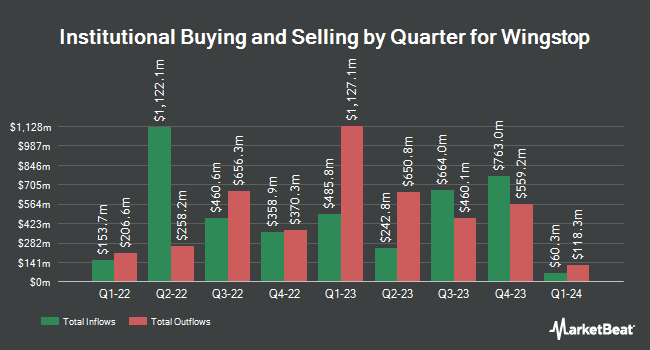

Harbor Capital Advisors Inc. lifted its position in Wingstop Inc. (NASDAQ:WING - Free Report) by 34.9% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 12,175 shares of the restaurant operator's stock after buying an additional 3,147 shares during the quarter. Harbor Capital Advisors Inc.'s holdings in Wingstop were worth $5,066,000 at the end of the most recent reporting period.

Several other institutional investors and hedge funds have also recently modified their holdings of WING. Sumitomo Mitsui Trust Holdings Inc. purchased a new stake in shares of Wingstop in the 1st quarter valued at $370,000. Mirae Asset Global Investments Co. Ltd. purchased a new stake in shares of Wingstop in the 1st quarter valued at $4,840,000. BNP Paribas Financial Markets raised its holdings in shares of Wingstop by 1,308.1% in the 1st quarter. BNP Paribas Financial Markets now owns 24,951 shares of the restaurant operator's stock valued at $9,142,000 after buying an additional 23,179 shares during the period. Fidelis Capital Partners LLC purchased a new stake in Wingstop during the 1st quarter worth about $144,000. Finally, Daiwa Securities Group Inc. increased its holdings in Wingstop by 276.9% during the 1st quarter. Daiwa Securities Group Inc. now owns 980 shares of the restaurant operator's stock worth $359,000 after purchasing an additional 720 shares during the period.

Wingstop Trading Up 0.1 %

Shares of NASDAQ WING traded up $0.24 during trading hours on Monday, reaching $297.18. The stock had a trading volume of 690,374 shares, compared to its average volume of 453,790. Wingstop Inc. has a fifty-two week low of $204.01 and a fifty-two week high of $433.86. The firm has a 50-day moving average of $388.10 and a 200-day moving average of $387.45. The firm has a market cap of $8.68 billion, a price-to-earnings ratio of 87.27, a PEG ratio of 2.74 and a beta of 1.76.

Wingstop (NASDAQ:WING - Get Free Report) last posted its quarterly earnings data on Wednesday, October 30th. The restaurant operator reported $0.88 earnings per share for the quarter, missing analysts' consensus estimates of $0.97 by ($0.09). Wingstop had a negative return on equity of 22.69% and a net margin of 17.05%. The company had revenue of $162.50 million for the quarter, compared to analyst estimates of $160.24 million. During the same period in the previous year, the business posted $0.69 earnings per share. The firm's revenue was up 38.8% compared to the same quarter last year. On average, equities analysts predict that Wingstop Inc. will post 3.79 EPS for the current year.

Wingstop Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, December 6th. Shareholders of record on Friday, November 15th will be given a dividend of $0.27 per share. The ex-dividend date of this dividend is Friday, November 15th. This represents a $1.08 dividend on an annualized basis and a yield of 0.36%. Wingstop's payout ratio is 31.49%.

Analyst Upgrades and Downgrades

Several equities research analysts have weighed in on WING shares. Truist Financial upped their price target on Wingstop from $407.00 to $423.00 and gave the stock a "hold" rating in a report on Thursday, August 1st. The Goldman Sachs Group upped their price target on Wingstop from $407.00 to $458.00 and gave the stock a "neutral" rating in a report on Thursday, August 1st. BTIG Research upgraded Wingstop from a "neutral" rating to a "buy" rating and set a $370.00 price target on the stock in a report on Thursday. Raymond James upgraded Wingstop from a "market perform" rating to an "outperform" rating and set a $42.00 price target on the stock in a report on Thursday, August 1st. Finally, Piper Sandler cut their price target on Wingstop from $375.00 to $300.00 and set a "neutral" rating on the stock in a report on Monday. Seven research analysts have rated the stock with a hold rating and twelve have given a buy rating to the company's stock. According to data from MarketBeat, the stock has an average rating of "Moderate Buy" and an average target price of $375.63.

Read Our Latest Analysis on WING

Insiders Place Their Bets

In other news, SVP Donnie Upshaw sold 3,199 shares of the firm's stock in a transaction that occurred on Thursday, August 8th. The stock was sold at an average price of $372.71, for a total value of $1,192,299.29. Following the completion of the sale, the senior vice president now directly owns 97 shares of the company's stock, valued at $36,152.87. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. 0.36% of the stock is owned by insiders.

About Wingstop

(

Free Report)

Wingstop Inc, together with its subsidiaries, franchises and operates restaurants under the Wingstop brand. Its restaurants offer classic wings, boneless wings, tenders, and hand-sauced-and-tossed in various flavors, as well as chicken sandwiches with fries and hand-cut carrots and celery that are cooked-to-order.

See Also

Before you consider Wingstop, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wingstop wasn't on the list.

While Wingstop currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.