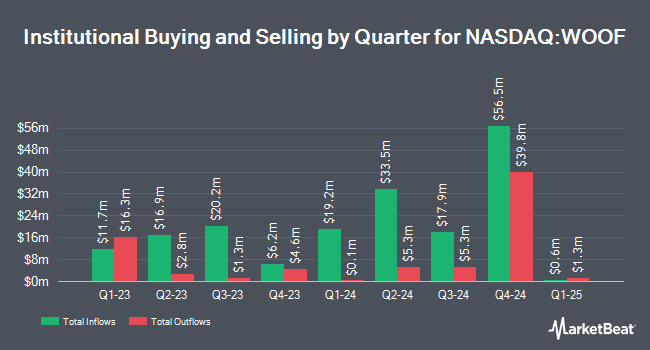

Point72 Asset Management L.P. boosted its stake in Petco Health and Wellness Company, Inc. (NASDAQ:WOOF - Free Report) by 1,212.7% in the second quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 1,815,479 shares of the company's stock after buying an additional 1,677,179 shares during the quarter. Point72 Asset Management L.P. owned approximately 0.58% of Petco Health and Wellness worth $6,863,000 as of its most recent SEC filing.

A number of other institutional investors and hedge funds have also bought and sold shares of the stock. Susquehanna Fundamental Investments LLC raised its position in Petco Health and Wellness by 50.8% in the 2nd quarter. Susquehanna Fundamental Investments LLC now owns 833,153 shares of the company's stock valued at $3,149,000 after buying an additional 280,644 shares during the last quarter. The Manufacturers Life Insurance Company purchased a new stake in Petco Health and Wellness in the 2nd quarter valued at $135,000. Millennium Management LLC raised its position in Petco Health and Wellness by 233.7% in the 2nd quarter. Millennium Management LLC now owns 2,679,132 shares of the company's stock valued at $10,127,000 after buying an additional 1,876,233 shares during the last quarter. Dark Forest Capital Management LP purchased a new stake in Petco Health and Wellness in the 2nd quarter valued at $93,000. Finally, AQR Capital Management LLC raised its position in Petco Health and Wellness by 82.1% in the 2nd quarter. AQR Capital Management LLC now owns 6,549,366 shares of the company's stock valued at $22,661,000 after buying an additional 2,953,667 shares during the last quarter.

Analyst Upgrades and Downgrades

WOOF has been the subject of a number of analyst reports. Wells Fargo & Company increased their price target on Petco Health and Wellness from $2.75 to $3.00 and gave the company an "equal weight" rating in a research report on Wednesday, September 11th. Wedbush restated an "outperform" rating and issued a $5.00 price objective on shares of Petco Health and Wellness in a research note on Wednesday, September 11th. Citigroup upped their price objective on Petco Health and Wellness from $4.00 to $4.50 and gave the company a "neutral" rating in a research note on Thursday, September 12th. Royal Bank of Canada upped their price objective on Petco Health and Wellness from $3.00 to $3.50 and gave the company an "outperform" rating in a research note on Wednesday, September 11th. Finally, The Goldman Sachs Group reduced their price objective on Petco Health and Wellness from $5.00 to $4.00 and set a "buy" rating for the company in a research note on Thursday, September 12th. One research analyst has rated the stock with a sell rating, eight have issued a hold rating and four have issued a buy rating to the company's stock. According to data from MarketBeat.com, Petco Health and Wellness presently has an average rating of "Hold" and an average target price of $3.45.

Read Our Latest Stock Report on Petco Health and Wellness

Petco Health and Wellness Price Performance

WOOF traded up $0.55 during trading on Wednesday, reaching $5.02. 4,920,322 shares of the company were exchanged, compared to its average volume of 4,755,460. The company's 50-day moving average is $3.44 and its two-hundred day moving average is $2.95. The company has a market cap of $1.56 billion, a price-to-earnings ratio of -1.02 and a beta of 1.88. The company has a quick ratio of 0.24, a current ratio of 0.84 and a debt-to-equity ratio of 1.39. Petco Health and Wellness Company, Inc. has a 12-month low of $1.41 and a 12-month high of $5.09.

Petco Health and Wellness (NASDAQ:WOOF - Get Free Report) last issued its quarterly earnings data on Tuesday, September 10th. The company reported ($0.02) earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of ($0.02). Petco Health and Wellness had a negative return on equity of 6.51% and a negative net margin of 21.46%. The business had revenue of $1.52 billion for the quarter, compared to analysts' expectations of $1.53 billion. During the same quarter in the prior year, the firm posted ($0.01) EPS. The firm's quarterly revenue was down .5% on a year-over-year basis. Research analysts forecast that Petco Health and Wellness Company, Inc. will post -0.23 earnings per share for the current fiscal year.

About Petco Health and Wellness

(

Free Report)

Petco Health and Wellness Company, Inc, operates as a health and wellness company, focuses on enhancing the lives of pets, pet parents, and its Petco partners in the United States, Mexico, and Puerto Rico. The company provides veterinary care, grooming, training, tele-health, and Vital Care and pet health insurance services, as well as veterinary services through Vetco mobile clinics.

Featured Stories

Before you consider Petco Health and Wellness, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Petco Health and Wellness wasn't on the list.

While Petco Health and Wellness currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.