Assenagon Asset Management S.A. purchased a new position in shares of Verint Systems Inc. (NASDAQ:VRNT - Free Report) in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor purchased 83,779 shares of the technology company's stock, valued at approximately $2,122,000. Assenagon Asset Management S.A. owned about 0.14% of Verint Systems as of its most recent filing with the Securities and Exchange Commission (SEC).

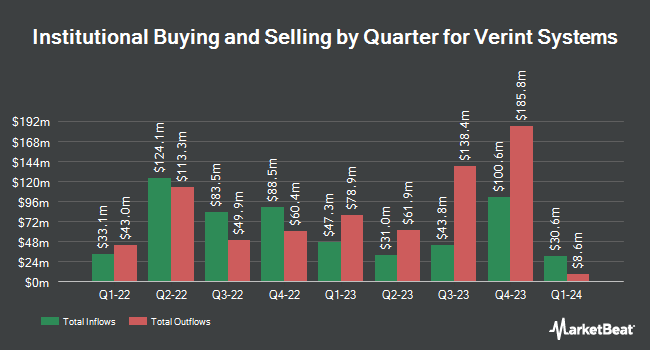

Several other institutional investors also recently bought and sold shares of VRNT. Quarry LP boosted its stake in shares of Verint Systems by 160.9% in the second quarter. Quarry LP now owns 793 shares of the technology company's stock valued at $26,000 after purchasing an additional 489 shares during the period. Fidelis Capital Partners LLC acquired a new position in shares of Verint Systems in the first quarter worth about $30,000. PNC Financial Services Group Inc. boosted its holdings in shares of Verint Systems by 764.2% in the fourth quarter. PNC Financial Services Group Inc. now owns 1,037 shares of the technology company's stock worth $28,000 after buying an additional 917 shares during the period. Innealta Capital LLC purchased a new stake in shares of Verint Systems in the second quarter worth approximately $36,000. Finally, FinTrust Capital Advisors LLC raised its position in Verint Systems by 173.7% during the first quarter. FinTrust Capital Advisors LLC now owns 1,188 shares of the technology company's stock valued at $39,000 after acquiring an additional 754 shares in the last quarter. 94.95% of the stock is currently owned by hedge funds and other institutional investors.

Verint Systems Stock Performance

Shares of VRNT traded up $0.16 during trading hours on Friday, hitting $21.46. The stock had a trading volume of 399,258 shares, compared to its average volume of 668,231. The stock has a fifty day moving average price of $25.72 and a 200 day moving average price of $30.06. Verint Systems Inc. has a 12 month low of $18.87 and a 12 month high of $38.17. The firm has a market capitalization of $1.33 billion, a PE ratio of 31.79, a PEG ratio of 0.93 and a beta of 1.24. The company has a debt-to-equity ratio of 0.49, a current ratio of 1.41 and a quick ratio of 1.36.

Verint Systems (NASDAQ:VRNT - Get Free Report) last issued its quarterly earnings results on Wednesday, September 4th. The technology company reported $0.49 earnings per share for the quarter, missing the consensus estimate of $0.53 by ($0.04). The business had revenue of $210.17 million during the quarter, compared to analyst estimates of $212.81 million. Verint Systems had a return on equity of 16.17% and a net margin of 6.78%. Verint Systems's revenue was up .0% compared to the same quarter last year. During the same period in the prior year, the business posted $0.22 EPS. Analysts anticipate that Verint Systems Inc. will post 1.97 EPS for the current year.

Wall Street Analyst Weigh In

A number of research firms have weighed in on VRNT. Needham & Company LLC reiterated a "buy" rating and set a $40.00 price target on shares of Verint Systems in a research note on Wednesday, September 25th. Royal Bank of Canada restated an "outperform" rating and set a $36.00 target price on shares of Verint Systems in a research report on Thursday, September 5th. Wedbush reiterated an "outperform" rating and issued a $38.00 price objective on shares of Verint Systems in a research report on Thursday, September 26th. Evercore ISI reduced their price target on Verint Systems from $34.00 to $30.00 and set an "in-line" rating for the company in a research report on Thursday, September 5th. Finally, Jefferies Financial Group dropped their price objective on Verint Systems from $32.00 to $28.00 and set a "hold" rating on the stock in a research note on Thursday, September 5th. Three analysts have rated the stock with a hold rating and five have given a buy rating to the company. According to data from MarketBeat, Verint Systems presently has an average rating of "Moderate Buy" and an average price target of $34.67.

Read Our Latest Analysis on VRNT

Insider Activity

In other Verint Systems news, CFO Grant A. Highlander sold 3,389 shares of Verint Systems stock in a transaction on Monday, September 16th. The shares were sold at an average price of $25.85, for a total value of $87,605.65. Following the completion of the transaction, the chief financial officer now owns 131,267 shares of the company's stock, valued at $3,393,251.95. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available through this link. In related news, CEO Dan Bodner sold 16,932 shares of the business's stock in a transaction that occurred on Monday, September 16th. The stock was sold at an average price of $25.85, for a total value of $437,692.20. Following the completion of the sale, the chief executive officer now owns 592,832 shares of the company's stock, valued at approximately $15,324,707.20. The trade was a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through this link. Also, CFO Grant A. Highlander sold 3,389 shares of the company's stock in a transaction that occurred on Monday, September 16th. The stock was sold at an average price of $25.85, for a total value of $87,605.65. Following the transaction, the chief financial officer now owns 131,267 shares of the company's stock, valued at approximately $3,393,251.95. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 33,811 shares of company stock worth $874,014 over the last three months. 1.70% of the stock is currently owned by corporate insiders.

Verint Systems Profile

(

Free Report)

Verint Systems Inc provides customer engagement solutions worldwide. It offers forecasting and scheduling, channels and routing, knowledge management, fraud and security solutions, quality and compliance, analytics and insights, real-time assistance, self-services, financial compliance, and voice pf the consumer solutions.

Read More

Before you consider Verint Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Verint Systems wasn't on the list.

While Verint Systems currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.