Analyst Ratings Changes

Several research firms recently issued reports on TGTX. HC Wainwright reissued a "buy" rating and set a $49.00 price objective on shares of TG Therapeutics in a research note on Wednesday, September 18th. B. Riley boosted their price objective on TG Therapeutics from $29.00 to $34.00 and gave the stock a "buy" rating in a report on Wednesday, August 7th. TD Cowen assumed coverage on shares of TG Therapeutics in a research report on Tuesday. They issued a "buy" rating and a $50.00 price objective on the stock. Finally, The Goldman Sachs Group lifted their target price on shares of TG Therapeutics from $18.00 to $20.00 and gave the company a "neutral" rating in a research report on Wednesday, August 7th. Two analysts have rated the stock with a hold rating and five have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, TG Therapeutics currently has a consensus rating of "Moderate Buy" and a consensus price target of $36.33.

Check Out Our Latest Analysis on TGTX

About TG Therapeutics

(

Get Free Report)

TG Therapeutics, Inc, a commercial stage biopharmaceutical company, focuses on the acquisition, development, and commercialization of novel treatments for B-cell mediated diseases in the United States and internationally. It provides BRIUMVI, an anti-CD20 monoclonal antibody for the treatment of adult patients with relapsing forms of multiple sclerosis (RMS), including clinically isolated syndrome, relapsing-remitting disease, and active secondary progressive disease in adults.

Read More

Before you consider TG Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TG Therapeutics wasn't on the list.

While TG Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.