Allspring Global Investments Holdings LLC lowered its position in Verint Systems Inc. (NASDAQ:VRNT - Free Report) by 49.5% in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 84,933 shares of the technology company's stock after selling 83,399 shares during the period. Allspring Global Investments Holdings LLC owned 0.14% of Verint Systems worth $2,151,000 at the end of the most recent reporting period.

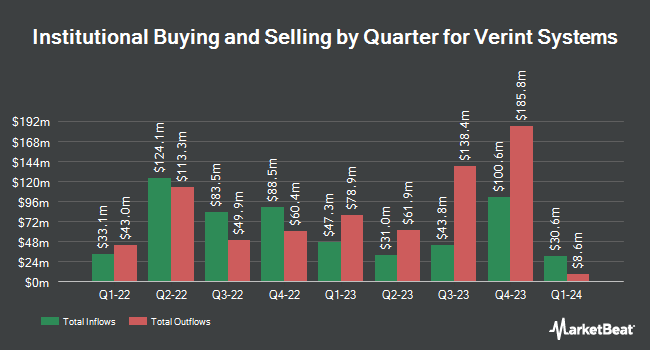

A number of other institutional investors also recently modified their holdings of VRNT. Vanguard Group Inc. raised its position in Verint Systems by 1.0% in the 4th quarter. Vanguard Group Inc. now owns 7,182,580 shares of the technology company's stock worth $194,145,000 after purchasing an additional 73,592 shares during the last quarter. Price T Rowe Associates Inc. MD raised its position in Verint Systems by 46.5% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 104,984 shares of the technology company's stock worth $3,481,000 after purchasing an additional 33,303 shares during the last quarter. Acadian Asset Management LLC raised its position in Verint Systems by 4,185,900.0% in the 2nd quarter. Acadian Asset Management LLC now owns 41,860 shares of the technology company's stock worth $1,345,000 after purchasing an additional 41,859 shares during the last quarter. L & S Advisors Inc bought a new position in Verint Systems in the 2nd quarter worth approximately $1,603,000. Finally, Comerica Bank raised its position in Verint Systems by 572.8% in the 1st quarter. Comerica Bank now owns 44,694 shares of the technology company's stock worth $1,482,000 after purchasing an additional 38,051 shares during the last quarter. Institutional investors own 94.95% of the company's stock.

Verint Systems Trading Up 0.3 %

Shares of VRNT stock traded up $0.07 on Wednesday, hitting $21.94. The stock had a trading volume of 400,540 shares, compared to its average volume of 670,514. Verint Systems Inc. has a twelve month low of $18.45 and a twelve month high of $38.17. The firm has a market cap of $1.35 billion, a P/E ratio of 45.56, a PEG ratio of 0.93 and a beta of 1.24. The company has a current ratio of 1.41, a quick ratio of 1.36 and a debt-to-equity ratio of 0.49. The company has a fifty day moving average price of $25.95 and a two-hundred day moving average price of $30.12.

Verint Systems (NASDAQ:VRNT - Get Free Report) last announced its earnings results on Wednesday, September 4th. The technology company reported $0.49 earnings per share for the quarter, missing analysts' consensus estimates of $0.53 by ($0.04). The company had revenue of $210.17 million during the quarter, compared to analyst estimates of $212.81 million. Verint Systems had a return on equity of 16.17% and a net margin of 6.78%. Verint Systems's revenue for the quarter was up .0% on a year-over-year basis. During the same period in the previous year, the company posted $0.22 earnings per share. As a group, analysts forecast that Verint Systems Inc. will post 1.97 earnings per share for the current fiscal year.

Insider Buying and Selling

In related news, CFO Grant A. Highlander sold 3,389 shares of the company's stock in a transaction on Monday, September 16th. The shares were sold at an average price of $25.85, for a total value of $87,605.65. Following the completion of the transaction, the chief financial officer now directly owns 131,267 shares of the company's stock, valued at approximately $3,393,251.95. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. In other Verint Systems news, President Elan Moriah sold 7,160 shares of the business's stock in a transaction dated Monday, September 16th. The shares were sold at an average price of $25.85, for a total transaction of $185,086.00. Following the sale, the president now directly owns 139,251 shares of the company's stock, valued at $3,599,638.35. The trade was a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available through this link. Also, CFO Grant A. Highlander sold 3,389 shares of the business's stock in a transaction dated Monday, September 16th. The stock was sold at an average price of $25.85, for a total transaction of $87,605.65. Following the sale, the chief financial officer now directly owns 131,267 shares in the company, valued at $3,393,251.95. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 33,811 shares of company stock valued at $874,014. Company insiders own 1.70% of the company's stock.

Analyst Upgrades and Downgrades

A number of analysts have commented on the stock. StockNews.com raised shares of Verint Systems from a "hold" rating to a "buy" rating in a report on Thursday, September 5th. Royal Bank of Canada reaffirmed an "outperform" rating and set a $36.00 target price on shares of Verint Systems in a report on Thursday, September 5th. Needham & Company LLC reaffirmed a "buy" rating and set a $40.00 target price on shares of Verint Systems in a report on Wednesday, September 25th. Wedbush reaffirmed an "outperform" rating and set a $38.00 target price on shares of Verint Systems in a report on Thursday, September 26th. Finally, TD Cowen lowered their target price on shares of Verint Systems from $40.00 to $36.00 and set a "buy" rating for the company in a report on Thursday, September 5th. Three investment analysts have rated the stock with a hold rating and five have given a buy rating to the stock. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and an average target price of $34.67.

Check Out Our Latest Report on VRNT

Verint Systems Profile

(

Free Report)

Verint Systems Inc provides customer engagement solutions worldwide. It offers forecasting and scheduling, channels and routing, knowledge management, fraud and security solutions, quality and compliance, analytics and insights, real-time assistance, self-services, financial compliance, and voice pf the consumer solutions.

Featured Articles

Before you consider Verint Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Verint Systems wasn't on the list.

While Verint Systems currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.