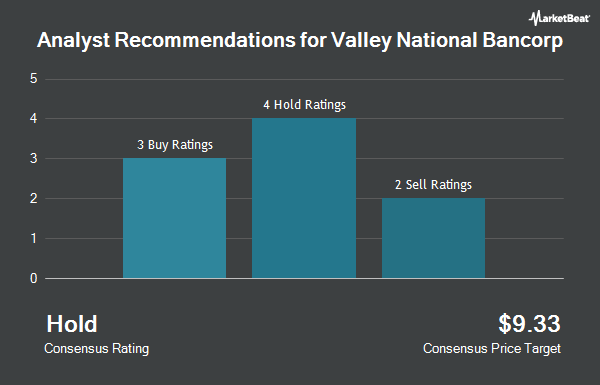

Shares of Valley National Bancorp (NASDAQ:VLY - Get Free Report) have earned a consensus recommendation of "Hold" from the eight brokerages that are covering the firm, MarketBeat.com reports. Seven equities research analysts have rated the stock with a hold rating and one has issued a buy rating on the company. The average 1-year target price among analysts that have covered the stock in the last year is $9.75.

A number of equities analysts have recently commented on the stock. Keefe, Bruyette & Woods lifted their price target on shares of Valley National Bancorp from $8.00 to $8.50 and gave the stock a "market perform" rating in a report on Friday, July 26th. Piper Sandler lifted their price target on shares of Valley National Bancorp from $9.00 to $10.00 and gave the stock a "neutral" rating in a report on Friday, October 25th. StockNews.com lowered shares of Valley National Bancorp from a "hold" rating to a "sell" rating in a report on Wednesday, August 14th. Wedbush reiterated a "neutral" rating and set a $10.00 price target on shares of Valley National Bancorp in a report on Friday, October 25th. Finally, JPMorgan Chase & Co. lifted their target price on shares of Valley National Bancorp from $9.00 to $10.00 and gave the stock a "neutral" rating in a research note on Wednesday, October 9th.

View Our Latest Research Report on Valley National Bancorp

Valley National Bancorp Price Performance

Valley National Bancorp stock traded down $0.05 during mid-day trading on Friday, reaching $9.42. The company had a trading volume of 3,855,882 shares, compared to its average volume of 5,033,248. Valley National Bancorp has a fifty-two week low of $6.47 and a fifty-two week high of $11.22. The company has a current ratio of 0.99, a quick ratio of 0.97 and a debt-to-equity ratio of 0.50. The company has a market cap of $4.80 billion, a P/E ratio of 15.19 and a beta of 1.06. The business has a fifty day simple moving average of $8.89 and a 200 day simple moving average of $7.97.

Valley National Bancorp (NASDAQ:VLY - Get Free Report) last issued its earnings results on Thursday, October 24th. The company reported $0.18 earnings per share for the quarter, meeting analysts' consensus estimates of $0.18. The firm had revenue of $921.22 million for the quarter, compared to analyst estimates of $467.87 million. Valley National Bancorp had a net margin of 9.42% and a return on equity of 5.87%. During the same quarter last year, the business posted $0.26 earnings per share. On average, equities research analysts predict that Valley National Bancorp will post 0.67 earnings per share for the current year.

Valley National Bancorp Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Tuesday, October 1st. Shareholders of record on Friday, September 13th were paid a $0.11 dividend. This represents a $0.44 annualized dividend and a yield of 4.67%. The ex-dividend date was Friday, September 13th. Valley National Bancorp's dividend payout ratio (DPR) is currently 70.97%.

Institutional Investors Weigh In On Valley National Bancorp

Several hedge funds and other institutional investors have recently bought and sold shares of the stock. AQR Capital Management LLC grew its holdings in shares of Valley National Bancorp by 193.2% during the second quarter. AQR Capital Management LLC now owns 10,173,791 shares of the company's stock valued at $69,233,000 after buying an additional 6,703,552 shares during the last quarter. Millennium Management LLC grew its holdings in shares of Valley National Bancorp by 995.0% during the second quarter. Millennium Management LLC now owns 2,775,698 shares of the company's stock valued at $19,374,000 after buying an additional 2,522,204 shares during the last quarter. Stieven Capital Advisors L.P. acquired a new position in shares of Valley National Bancorp during the first quarter valued at about $6,618,000. BNP Paribas Financial Markets grew its holdings in shares of Valley National Bancorp by 378.4% during the first quarter. BNP Paribas Financial Markets now owns 612,314 shares of the company's stock valued at $4,874,000 after buying an additional 484,332 shares during the last quarter. Finally, Point72 Asset Management L.P. grew its holdings in shares of Valley National Bancorp by 461.7% during the second quarter. Point72 Asset Management L.P. now owns 567,303 shares of the company's stock valued at $3,960,000 after buying an additional 466,303 shares during the last quarter. 61.00% of the stock is owned by institutional investors.

About Valley National Bancorp

(

Get Free ReportValley National Bancorp operates as the holding company for Valley National Bank that provides various commercial, private banking, retail, insurance, and wealth management financial services products. It operates through Consumer Banking, Commercial Banking, and Treasury and Corporate other segments.

Recommended Stories

Before you consider Valley National Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Valley National Bancorp wasn't on the list.

While Valley National Bancorp currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.