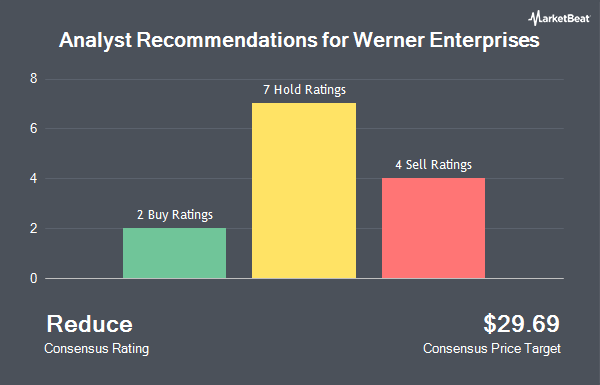

Shares of Werner Enterprises, Inc. (NASDAQ:WERN - Get Free Report) have been given a consensus recommendation of "Reduce" by the fourteen brokerages that are presently covering the firm, MarketBeat reports. Six research analysts have rated the stock with a sell recommendation, five have given a hold recommendation and three have given a buy recommendation to the company. The average 12-month price objective among brokers that have issued a report on the stock in the last year is $37.57.

Several brokerages have commented on WERN. Stifel Nicolaus dropped their target price on shares of Werner Enterprises from $39.00 to $33.00 and set a "hold" rating on the stock in a report on Thursday, August 1st. Evercore ISI reduced their target price on shares of Werner Enterprises from $37.00 to $35.00 and set an "in-line" rating for the company in a research note on Thursday, October 3rd. Morgan Stanley dropped their price target on Werner Enterprises from $57.00 to $56.00 and set an "overweight" rating on the stock in a research note on Monday, July 8th. Stephens cut their price target on Werner Enterprises from $40.00 to $36.00 and set an "equal weight" rating on the stock in a report on Monday, August 5th. Finally, UBS Group downgraded Werner Enterprises from a "buy" rating to a "neutral" rating and set a $39.00 price objective for the company. in a report on Tuesday, July 9th.

Check Out Our Latest Analysis on WERN

Institutional Trading of Werner Enterprises

Several hedge funds and other institutional investors have recently bought and sold shares of WERN. Vanguard Group Inc. increased its holdings in Werner Enterprises by 9.7% in the 4th quarter. Vanguard Group Inc. now owns 6,420,141 shares of the transportation company's stock valued at $272,021,000 after buying an additional 565,193 shares during the period. PNC Financial Services Group Inc. raised its position in Werner Enterprises by 16.3% during the fourth quarter. PNC Financial Services Group Inc. now owns 8,892 shares of the transportation company's stock valued at $377,000 after purchasing an additional 1,245 shares in the last quarter. Allspring Global Investments Holdings LLC lifted its stake in Werner Enterprises by 3.5% during the first quarter. Allspring Global Investments Holdings LLC now owns 1,421,798 shares of the transportation company's stock worth $55,621,000 after purchasing an additional 48,340 shares during the last quarter. Norden Group LLC boosted its holdings in shares of Werner Enterprises by 1,048.4% in the 1st quarter. Norden Group LLC now owns 91,312 shares of the transportation company's stock valued at $3,572,000 after purchasing an additional 83,361 shares in the last quarter. Finally, Diversify Advisory Services LLC bought a new position in shares of Werner Enterprises in the 1st quarter valued at $267,000. Institutional investors and hedge funds own 89.32% of the company's stock.

Werner Enterprises Trading Up 0.9 %

NASDAQ WERN traded up $0.32 on Friday, reaching $37.34. The company had a trading volume of 350,576 shares, compared to its average volume of 746,157. Werner Enterprises has a 52 week low of $33.12 and a 52 week high of $43.26. The stock's 50 day moving average is $37.07 and its 200-day moving average is $36.72. The company has a quick ratio of 1.64, a current ratio of 1.69 and a debt-to-equity ratio of 0.45. The stock has a market cap of $2.31 billion, a price-to-earnings ratio of 37.72, a PEG ratio of 11.82 and a beta of 0.79.

Werner Enterprises (NASDAQ:WERN - Get Free Report) last announced its quarterly earnings results on Tuesday, July 30th. The transportation company reported $0.17 EPS for the quarter, missing analysts' consensus estimates of $0.20 by ($0.03). The company had revenue of $760.80 million during the quarter, compared to the consensus estimate of $769.81 million. Werner Enterprises had a net margin of 1.99% and a return on equity of 4.70%. The business's revenue was down 6.2% compared to the same quarter last year. During the same period last year, the company earned $0.52 earnings per share. Equities analysts predict that Werner Enterprises will post 0.87 earnings per share for the current year.

Werner Enterprises Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Wednesday, October 23rd. Investors of record on Monday, October 7th were issued a dividend of $0.14 per share. The ex-dividend date was Monday, October 7th. This represents a $0.56 annualized dividend and a yield of 1.50%. Werner Enterprises's payout ratio is currently 56.57%.

Werner Enterprises Company Profile

(

Get Free ReportWerner Enterprises, Inc, together with its subsidiaries, engages in transporting truckload shipments of general commodities in interstate and intrastate commerce in the United States, Mexico, and internationally. The company operates through two segments, Truckload Transportation Services and Werner Logistics.

Featured Stories

Before you consider Werner Enterprises, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Werner Enterprises wasn't on the list.

While Werner Enterprises currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.