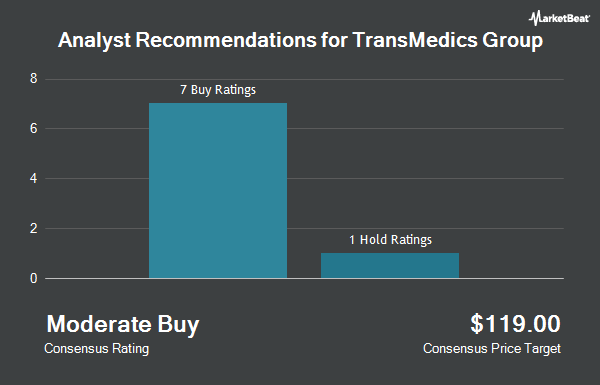

Shares of TransMedics Group, Inc. (NASDAQ:TMDX - Get Free Report) have been given an average rating of "Buy" by the eleven research firms that are covering the firm, Marketbeat.com reports. One equities research analyst has rated the stock with a hold rating, nine have issued a buy rating and one has assigned a strong buy rating to the company. The average 1 year target price among analysts that have issued a report on the stock in the last year is $144.80.

Several equities analysts recently weighed in on the stock. Robert W. Baird cut their price objective on shares of TransMedics Group from $200.00 to $150.00 and set an "outperform" rating on the stock in a report on Tuesday, October 29th. Baird R W upgraded TransMedics Group to a "strong-buy" rating in a research report on Tuesday, September 24th. JPMorgan Chase & Co. decreased their price objective on shares of TransMedics Group from $173.00 to $116.00 and set an "overweight" rating for the company in a report on Tuesday, October 29th. Oppenheimer reduced their price target on shares of TransMedics Group from $200.00 to $125.00 and set an "outperform" rating on the stock in a research report on Tuesday, October 29th. Finally, Piper Sandler reissued an "overweight" rating and issued a $180.00 price target on shares of TransMedics Group in a report on Tuesday, October 29th.

Read Our Latest Stock Report on TMDX

Insider Transactions at TransMedics Group

In related news, insider Anil P. Ranganath sold 4,289 shares of TransMedics Group stock in a transaction that occurred on Wednesday, August 7th. The stock was sold at an average price of $152.20, for a total value of $652,785.80. Following the sale, the insider now owns 8,893 shares of the company's stock, valued at approximately $1,353,514.60. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. In related news, insider Anil P. Ranganath sold 4,289 shares of the firm's stock in a transaction on Wednesday, August 7th. The shares were sold at an average price of $152.20, for a total value of $652,785.80. Following the completion of the transaction, the insider now owns 8,893 shares of the company's stock, valued at approximately $1,353,514.60. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, insider Tamer I. Khayal sold 2,958 shares of the business's stock in a transaction dated Tuesday, October 1st. The stock was sold at an average price of $148.24, for a total transaction of $438,493.92. Following the sale, the insider now directly owns 20,843 shares in the company, valued at $3,089,766.32. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 61,247 shares of company stock valued at $9,518,181 over the last three months. Company insiders own 7.00% of the company's stock.

Institutional Inflows and Outflows

Several institutional investors have recently made changes to their positions in the stock. State of Alaska Department of Revenue acquired a new stake in shares of TransMedics Group in the 3rd quarter valued at approximately $2,560,000. Allspring Global Investments Holdings LLC grew its position in shares of TransMedics Group by 5.3% in the 3rd quarter. Allspring Global Investments Holdings LLC now owns 599,116 shares of the company's stock valued at $94,061,000 after acquiring an additional 30,092 shares during the period. Deerfield Management Company L.P. Series C acquired a new position in shares of TransMedics Group during the 2nd quarter worth about $1,400,000. Handelsbanken Fonder AB raised its holdings in shares of TransMedics Group by 657.6% in the 3rd quarter. Handelsbanken Fonder AB now owns 64,400 shares of the company's stock valued at $10,111,000 after purchasing an additional 55,900 shares during the period. Finally, Russell Investments Group Ltd. lifted its stake in TransMedics Group by 337,462.5% in the 1st quarter. Russell Investments Group Ltd. now owns 27,005 shares of the company's stock valued at $1,997,000 after purchasing an additional 26,997 shares during the last quarter. Institutional investors and hedge funds own 99.67% of the company's stock.

TransMedics Group Trading Up 3.1 %

Shares of NASDAQ TMDX traded up $2.57 during midday trading on Monday, hitting $84.97. The stock had a trading volume of 1,506,721 shares, compared to its average volume of 944,839. The firm has a market cap of $2.85 billion, a P/E ratio of 90.39 and a beta of 2.08. TransMedics Group has a fifty-two week low of $40.01 and a fifty-two week high of $177.37. The company has a debt-to-equity ratio of 2.42, a current ratio of 8.20 and a quick ratio of 8.48. The company's 50-day simple moving average is $138.81 and its 200 day simple moving average is $139.96.

TransMedics Group (NASDAQ:TMDX - Get Free Report) last announced its quarterly earnings data on Monday, October 28th. The company reported $0.12 earnings per share for the quarter, missing the consensus estimate of $0.29 by ($0.17). TransMedics Group had a return on equity of 18.74% and a net margin of 8.14%. The firm had revenue of $108.76 million for the quarter, compared to the consensus estimate of $115.00 million. During the same period in the prior year, the firm posted ($0.12) earnings per share. The business's revenue for the quarter was up 63.7% compared to the same quarter last year. Research analysts anticipate that TransMedics Group will post 1.08 EPS for the current year.

About TransMedics Group

(

Get Free ReportTransMedics Group, Inc, a commercial-stage medical technology company, engages in transforming organ transplant therapy for end-stage organ failure patients in the United States and internationally. The company offers Organ Care System (OCS), a portable organ perfusion, optimization, and monitoring system that utilizes its proprietary and customized technology to replicate near-physiologic conditions for donor organs outside of the human body.

Recommended Stories

Before you consider TransMedics Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TransMedics Group wasn't on the list.

While TransMedics Group currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.