Viper Energy (NASDAQ:VNOM - Free Report) had its price objective increased by Truist Financial from $54.00 to $57.00 in a research note published on Monday morning, Benzinga reports. Truist Financial currently has a buy rating on the oil and gas producer's stock.

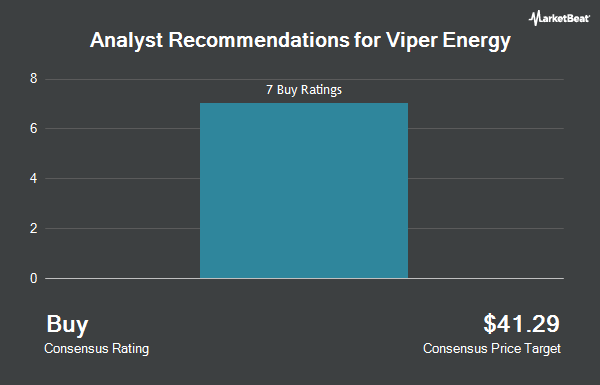

Several other research firms have also recently issued reports on VNOM. TD Securities lifted their price objective on shares of Viper Energy from $46.00 to $48.00 and gave the stock a "buy" rating in a research report on Thursday, September 12th. Barclays upped their price objective on Viper Energy from $44.00 to $47.00 and gave the stock an "overweight" rating in a research report on Tuesday, August 6th. Evercore ISI raised their target price on Viper Energy from $37.00 to $45.00 and gave the stock an "outperform" rating in a research report on Monday, July 8th. Roth Mkm increased their price target on shares of Viper Energy from $46.00 to $53.00 and gave the company a "buy" rating in a research note on Wednesday, October 16th. Finally, JPMorgan Chase & Co. raised their price objective on shares of Viper Energy from $41.00 to $44.00 and gave the stock an "overweight" rating in a report on Wednesday, October 2nd. One research analyst has rated the stock with a hold rating and eight have given a buy rating to the company. Based on data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $49.00.

Check Out Our Latest Stock Analysis on VNOM

Viper Energy Stock Up 0.7 %

NASDAQ VNOM traded up $0.34 during trading hours on Monday, hitting $51.63. 720,471 shares of the company were exchanged, compared to its average volume of 1,110,338. The company has a quick ratio of 7.06, a current ratio of 7.06 and a debt-to-equity ratio of 0.35. The firm has a market cap of $9.13 billion, a price-to-earnings ratio of 17.57 and a beta of 1.73. The company has a 50 day moving average of $47.36 and a two-hundred day moving average of $41.98. Viper Energy has a 52-week low of $27.61 and a 52-week high of $52.32.

Viper Energy (NASDAQ:VNOM - Get Free Report) last released its earnings results on Monday, August 5th. The oil and gas producer reported $0.61 earnings per share for the quarter, topping analysts' consensus estimates of $0.42 by $0.19. Viper Energy had a net margin of 25.63% and a return on equity of 8.46%. The firm had revenue of $216.71 million for the quarter, compared to analyst estimates of $216.28 million. During the same period in the prior year, the firm earned $0.47 earnings per share. The business's quarterly revenue was up 34.8% compared to the same quarter last year. Equities research analysts anticipate that Viper Energy will post 1.99 earnings per share for the current year.

Viper Energy Cuts Dividend

The firm also recently declared a quarterly dividend, which was paid on Thursday, August 22nd. Investors of record on Thursday, August 15th were given a $0.30 dividend. The ex-dividend date of this dividend was Thursday, August 15th. This represents a $1.20 annualized dividend and a yield of 2.32%. Viper Energy's dividend payout ratio (DPR) is 41.10%.

Hedge Funds Weigh In On Viper Energy

Hedge funds and other institutional investors have recently made changes to their positions in the stock. GAMMA Investing LLC raised its stake in Viper Energy by 208.1% during the 3rd quarter. GAMMA Investing LLC now owns 681 shares of the oil and gas producer's stock valued at $31,000 after acquiring an additional 460 shares during the last quarter. International Assets Investment Management LLC acquired a new stake in shares of Viper Energy during the second quarter worth $36,000. Plato Investment Management Ltd grew its position in Viper Energy by 119.2% in the 2nd quarter. Plato Investment Management Ltd now owns 2,834 shares of the oil and gas producer's stock valued at $106,000 after buying an additional 1,541 shares during the last quarter. ORG Partners LLC increased its stake in Viper Energy by 962.3% in the 2nd quarter. ORG Partners LLC now owns 2,815 shares of the oil and gas producer's stock valued at $107,000 after buying an additional 2,550 shares during the period. Finally, Allspring Global Investments Holdings LLC purchased a new position in Viper Energy during the 3rd quarter worth $144,000. Hedge funds and other institutional investors own 87.72% of the company's stock.

About Viper Energy

(

Get Free Report)

Viper Energy, Inc owns and acquires mineral and royalty interests in oil and natural gas properties in the Permian Basin, North America. Viper Energy Partners GP LLC operates as the general partner of the company. The company was formerly known as Viper Energy Partners LP and changed its name to Viper Energy, Inc in November 2023.

Further Reading

Before you consider Viper Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Viper Energy wasn't on the list.

While Viper Energy currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.