VSE (NASDAQ:VSEC - Get Free Report) will be posting its quarterly earnings results after the market closes on Tuesday, November 5th. Analysts expect VSE to post earnings of $0.63 per share for the quarter. Investors that are interested in registering for the company's conference call can do so using this link.

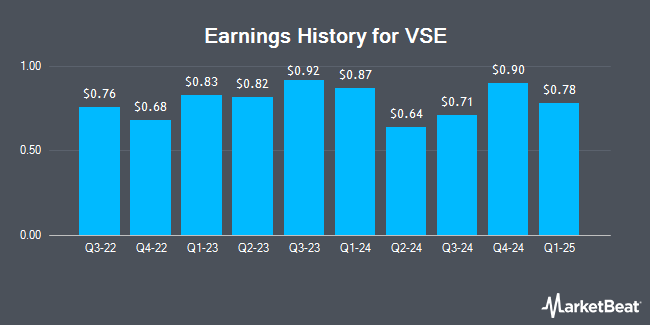

VSE (NASDAQ:VSEC - Get Free Report) last posted its quarterly earnings results on Wednesday, July 31st. The construction company reported $0.64 earnings per share for the quarter, missing analysts' consensus estimates of $0.65 by ($0.01). VSE had a return on equity of 7.87% and a net margin of 1.21%. The firm had revenue of $265.96 million for the quarter, compared to analysts' expectations of $256.60 million. On average, analysts expect VSE to post $3 EPS for the current fiscal year and $5 EPS for the next fiscal year.

VSE Stock Up 0.7 %

NASDAQ:VSEC traded up $0.71 during mid-day trading on Friday, reaching $103.33. The stock had a trading volume of 204,386 shares, compared to its average volume of 144,991. The stock has a market cap of $1.90 billion, a P/E ratio of 32.70 and a beta of 1.60. The business's 50 day moving average is $90.79 and its 200 day moving average is $85.95. The company has a debt-to-equity ratio of 0.55, a current ratio of 3.53 and a quick ratio of 1.17. VSE has a fifty-two week low of $54.65 and a fifty-two week high of $108.30.

Insider Buying and Selling at VSE

In other news, major shareholder Calvin Scott Koonce sold 15,300 shares of the company's stock in a transaction that occurred on Thursday, August 29th. The stock was sold at an average price of $91.83, for a total transaction of $1,404,999.00. Following the completion of the transaction, the insider now directly owns 463,284 shares in the company, valued at $42,543,369.72. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Insiders own 14.60% of the company's stock.

Wall Street Analyst Weigh In

VSEC has been the subject of several analyst reports. Truist Financial lifted their price objective on shares of VSE from $97.00 to $115.00 and gave the company a "buy" rating in a research note on Wednesday, October 16th. Jefferies Financial Group boosted their price target on VSE from $100.00 to $110.00 and gave the stock a "buy" rating in a research report on Thursday, October 17th. Royal Bank of Canada increased their price objective on VSE from $100.00 to $120.00 and gave the company an "outperform" rating in a report on Tuesday, October 22nd. Finally, Benchmark restated a "buy" rating and issued a $100.00 target price on shares of VSE in a report on Friday, August 2nd. One analyst has rated the stock with a sell rating and six have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average price target of $107.83.

Read Our Latest Stock Analysis on VSE

VSE Company Profile

(

Get Free Report)

VSE Corporation operates as a diversified aftermarket products and services company in the United States. The company operates through two segments, Aviation and Fleet. The Aviation segment provides aftermarket parts supply and distribution; maintenance, repair, and overhaul services for components and engine accessories supporting commercial, business, and general aviation operators.

Featured Stories

Before you consider VSE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and VSE wasn't on the list.

While VSE currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.