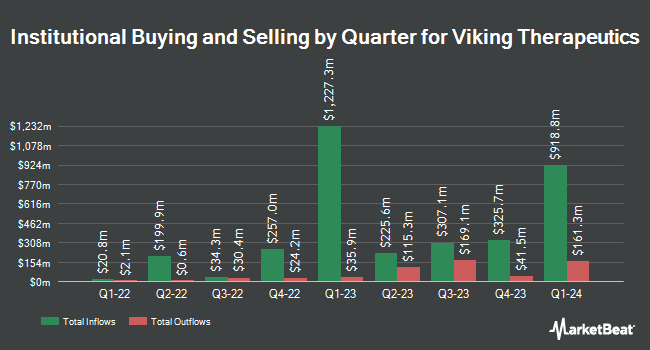

International Assets Investment Management LLC lifted its holdings in shares of Viking Therapeutics, Inc. (NASDAQ:VKTX - Free Report) by 10,775.6% in the third quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 1,004,033 shares of the biotechnology company's stock after buying an additional 994,801 shares during the period. International Assets Investment Management LLC owned about 0.91% of Viking Therapeutics worth $63,565,000 as of its most recent filing with the SEC.

Several other institutional investors and hedge funds have also modified their holdings of the business. Blue Trust Inc. bought a new position in shares of Viking Therapeutics in the 3rd quarter valued at $26,000. Thurston Springer Miller Herd & Titak Inc. acquired a new position in Viking Therapeutics in the 2nd quarter worth about $27,000. GAMMA Investing LLC raised its position in Viking Therapeutics by 124.6% in the third quarter. GAMMA Investing LLC now owns 438 shares of the biotechnology company's stock valued at $28,000 after purchasing an additional 243 shares during the last quarter. Gilliland Jeter Wealth Management LLC acquired a new stake in shares of Viking Therapeutics during the third quarter valued at about $32,000. Finally, Massmutual Trust Co. FSB ADV grew its holdings in shares of Viking Therapeutics by 84.3% during the third quarter. Massmutual Trust Co. FSB ADV now owns 553 shares of the biotechnology company's stock worth $35,000 after purchasing an additional 253 shares during the last quarter. 76.03% of the stock is currently owned by institutional investors.

Insiders Place Their Bets

In other Viking Therapeutics news, COO Marianna Mancini sold 18,026 shares of the stock in a transaction that occurred on Tuesday, July 30th. The stock was sold at an average price of $57.13, for a total value of $1,029,825.38. Following the transaction, the chief operating officer now owns 362,149 shares in the company, valued at approximately $20,689,572.37. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. In other Viking Therapeutics news, COO Marianna Mancini sold 18,026 shares of the stock in a transaction that occurred on Tuesday, July 30th. The stock was sold at an average price of $57.13, for a total value of $1,029,825.38. Following the transaction, the chief operating officer now owns 362,149 shares in the company, valued at approximately $20,689,572.37. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, CEO Brian Lian sold 115,859 shares of the stock in a transaction that occurred on Tuesday, July 30th. The stock was sold at an average price of $57.58, for a total value of $6,671,161.22. Following the completion of the transaction, the chief executive officer now owns 2,354,927 shares in the company, valued at approximately $135,596,696.66. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 527,671 shares of company stock worth $34,700,603. Corporate insiders own 4.70% of the company's stock.

Viking Therapeutics Price Performance

Shares of Viking Therapeutics stock traded up $4.81 on Friday, hitting $78.03. 9,163,105 shares of the company's stock traded hands, compared to its average volume of 4,374,743. Viking Therapeutics, Inc. has a one year low of $8.28 and a one year high of $99.41. The company has a fifty day moving average of $63.67 and a two-hundred day moving average of $61.61. The company has a market capitalization of $8.60 billion, a price-to-earnings ratio of -83.90 and a beta of 1.00.

Viking Therapeutics (NASDAQ:VKTX - Get Free Report) last announced its earnings results on Wednesday, October 23rd. The biotechnology company reported ($0.22) EPS for the quarter, beating the consensus estimate of ($0.24) by $0.02. During the same period in the prior year, the business posted ($0.23) EPS. Equities research analysts anticipate that Viking Therapeutics, Inc. will post -1 earnings per share for the current year.

Analyst Ratings Changes

A number of brokerages recently issued reports on VKTX. HC Wainwright reiterated a "buy" rating and issued a $90.00 price objective on shares of Viking Therapeutics in a report on Thursday. Morgan Stanley reaffirmed an "overweight" rating and set a $105.00 price target on shares of Viking Therapeutics in a research note on Thursday, September 12th. Raymond James upped their price target on Viking Therapeutics from $116.00 to $118.00 and gave the company a "strong-buy" rating in a research report on Thursday, July 25th. JPMorgan Chase & Co. assumed coverage on Viking Therapeutics in a research report on Wednesday, September 11th. They set an "overweight" rating and a $80.00 price objective for the company. Finally, StockNews.com raised Viking Therapeutics to a "sell" rating in a research note on Tuesday, October 15th. One research analyst has rated the stock with a sell rating, ten have given a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat, the company has an average rating of "Moderate Buy" and a consensus target price of $108.60.

View Our Latest Report on VKTX

About Viking Therapeutics

(

Free Report)

Viking Therapeutics, Inc, a clinical-stage biopharmaceutical company, focuses on the development of novel therapies for metabolic and endocrine disorders. The company's lead drug candidate is VK2809, an orally available tissue and receptor-subtype selective agonist of the thyroid hormone receptor beta (TRß), which is in Phase IIb clinical trials to treat patients with biopsy-confirmed non-alcoholic steatohepatitis, as well as NAFLD.

Featured Stories

Before you consider Viking Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Viking Therapeutics wasn't on the list.

While Viking Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.