Millennium Management LLC grew its position in Vaxart, Inc. (NASDAQ:VXRT - Free Report) by 110.8% in the second quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm owned 3,985,670 shares of the biotechnology company's stock after acquiring an additional 2,095,274 shares during the quarter. Millennium Management LLC owned 2.25% of Vaxart worth $2,660,000 as of its most recent SEC filing.

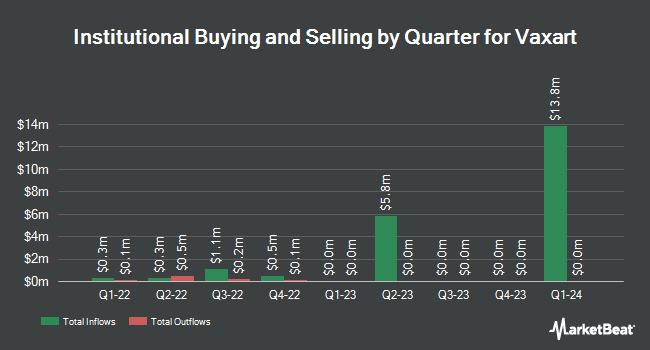

Other institutional investors also recently modified their holdings of the company. RA Capital Management L.P. acquired a new stake in shares of Vaxart during the 1st quarter valued at about $20,000,000. Vanguard Group Inc. grew its stake in shares of Vaxart by 19.9% in the 1st quarter. Vanguard Group Inc. now owns 8,449,362 shares of the biotechnology company's stock valued at $10,984,000 after purchasing an additional 1,404,391 shares during the period. Monaco Asset Management SAM acquired a new position in shares of Vaxart in the 2nd quarter worth approximately $402,000. Sequoia Financial Advisors LLC bought a new position in shares of Vaxart during the 2nd quarter worth approximately $65,000. Finally, Tidal Investments LLC bought a new position in shares of Vaxart during the 1st quarter worth approximately $56,000. Institutional investors and hedge funds own 18.05% of the company's stock.

Vaxart Stock Up 3.7 %

NASDAQ:VXRT traded up $0.03 on Wednesday, reaching $0.81. The stock had a trading volume of 1,343,946 shares, compared to its average volume of 2,621,036. The company has a market capitalization of $144.09 million, a P/E ratio of -1.54 and a beta of 0.66. Vaxart, Inc. has a 1-year low of $0.52 and a 1-year high of $1.54. The stock has a fifty day moving average price of $0.83 and a 200-day moving average price of $0.80.

Vaxart (NASDAQ:VXRT - Get Free Report) last posted its earnings results on Thursday, August 8th. The biotechnology company reported ($0.09) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.03 by ($0.12). Vaxart had a negative net margin of 543.21% and a negative return on equity of 114.19%. The firm had revenue of $6.40 million during the quarter, compared to the consensus estimate of $65.70 million. During the same quarter last year, the firm posted ($0.16) EPS. Sell-side analysts predict that Vaxart, Inc. will post -0.47 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

Separately, Oppenheimer began coverage on Vaxart in a research report on Thursday, August 15th. They issued an "outperform" rating and a $4.00 price target on the stock.

Check Out Our Latest Stock Report on Vaxart

Vaxart Profile

(

Free Report)

Vaxart, Inc, a clinical-stage biotechnology company, discovers and develops oral recombinant protein vaccines based on its proprietary oral vaccine platform. The company's product pipeline includes norovirus vaccine, a bivalent oral tablet vaccine in Phase 2 clinical trial for the GI.1 and GII.4 norovirus strains; coronavirus vaccine, which is in Phase 2 clinical trial, for the treatment of SARS-CoV-2 infection; seasonal influenza vaccine, which is in Phase 2 clinical trial, to treat H1 influenza infection; and human papillomavirus therapeutic vaccine, which is in preclinical stage, that targets HPV-16 and HPV-18 for cervical cancers and precancerous cervical lesions.

Read More

Before you consider Vaxart, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vaxart wasn't on the list.

While Vaxart currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.