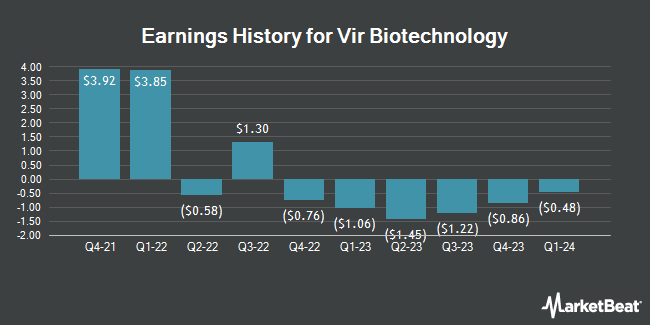

Vir Biotechnology (NASDAQ:VIR - Get Free Report) released its earnings results on Thursday. The company reported ($1.56) earnings per share for the quarter, missing the consensus estimate of ($1.05) by ($0.51), Briefing.com reports. Vir Biotechnology had a negative net margin of 678.40% and a negative return on equity of 35.00%. The company had revenue of $2.38 million during the quarter, compared to the consensus estimate of $5.54 million. During the same quarter in the previous year, the business posted ($1.22) EPS. The firm's quarterly revenue was down 9.8% on a year-over-year basis.

Vir Biotechnology Price Performance

VIR opened at $9.26 on Friday. The company's 50 day simple moving average is $7.75 and its 200-day simple moving average is $8.87. Vir Biotechnology has a one year low of $7.12 and a one year high of $13.09. The stock has a market capitalization of $1.27 billion, a P/E ratio of -2.36 and a beta of 0.46.

Analyst Upgrades and Downgrades

VIR has been the subject of a number of recent research reports. HC Wainwright restated a "buy" rating and issued a $110.00 target price on shares of Vir Biotechnology in a research note on Tuesday, August 20th. Barclays upped their price objective on Vir Biotechnology from $27.00 to $28.00 and gave the company an "overweight" rating in a research note on Friday, August 2nd. Finally, Needham & Company LLC restated a "buy" rating and set a $19.00 target price on shares of Vir Biotechnology in a research report on Friday. Two analysts have rated the stock with a hold rating and three have given a buy rating to the stock. According to MarketBeat.com, Vir Biotechnology currently has a consensus rating of "Moderate Buy" and a consensus price target of $36.80.

Check Out Our Latest Analysis on VIR

Insider Buying and Selling at Vir Biotechnology

In other news, Director Janet Napolitano sold 12,190 shares of the company's stock in a transaction on Monday, September 9th. The stock was sold at an average price of $7.80, for a total transaction of $95,082.00. Following the transaction, the director now owns 11,616 shares of the company's stock, valued at $90,604.80. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available through this link. Corporate insiders own 15.60% of the company's stock.

Vir Biotechnology Company Profile

(

Get Free Report)

Vir Biotechnology, Inc, an immunology company, develops therapeutic products to treat and prevent serious infectious diseases. Its clinical development pipeline consists of product candidates targeting hepatitis delta virus (HDV), hepatitis B virus (HBV), and human immunodeficiency virus (HIV). The company's preclinical candidates include those targeting influenza A and B, coronavirus disease 2019, respiratory syncytial virus (RSV) and human metapneumovirus (MPV), and human papillomavirus (HPV).

Recommended Stories

Before you consider Vir Biotechnology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vir Biotechnology wasn't on the list.

While Vir Biotechnology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.