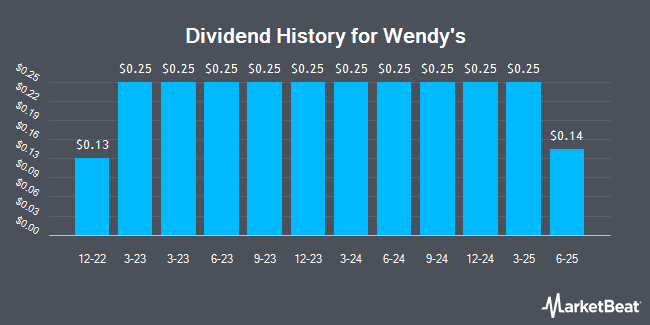

The Wendy's Company (NASDAQ:WEN - Get Free Report) announced a quarterly dividend on Thursday, October 31st, RTT News reports. Investors of record on Monday, December 2nd will be given a dividend of 0.25 per share by the restaurant operator on Monday, December 16th. This represents a $1.00 annualized dividend and a yield of 5.23%.

Wendy's has raised its dividend by an average of 51.1% annually over the last three years. Wendy's has a payout ratio of 94.3% indicating that its dividend is currently covered by earnings, but may not be in the future if the company's earnings decline. Equities research analysts expect Wendy's to earn $1.05 per share next year, which means the company should continue to be able to cover its $1.00 annual dividend with an expected future payout ratio of 95.2%.

Wendy's Stock Down 5.9 %

Shares of WEN stock traded down $1.20 during mid-day trading on Thursday, reaching $19.11. 8,816,878 shares of the company's stock traded hands, compared to its average volume of 3,517,125. Wendy's has a 12 month low of $15.61 and a 12 month high of $20.65. The company has a market cap of $3.92 billion, a P/E ratio of 19.22, a P/E/G ratio of 2.47 and a beta of 0.80. The company has a quick ratio of 2.15, a current ratio of 2.17 and a debt-to-equity ratio of 12.01. The company's 50-day moving average price is $17.92 and its 200-day moving average price is $17.71.

Wendy's (NASDAQ:WEN - Get Free Report) last announced its earnings results on Thursday, August 1st. The restaurant operator reported $0.27 EPS for the quarter, missing analysts' consensus estimates of $0.28 by ($0.01). Wendy's had a net margin of 9.18% and a return on equity of 67.74%. The business had revenue of $570.73 million for the quarter, compared to the consensus estimate of $577.15 million. During the same quarter last year, the firm posted $0.28 EPS. The business's quarterly revenue was up 1.6% on a year-over-year basis. On average, equities analysts expect that Wendy's will post 0.98 earnings per share for the current fiscal year.

Analysts Set New Price Targets

A number of brokerages have recently commented on WEN. Truist Financial dropped their target price on shares of Wendy's from $22.00 to $21.00 and set a "buy" rating on the stock in a report on Tuesday, July 9th. Citigroup lifted their price target on Wendy's from $18.00 to $18.75 and gave the stock a "neutral" rating in a research report on Tuesday, October 8th. Deutsche Bank Aktiengesellschaft lowered their price target on Wendy's from $20.00 to $18.00 and set a "hold" rating for the company in a research report on Friday, August 2nd. Wolfe Research raised Wendy's to a "strong-buy" rating in a research report on Friday, September 13th. Finally, Wedbush reaffirmed a "neutral" rating and issued a $19.50 price target on shares of Wendy's in a research report on Thursday, August 1st. One research analyst has rated the stock with a sell rating, fourteen have given a hold rating, four have given a buy rating and one has given a strong buy rating to the company. According to MarketBeat, Wendy's presently has a consensus rating of "Hold" and a consensus target price of $20.22.

Get Our Latest Stock Analysis on WEN

Insider Activity at Wendy's

In related news, Director Matthew H. Peltz sold 1,000,000 shares of the business's stock in a transaction that occurred on Thursday, August 8th. The stock was sold at an average price of $17.18, for a total transaction of $17,180,000.00. Following the completion of the transaction, the director now directly owns 14,943,466 shares in the company, valued at approximately $256,728,745.88. The trade was a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. 17.10% of the stock is currently owned by corporate insiders.

Wendy's Company Profile

(

Get Free Report)

The Wendy's Company, together with its subsidiaries, operates as a quick-service restaurant company in the United States and internationally. It operates through Wendy's U.S., Wendy's International, and Global Real Estate & Development segments. The company is involved in operating, developing, and franchising a system of quick-service restaurants specializing in hamburger sandwiches.

Featured Articles

Before you consider Wendy's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wendy's wasn't on the list.

While Wendy's currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.