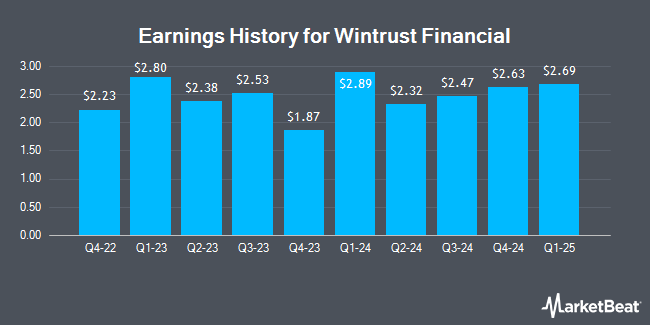

Wintrust Financial (NASDAQ:WTFC - Get Free Report) issued its quarterly earnings data on Monday. The bank reported $2.47 EPS for the quarter, missing the consensus estimate of $2.50 by ($0.03), Briefing.com reports. The company had revenue of $615.73 million during the quarter, compared to analysts' expectations of $623.45 million. Wintrust Financial had a return on equity of 12.71% and a net margin of 17.02%. The business's revenue for the quarter was up 7.1% compared to the same quarter last year. During the same period last year, the company earned $2.53 earnings per share.

Wintrust Financial Price Performance

Shares of NASDAQ:WTFC traded up $2.47 during trading on Tuesday, reaching $114.76. The company had a trading volume of 704,185 shares, compared to its average volume of 383,802. The company has a fifty day moving average of $106.49 and a two-hundred day moving average of $101.97. The company has a current ratio of 0.99, a quick ratio of 0.99 and a debt-to-equity ratio of 0.85. The stock has a market capitalization of $7.09 billion, a P/E ratio of 11.87 and a beta of 1.16. Wintrust Financial has a 12 month low of $71.86 and a 12 month high of $117.77.

Wintrust Financial Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Thursday, August 22nd. Investors of record on Thursday, August 8th were given a $0.45 dividend. This represents a $1.80 annualized dividend and a dividend yield of 1.57%. The ex-dividend date was Thursday, August 8th. Wintrust Financial's dividend payout ratio (DPR) is 18.61%.

Analyst Upgrades and Downgrades

Several equities analysts have weighed in on WTFC shares. Stephens restated an "overweight" rating and set a $115.00 price objective on shares of Wintrust Financial in a research note on Thursday, July 18th. DA Davidson boosted their price target on shares of Wintrust Financial from $120.00 to $125.00 and gave the stock a "buy" rating in a report on Friday, July 19th. Keefe, Bruyette & Woods lowered shares of Wintrust Financial from an "outperform" rating to a "market perform" rating and increased their price objective for the company from $110.00 to $115.00 in a research note on Friday, July 19th. Royal Bank of Canada lifted their target price on shares of Wintrust Financial from $116.00 to $117.00 and gave the stock an "outperform" rating in a research report on Tuesday, July 9th. Finally, Wedbush reaffirmed an "outperform" rating and issued a $130.00 target price on shares of Wintrust Financial in a report on Tuesday. Three investment analysts have rated the stock with a hold rating, ten have assigned a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $118.23.

Read Our Latest Analysis on WTFC

Wintrust Financial Company Profile

(

Get Free Report)

Wintrust Financial Corporation operates as a financial holding company. It operates in three segments: Community Banking, Specialty Finance, and Wealth Management. The Community Banking segment offers non-interest bearing deposits, non-brokered interest-bearing transaction accounts, and savings and domestic time deposits; home equity, consumer, and real estate loans; safe deposit facilities; and automatic teller machine (ATM), online and mobile banking, and other services.

See Also

Before you consider Wintrust Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wintrust Financial wasn't on the list.

While Wintrust Financial currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.