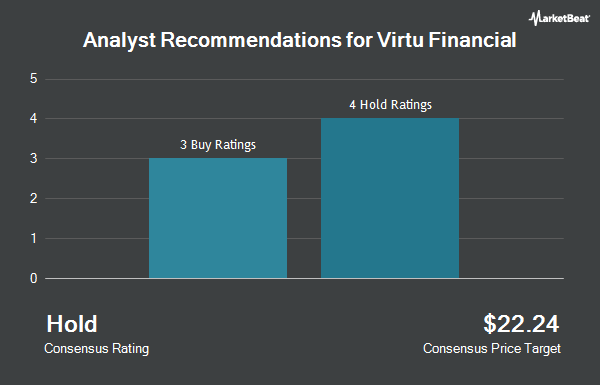

Shares of Virtu Financial, Inc. (NASDAQ:VIRT - Get Free Report) have been given a consensus rating of "Hold" by the seven brokerages that are currently covering the firm, Marketbeat reports. Four analysts have rated the stock with a hold rating and three have given a buy rating to the company. The average 12 month price objective among brokerages that have updated their coverage on the stock in the last year is $29.50.

Several equities research analysts recently weighed in on the stock. Piper Sandler reaffirmed an "overweight" rating and set a $35.00 target price on shares of Virtu Financial in a research note on Thursday. Citigroup upped their target price on shares of Virtu Financial from $32.00 to $37.00 and gave the stock a "buy" rating in a research note on Wednesday, October 9th. Morgan Stanley upped their target price on shares of Virtu Financial from $23.00 to $25.00 and gave the stock an "equal weight" rating in a research note on Thursday, October 17th. The Goldman Sachs Group upped their target price on shares of Virtu Financial from $26.00 to $29.00 and gave the stock a "neutral" rating in a research note on Monday, September 30th. Finally, Bank of America cut their target price on shares of Virtu Financial from $37.00 to $35.00 and set a "buy" rating on the stock in a research note on Thursday, October 3rd.

Get Our Latest Report on Virtu Financial

Insider Activity

In other news, Director Virginia Gambale sold 5,400 shares of the company's stock in a transaction on Monday, August 5th. The shares were sold at an average price of $27.30, for a total value of $147,420.00. Following the completion of the transaction, the director now owns 24,122 shares in the company, valued at approximately $658,530.60. This represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through this link. Company insiders own 46.70% of the company's stock.

Institutional Inflows and Outflows

Large investors have recently modified their holdings of the stock. First Horizon Advisors Inc. raised its position in Virtu Financial by 21.0% in the 2nd quarter. First Horizon Advisors Inc. now owns 2,143 shares of the financial services provider's stock valued at $48,000 after purchasing an additional 372 shares during the last quarter. Abich Financial Wealth Management LLC raised its position in Virtu Financial by 22.2% in the 2nd quarter. Abich Financial Wealth Management LLC now owns 2,680 shares of the financial services provider's stock valued at $60,000 after purchasing an additional 487 shares during the last quarter. Mercer Global Advisors Inc. ADV raised its position in Virtu Financial by 3.1% in the 2nd quarter. Mercer Global Advisors Inc. ADV now owns 19,421 shares of the financial services provider's stock valued at $436,000 after purchasing an additional 587 shares during the last quarter. First Bank & Trust raised its position in Virtu Financial by 3.9% in the 1st quarter. First Bank & Trust now owns 19,614 shares of the financial services provider's stock valued at $402,000 after purchasing an additional 734 shares during the last quarter. Finally, Legacy Capital Group California Inc. raised its position in Virtu Financial by 8.0% in the 3rd quarter. Legacy Capital Group California Inc. now owns 12,044 shares of the financial services provider's stock valued at $367,000 after purchasing an additional 888 shares during the last quarter. Institutional investors and hedge funds own 45.78% of the company's stock.

Virtu Financial Trading Up 0.4 %

Shares of Virtu Financial stock traded up $0.11 on Friday, reaching $30.97. The company had a trading volume of 1,104,090 shares, compared to its average volume of 1,282,295. Virtu Financial has a 52-week low of $16.02 and a 52-week high of $33.55. The firm's 50 day moving average price is $31.41 and its two-hundred day moving average price is $26.52. The firm has a market cap of $4.87 billion, a PE ratio of 21.66, a PEG ratio of 0.49 and a beta of 0.38. The company has a debt-to-equity ratio of 1.22, a quick ratio of 0.43 and a current ratio of 0.43.

Virtu Financial Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Sunday, December 15th. Shareholders of record on Sunday, December 1st will be issued a dividend of $0.24 per share. This represents a $0.96 annualized dividend and a yield of 3.10%. The ex-dividend date is Sunday, December 1st. Virtu Financial's dividend payout ratio (DPR) is presently 67.13%.

About Virtu Financial

(

Get Free ReportVirtu Financial, Inc operates as a financial services company in the United States, Asia Pacific, Canada, EMEA, Ireland, and internationally. The company operates through two segments, Market Making and Execution Services. Its product includes offerings in execution, liquidity sourcing, analytics and broker-neutral, capital markets, and multi-dealer platforms in workflow technology.

Recommended Stories

Before you consider Virtu Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Virtu Financial wasn't on the list.

While Virtu Financial currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.