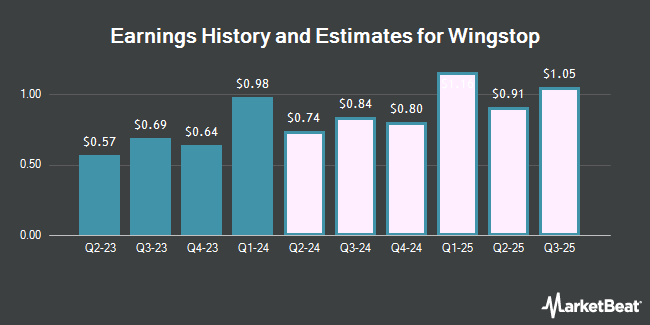

Wingstop Inc. (NASDAQ:WING - Free Report) - Stock analysts at Wedbush lowered their FY2024 EPS estimates for shares of Wingstop in a report issued on Thursday, October 31st. Wedbush analyst N. Setyan now forecasts that the restaurant operator will post earnings per share of $3.63 for the year, down from their prior estimate of $3.80. Wedbush currently has a "Outperform" rating and a $440.00 target price on the stock. The consensus estimate for Wingstop's current full-year earnings is $3.79 per share. Wedbush also issued estimates for Wingstop's Q4 2024 earnings at $0.84 EPS, Q1 2025 earnings at $1.13 EPS, Q2 2025 earnings at $1.16 EPS, Q4 2025 earnings at $1.13 EPS and FY2025 earnings at $4.59 EPS.

Wingstop (NASDAQ:WING - Get Free Report) last issued its quarterly earnings data on Wednesday, October 30th. The restaurant operator reported $0.88 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.97 by ($0.09). The firm had revenue of $162.50 million for the quarter, compared to the consensus estimate of $160.24 million. Wingstop had a negative return on equity of 22.69% and a net margin of 17.05%. The company's revenue was up 38.8% on a year-over-year basis. During the same quarter in the prior year, the firm earned $0.69 EPS.

A number of other brokerages have also recently issued reports on WING. Citigroup boosted their target price on shares of Wingstop from $417.00 to $440.00 and gave the company a "neutral" rating in a research report on Friday, October 4th. TD Cowen decreased their target price on shares of Wingstop from $450.00 to $365.00 and set a "buy" rating on the stock in a research report on Thursday. Morgan Stanley lifted their price target on shares of Wingstop from $390.00 to $400.00 and gave the company an "equal weight" rating in a research report on Tuesday, July 16th. Barclays reduced their price target on Wingstop from $470.00 to $380.00 and set an "overweight" rating on the stock in a research report on Thursday. Finally, Stephens dropped their price objective on Wingstop from $490.00 to $468.00 and set an "overweight" rating for the company in a report on Thursday. Seven analysts have rated the stock with a hold rating and twelve have given a buy rating to the stock. According to data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average target price of $375.63.

View Our Latest Research Report on Wingstop

Wingstop Price Performance

NASDAQ WING traded up $0.24 on Monday, reaching $297.18. The stock had a trading volume of 686,425 shares, compared to its average volume of 453,790. The company has a market cap of $8.68 billion, a P/E ratio of 87.27, a price-to-earnings-growth ratio of 2.74 and a beta of 1.76. The firm has a fifty day moving average of $388.10 and a two-hundred day moving average of $387.45. Wingstop has a 1-year low of $204.01 and a 1-year high of $433.86.

Wingstop Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Friday, December 6th. Shareholders of record on Friday, November 15th will be given a $0.27 dividend. The ex-dividend date is Friday, November 15th. This represents a $1.08 annualized dividend and a yield of 0.36%. Wingstop's dividend payout ratio is presently 31.49%.

Insider Activity

In related news, SVP Donnie Upshaw sold 3,199 shares of the firm's stock in a transaction that occurred on Thursday, August 8th. The shares were sold at an average price of $372.71, for a total value of $1,192,299.29. Following the completion of the transaction, the senior vice president now owns 97 shares in the company, valued at $36,152.87. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Insiders own 0.36% of the company's stock.

Institutional Inflows and Outflows

Several hedge funds and other institutional investors have recently bought and sold shares of the stock. Fulton Bank N.A. lifted its stake in shares of Wingstop by 5.0% in the third quarter. Fulton Bank N.A. now owns 547 shares of the restaurant operator's stock worth $228,000 after acquiring an additional 26 shares during the period. CIBC Asset Management Inc lifted its position in shares of Wingstop by 3.7% in the 2nd quarter. CIBC Asset Management Inc now owns 821 shares of the restaurant operator's stock worth $347,000 after purchasing an additional 29 shares during the period. Dark Forest Capital Management LP boosted its stake in shares of Wingstop by 4.3% in the 2nd quarter. Dark Forest Capital Management LP now owns 752 shares of the restaurant operator's stock valued at $318,000 after purchasing an additional 31 shares during the last quarter. Massmutual Trust Co. FSB ADV increased its position in shares of Wingstop by 60.3% during the second quarter. Massmutual Trust Co. FSB ADV now owns 93 shares of the restaurant operator's stock worth $39,000 after buying an additional 35 shares during the period. Finally, Hollencrest Capital Management raised its stake in Wingstop by 53.8% during the third quarter. Hollencrest Capital Management now owns 100 shares of the restaurant operator's stock worth $42,000 after buying an additional 35 shares during the last quarter.

About Wingstop

(

Get Free Report)

Wingstop Inc, together with its subsidiaries, franchises and operates restaurants under the Wingstop brand. Its restaurants offer classic wings, boneless wings, tenders, and hand-sauced-and-tossed in various flavors, as well as chicken sandwiches with fries and hand-cut carrots and celery that are cooked-to-order.

Featured Articles

Before you consider Wingstop, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wingstop wasn't on the list.

While Wingstop currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.