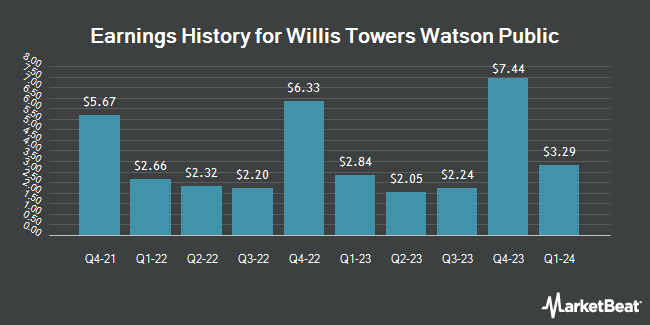

Willis Towers Watson Public (NASDAQ:WTW - Get Free Report) posted its quarterly earnings results on Thursday. The company reported $2.93 EPS for the quarter, topping analysts' consensus estimates of $2.68 by $0.25, Briefing.com reports. Willis Towers Watson Public had a return on equity of 16.97% and a net margin of 11.24%. The firm had revenue of $2.29 billion during the quarter, compared to analyst estimates of $2.28 billion. During the same period last year, the company earned $2.24 earnings per share. The business's revenue for the quarter was up 5.7% on a year-over-year basis. Willis Towers Watson Public updated its FY 2024 guidance to 16.000-17.000 EPS and its FY24 guidance to $16.00-17.00 EPS.

Willis Towers Watson Public Stock Down 0.9 %

Shares of NASDAQ WTW traded down $2.79 during trading on Friday, reaching $299.40. The company had a trading volume of 700,052 shares, compared to its average volume of 468,693. The business's 50-day moving average is $291.60 and its 200 day moving average is $272.87. The company has a quick ratio of 1.94, a current ratio of 1.94 and a debt-to-equity ratio of 0.56. The stock has a market cap of $30.41 billion, a PE ratio of 28.92, a P/E/G ratio of 1.85 and a beta of 0.74. Willis Towers Watson Public has a 12-month low of $232.77 and a 12-month high of $308.87.

Willis Towers Watson Public Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Tuesday, October 15th. Stockholders of record on Monday, September 30th were issued a dividend of $0.88 per share. The ex-dividend date was Monday, September 30th. This represents a $3.52 annualized dividend and a dividend yield of 1.18%. Willis Towers Watson Public's payout ratio is 33.68%.

Wall Street Analysts Forecast Growth

Several brokerages have commented on WTW. UBS Group upgraded Willis Towers Watson Public to a "hold" rating in a research note on Wednesday, October 9th. Morgan Stanley reduced their price target on shares of Willis Towers Watson Public from $275.00 to $272.00 and set an "equal weight" rating for the company in a research report on Wednesday, July 10th. Roth Mkm lifted their price objective on Willis Towers Watson Public from $315.00 to $345.00 and gave the company a "buy" rating in a research note on Wednesday, October 2nd. Truist Financial raised their price target on Willis Towers Watson Public from $335.00 to $365.00 and gave the company a "buy" rating in a report on Wednesday, October 2nd. Finally, Keefe, Bruyette & Woods upped their price objective on shares of Willis Towers Watson Public from $320.00 to $323.00 and gave the stock an "outperform" rating in a research report on Wednesday, July 31st. One analyst has rated the stock with a sell rating, seven have issued a hold rating and eight have issued a buy rating to the company. According to MarketBeat, the company currently has an average rating of "Hold" and an average price target of $309.47.

View Our Latest Stock Analysis on Willis Towers Watson Public

About Willis Towers Watson Public

(

Get Free Report)

Willis Towers Watson Public Limited Company operates as an advisory, broking, and solutions company worldwide. It operates through two segments: Health, Wealth & Career and Risk & Broking. The company offers strategy and design consulting, plan management service and support, broking and administration services for health, wellbeing, and other group benefit program, including medical, dental, disability, life, voluntary benefits and other coverages; actuarial support, plan design, and administrative services for pension and retirement savings plans; retirement consulting services and solutions; and integrated solutions that consists of investment discretionary management, pension administration, core actuarial, and communication and change management assistance services.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Willis Towers Watson Public, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Willis Towers Watson Public wasn't on the list.

While Willis Towers Watson Public currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.