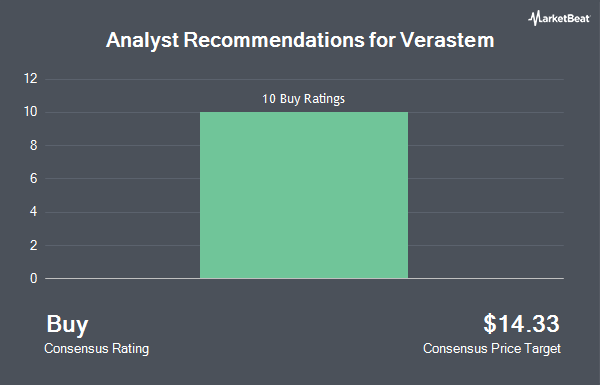

Shares of Verastem, Inc. (NASDAQ:VSTM - Get Free Report) have been assigned a consensus recommendation of "Buy" from the eight brokerages that are presently covering the firm, Marketbeat reports. Eight equities research analysts have rated the stock with a buy rating. The average 12 month price objective among brokerages that have issued a report on the stock in the last year is $14.57.

Several equities research analysts have recently commented on the stock. HC Wainwright reissued a "buy" rating and set a $7.00 target price on shares of Verastem in a research report on Friday. B. Riley reduced their price objective on shares of Verastem from $21.00 to $7.00 and set a "buy" rating for the company in a research report on Wednesday, July 24th. Royal Bank of Canada reaffirmed an "outperform" rating and issued a $13.00 price objective on shares of Verastem in a research report on Friday. Guggenheim started coverage on shares of Verastem in a research report on Monday, September 30th. They issued a "buy" rating and a $13.00 price objective for the company. Finally, StockNews.com raised shares of Verastem from a "sell" rating to a "hold" rating in a research report on Monday, August 12th.

Get Our Latest Research Report on Verastem

Verastem Stock Up 20.6 %

Shares of NASDAQ:VSTM traded up $0.61 during midday trading on Monday, hitting $3.57. 3,217,051 shares of the company's stock were exchanged, compared to its average volume of 553,461. The company has a debt-to-equity ratio of 1.88, a current ratio of 3.28 and a quick ratio of 3.28. The stock has a 50 day moving average price of $2.67 and a 200-day moving average price of $5.01. The company has a market cap of $143.66 million, a PE ratio of -1.04 and a beta of 0.17. Verastem has a 12 month low of $2.10 and a 12 month high of $14.22.

Verastem (NASDAQ:VSTM - Get Free Report) last posted its earnings results on Thursday, August 8th. The biopharmaceutical company reported ($0.31) EPS for the quarter, topping the consensus estimate of ($1.06) by $0.75. The business had revenue of $10.00 million for the quarter. On average, sell-side analysts anticipate that Verastem will post -3.36 EPS for the current fiscal year.

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in the stock. SG Americas Securities LLC purchased a new position in Verastem in the third quarter valued at about $43,000. Nantahala Capital Management LLC purchased a new stake in shares of Verastem during the 2nd quarter valued at approximately $1,192,000. Acadian Asset Management LLC purchased a new stake in shares of Verastem during the 2nd quarter valued at approximately $82,000. Rhumbline Advisers lifted its stake in shares of Verastem by 4,172.0% during the 2nd quarter. Rhumbline Advisers now owns 28,793 shares of the biopharmaceutical company's stock valued at $86,000 after buying an additional 28,119 shares in the last quarter. Finally, Bank of New York Mellon Corp purchased a new stake in shares of Verastem during the 2nd quarter valued at approximately $203,000. 88.37% of the stock is currently owned by hedge funds and other institutional investors.

Verastem Company Profile

(

Get Free ReportVerastem, Inc, a development-stage biopharmaceutical company, focuses on developing and commercializing drugs for the treatment of cancer in the United States. Its product candidates are Avutometinib, an orally available small molecule RAF/MEK clamp that inhibits the ras sarcoma RAF/MEK, ERK mitogen activated pathway kinase pathway which is involved in cell proliferation, migration, transformation, and survival of tumor cells; and Defactinib, an oral small molecule inhibitor of FAK and proline-rich tyrosine kinase for various solid tumors.

Featured Articles

Before you consider Verastem, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Verastem wasn't on the list.

While Verastem currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.