Taylor Frigon Capital Management LLC lessened its holdings in Tower Semiconductor Ltd. (NASDAQ:TSEM - Free Report) by 30.7% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 69,013 shares of the semiconductor company's stock after selling 30,602 shares during the period. Tower Semiconductor comprises about 1.5% of Taylor Frigon Capital Management LLC's portfolio, making the stock its 15th largest holding. Taylor Frigon Capital Management LLC owned 0.06% of Tower Semiconductor worth $3,049,000 at the end of the most recent quarter.

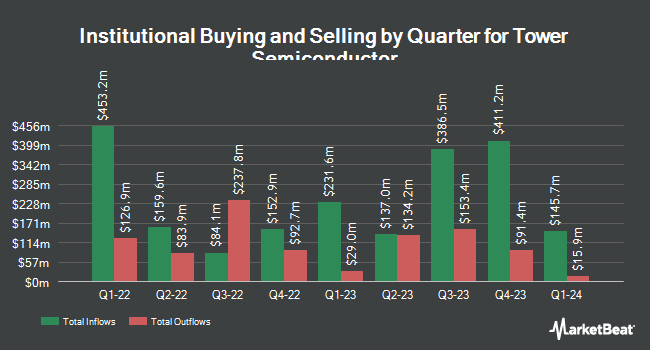

Several other institutional investors and hedge funds have also recently modified their holdings of TSEM. Hodges Capital Management Inc. increased its stake in Tower Semiconductor by 21.2% during the 1st quarter. Hodges Capital Management Inc. now owns 141,700 shares of the semiconductor company's stock worth $4,740,000 after buying an additional 24,800 shares in the last quarter. William Blair Investment Management LLC purchased a new stake in Tower Semiconductor during the 1st quarter worth approximately $34,911,000. Essex Investment Management Co. LLC increased its stake in Tower Semiconductor by 7.5% during the 3rd quarter. Essex Investment Management Co. LLC now owns 179,579 shares of the semiconductor company's stock worth $7,948,000 after buying an additional 12,551 shares in the last quarter. Artemis Investment Management LLP increased its stake in Tower Semiconductor by 96.4% during the 1st quarter. Artemis Investment Management LLP now owns 219,573 shares of the semiconductor company's stock worth $7,343,000 after buying an additional 107,787 shares in the last quarter. Finally, Jennison Associates LLC increased its stake in Tower Semiconductor by 28.1% during the 1st quarter. Jennison Associates LLC now owns 2,650,283 shares of the semiconductor company's stock worth $88,652,000 after buying an additional 580,610 shares in the last quarter. Hedge funds and other institutional investors own 70.51% of the company's stock.

Analyst Upgrades and Downgrades

Several equities research analysts have commented on TSEM shares. StockNews.com lowered Tower Semiconductor from a "strong-buy" rating to a "buy" rating in a research note on Friday, July 19th. Benchmark restated a "buy" rating and set a $55.00 target price on shares of Tower Semiconductor in a report on Monday, September 9th. Four equities research analysts have rated the stock with a buy rating, Based on data from MarketBeat.com, the company currently has an average rating of "Buy" and a consensus price target of $51.33.

Get Our Latest Report on TSEM

Tower Semiconductor Price Performance

Shares of Tower Semiconductor stock traded up $0.17 on Thursday, hitting $44.22. 139,051 shares of the company were exchanged, compared to its average volume of 503,874. The stock has a market capitalization of $4.90 billion, a price-to-earnings ratio of 9.99 and a beta of 0.90. The company has a 50-day moving average price of $42.85 and a 200 day moving average price of $39.26. Tower Semiconductor Ltd. has a 1-year low of $22.30 and a 1-year high of $46.53. The company has a quick ratio of 4.94, a current ratio of 5.90 and a debt-to-equity ratio of 0.05.

Tower Semiconductor (NASDAQ:TSEM - Get Free Report) last released its quarterly earnings data on Wednesday, July 24th. The semiconductor company reported $0.46 EPS for the quarter, beating analysts' consensus estimates of $0.41 by $0.05. Tower Semiconductor had a return on equity of 8.33% and a net margin of 35.58%. The firm had revenue of $351.18 million for the quarter, compared to analysts' expectations of $350.00 million. As a group, sell-side analysts predict that Tower Semiconductor Ltd. will post 1.82 earnings per share for the current fiscal year.

About Tower Semiconductor

(

Free Report)

Tower Semiconductor Ltd., an independent semiconductor foundry, focus on specialty process technologies to manufacture analog intensive mixed-signal semiconductor devices in Israel, the United States, Japan, Europe, and internationally. It provides various customizable process technologies, including SiGe, BiCMOS, mixed signal/CMOS, RF CMOS, CMOS image sensor, integrated power management, and MEMS.

Featured Articles

Before you consider Tower Semiconductor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tower Semiconductor wasn't on the list.

While Tower Semiconductor currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.