Palumbo Wealth Management LLC acquired a new position in shares of GeneDx Holdings Corp. (NASDAQ:WGS - Free Report) in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor acquired 6,761 shares of the company's stock, valued at approximately $287,000.

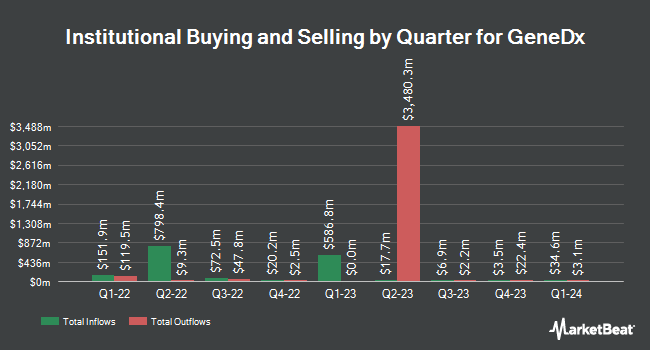

Other large investors also recently made changes to their positions in the company. Precision Wealth Strategies LLC acquired a new position in shares of GeneDx during the third quarter worth about $364,000. Raymond James & Associates acquired a new position in GeneDx during the 3rd quarter worth approximately $8,090,000. CWM LLC bought a new position in shares of GeneDx during the 3rd quarter worth approximately $89,000. SG Americas Securities LLC acquired a new stake in shares of GeneDx in the third quarter valued at approximately $198,000. Finally, Point72 Asset Management L.P. lifted its position in shares of GeneDx by 227.4% in the second quarter. Point72 Asset Management L.P. now owns 156,745 shares of the company's stock worth $4,097,000 after purchasing an additional 108,864 shares in the last quarter. Institutional investors own 61.72% of the company's stock.

Insider Transactions at GeneDx

In other GeneDx news, CEO Katherine Stueland sold 3,639 shares of the stock in a transaction dated Monday, September 9th. The shares were sold at an average price of $33.33, for a total value of $121,287.87. Following the transaction, the chief executive officer now directly owns 95,457 shares of the company's stock, valued at $3,181,581.81. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. In related news, major shareholder Opko Health, Inc. sold 100,000 shares of the company's stock in a transaction dated Thursday, August 8th. The shares were sold at an average price of $31.82, for a total value of $3,182,000.00. Following the transaction, the insider now directly owns 2,871,570 shares in the company, valued at approximately $91,373,357.40. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Also, CEO Katherine Stueland sold 3,639 shares of the firm's stock in a transaction dated Monday, September 9th. The stock was sold at an average price of $33.33, for a total transaction of $121,287.87. Following the transaction, the chief executive officer now directly owns 95,457 shares in the company, valued at approximately $3,181,581.81. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders sold 267,401 shares of company stock worth $8,794,447. 27.30% of the stock is owned by insiders.

Analyst Ratings Changes

A number of research analysts recently weighed in on WGS shares. Wells Fargo & Company raised their target price on shares of GeneDx from $34.00 to $75.00 and gave the company an "equal weight" rating in a research report on Wednesday. BTIG Research lifted their target price on GeneDx from $35.00 to $45.00 and gave the company a "buy" rating in a research report on Wednesday, July 31st. Craig Hallum increased their price target on GeneDx from $70.00 to $95.00 and gave the company a "buy" rating in a research report on Wednesday. TD Cowen upped their price objective on GeneDx from $46.00 to $50.00 and gave the stock a "buy" rating in a research note on Wednesday, July 31st. Finally, The Goldman Sachs Group raised their target price on shares of GeneDx from $54.00 to $70.00 and gave the company a "neutral" rating in a research note on Wednesday. Three equities research analysts have rated the stock with a hold rating and three have given a buy rating to the company's stock. According to MarketBeat, GeneDx currently has an average rating of "Moderate Buy" and an average price target of $59.33.

Read Our Latest Report on GeneDx

GeneDx Stock Performance

NASDAQ:WGS traded down $1.51 on Thursday, hitting $81.69. The company's stock had a trading volume of 781,022 shares, compared to its average volume of 438,132. The company has a current ratio of 2.38, a quick ratio of 2.22 and a debt-to-equity ratio of 0.27. GeneDx Holdings Corp. has a one year low of $1.16 and a one year high of $89.11. The stock has a fifty day moving average of $45.65 and a two-hundred day moving average of $32.42. The firm has a market capitalization of $2.20 billion, a P/E ratio of -26.75 and a beta of 2.32.

GeneDx (NASDAQ:WGS - Get Free Report) last announced its quarterly earnings results on Tuesday, July 30th. The company reported ($0.11) earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.26) by $0.15. GeneDx had a negative return on equity of 22.71% and a negative net margin of 48.21%. The business had revenue of $70.51 million during the quarter, compared to the consensus estimate of $58.90 million. Research analysts predict that GeneDx Holdings Corp. will post -0.75 earnings per share for the current year.

GeneDx Company Profile

(

Free Report)

GeneDx Holdings Corp., through its subsidiaries, provides genomics-related diagnostic and information services. The company offers Centrellis, an AI-driven health intelligence platform that integrates digital tools and artificial intelligence allowing scientists to ingest and synthesize clinical and genomic data to deliver comprehensive health insights.

Read More

Before you consider GeneDx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GeneDx wasn't on the list.

While GeneDx currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.