Meitav Investment House Ltd. grew its position in shares of Tower Semiconductor Ltd. (NASDAQ:TSEM - Free Report) by 5.1% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 2,555,530 shares of the semiconductor company's stock after purchasing an additional 123,713 shares during the period. Tower Semiconductor makes up 1.9% of Meitav Investment House Ltd.'s portfolio, making the stock its 15th biggest holding. Meitav Investment House Ltd. owned about 2.31% of Tower Semiconductor worth $113,220,000 at the end of the most recent quarter.

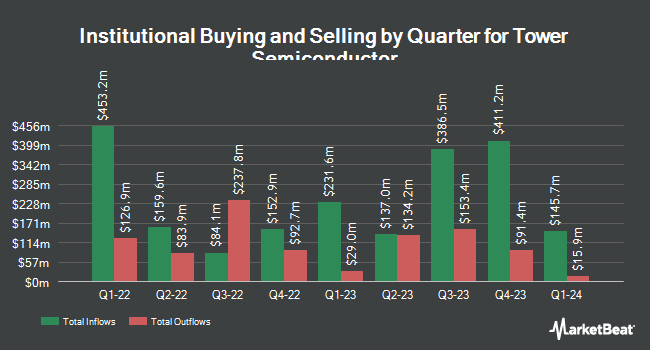

A number of other hedge funds have also recently made changes to their positions in the company. Truist Financial Corp grew its position in shares of Tower Semiconductor by 3.8% during the 2nd quarter. Truist Financial Corp now owns 7,432 shares of the semiconductor company's stock valued at $292,000 after purchasing an additional 273 shares in the last quarter. Signaturefd LLC grew its position in shares of Tower Semiconductor by 21.1% during the 3rd quarter. Signaturefd LLC now owns 2,472 shares of the semiconductor company's stock valued at $109,000 after purchasing an additional 431 shares in the last quarter. TD Asset Management Inc grew its position in shares of Tower Semiconductor by 3.2% during the 2nd quarter. TD Asset Management Inc now owns 16,156 shares of the semiconductor company's stock valued at $623,000 after purchasing an additional 506 shares in the last quarter. USA Financial Formulas purchased a new position in Tower Semiconductor in the third quarter worth $38,000. Finally, Blue Trust Inc. grew its position in Tower Semiconductor by 319.3% in the third quarter. Blue Trust Inc. now owns 1,807 shares of the semiconductor company's stock worth $80,000 after acquiring an additional 1,376 shares in the last quarter. 70.51% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

TSEM has been the subject of several research reports. Benchmark reiterated a "buy" rating and issued a $55.00 target price on shares of Tower Semiconductor in a research report on Monday, September 9th. StockNews.com lowered shares of Tower Semiconductor from a "strong-buy" rating to a "buy" rating in a research report on Friday, July 19th. Four research analysts have rated the stock with a buy rating, According to data from MarketBeat, the company has a consensus rating of "Buy" and a consensus price target of $51.33.

Read Our Latest Stock Analysis on Tower Semiconductor

Tower Semiconductor Trading Down 3.1 %

Tower Semiconductor stock traded down $1.34 during mid-day trading on Thursday, hitting $41.96. The company's stock had a trading volume of 365,877 shares, compared to its average volume of 501,806. The company has a debt-to-equity ratio of 0.05, a current ratio of 5.90 and a quick ratio of 4.94. The stock has a market cap of $4.65 billion, a price-to-earnings ratio of 9.82 and a beta of 0.90. The business has a 50 day moving average price of $43.25 and a 200-day moving average price of $39.65. Tower Semiconductor Ltd. has a 12 month low of $22.30 and a 12 month high of $46.53.

Tower Semiconductor Company Profile

(

Free Report)

Tower Semiconductor Ltd., an independent semiconductor foundry, focus on specialty process technologies to manufacture analog intensive mixed-signal semiconductor devices in Israel, the United States, Japan, Europe, and internationally. It provides various customizable process technologies, including SiGe, BiCMOS, mixed signal/CMOS, RF CMOS, CMOS image sensor, integrated power management, and MEMS.

Further Reading

Before you consider Tower Semiconductor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tower Semiconductor wasn't on the list.

While Tower Semiconductor currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.