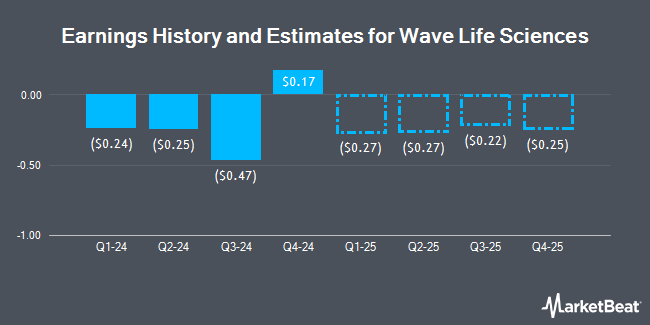

Wave Life Sciences Ltd. (NASDAQ:WVE - Free Report) - Stock analysts at Leerink Partnrs raised their Q3 2024 earnings per share estimates for Wave Life Sciences in a research note issued on Wednesday, October 16th. Leerink Partnrs analyst J. Schwartz now anticipates that the company will post earnings per share of ($0.19) for the quarter, up from their previous estimate of ($0.22). The consensus estimate for Wave Life Sciences' current full-year earnings is ($1.02) per share. Leerink Partnrs also issued estimates for Wave Life Sciences' Q4 2024 earnings at ($0.19) EPS, FY2024 earnings at ($0.87) EPS, Q1 2025 earnings at ($0.35) EPS, Q2 2025 earnings at ($0.36) EPS, Q3 2025 earnings at ($0.37) EPS, Q4 2025 earnings at ($0.28) EPS, FY2025 earnings at ($1.36) EPS and FY2026 earnings at ($0.76) EPS.

Wave Life Sciences (NASDAQ:WVE - Get Free Report) last issued its quarterly earnings results on Thursday, August 8th. The company reported ($0.25) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.16) by ($0.09). The business had revenue of $19.69 million during the quarter, compared to analyst estimates of $24.80 million. Wave Life Sciences had a negative net margin of 66.50% and a negative return on equity of 1,395.99%. During the same period in the prior year, the business posted ($0.20) earnings per share.

Other equities research analysts have also recently issued research reports about the stock. Leerink Partners increased their target price on shares of Wave Life Sciences from $20.00 to $22.00 and gave the company an "outperform" rating in a research note on Wednesday. JPMorgan Chase & Co. increased their target price on shares of Wave Life Sciences from $13.00 to $17.00 and gave the company an "overweight" rating in a research note on Thursday. B. Riley increased their target price on shares of Wave Life Sciences from $11.00 to $19.00 and gave the company a "buy" rating in a research note on Thursday, October 3rd. Royal Bank of Canada raised their price target on shares of Wave Life Sciences from $5.00 to $7.00 and gave the stock a "sector perform" rating in a research note on Friday, October 4th. Finally, HC Wainwright restated a "buy" rating and set a $22.00 price target on shares of Wave Life Sciences in a research note on Thursday. Two investment analysts have rated the stock with a hold rating, eight have given a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $18.56.

Read Our Latest Stock Analysis on WVE

Wave Life Sciences Price Performance

Shares of NASDAQ WVE traded up $0.70 during mid-day trading on Friday, hitting $15.31. The company had a trading volume of 2,030,381 shares, compared to its average volume of 1,089,892. The business's 50-day simple moving average is $6.90 and its 200-day simple moving average is $6.16. Wave Life Sciences has a 12 month low of $3.50 and a 12 month high of $15.92. The firm has a market cap of $1.88 billion, a P/E ratio of -28.10 and a beta of -1.10.

Institutional Trading of Wave Life Sciences

Hedge funds and other institutional investors have recently modified their holdings of the stock. Ameritas Investment Partners Inc. increased its holdings in shares of Wave Life Sciences by 50.2% in the first quarter. Ameritas Investment Partners Inc. now owns 7,334 shares of the company's stock valued at $45,000 after purchasing an additional 2,451 shares in the last quarter. Profund Advisors LLC acquired a new stake in shares of Wave Life Sciences in the second quarter valued at approximately $53,000. Principal Financial Group Inc. acquired a new stake in Wave Life Sciences during the 2nd quarter worth $74,000. Mackenzie Financial Corp raised its position in shares of Wave Life Sciences by 13.6% during the 2nd quarter. Mackenzie Financial Corp now owns 15,887 shares of the company's stock valued at $79,000 after acquiring an additional 1,905 shares during the last quarter. Finally, Hsbc Holdings PLC bought a new stake in shares of Wave Life Sciences during the 2nd quarter valued at $104,000. Institutional investors and hedge funds own 89.73% of the company's stock.

Insider Transactions at Wave Life Sciences

In other news, major shareholder Plc Gsk acquired 2,791,930 shares of the company's stock in a transaction dated Friday, September 27th. The stock was bought at an average price of $8.00 per share, with a total value of $22,335,440.00. Following the completion of the acquisition, the insider now owns 16,775,691 shares in the company, valued at approximately $134,205,528. This represents a 0.00 % increase in their position. The acquisition was disclosed in a document filed with the SEC, which is available through this hyperlink. In other news, major shareholder Plc Gsk acquired 2,791,930 shares of the company's stock in a transaction dated Friday, September 27th. The stock was bought at an average price of $8.00 per share, with a total value of $22,335,440.00. Following the completion of the acquisition, the insider now owns 16,775,691 shares in the company, valued at approximately $134,205,528. This represents a 0.00 % increase in their position. The acquisition was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, CFO Kyle Moran sold 17,146 shares of the firm's stock in a transaction that occurred on Wednesday, September 25th. The stock was sold at an average price of $9.00, for a total transaction of $154,314.00. Following the sale, the chief financial officer now directly owns 19,777 shares of the company's stock, valued at approximately $177,993. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 364,822 shares of company stock valued at $4,645,768. Corporate insiders own 29.10% of the company's stock.

Wave Life Sciences Company Profile

(

Get Free Report)

Wave Life Sciences Ltd., a clinical-stage biotechnology company, designs, develops, and commercializes ribonucleic acid (RNA) medicines through PRISM, a discovery and drug development platform. The company's RNA medicines platform, PRISM, combines multiple modalities, chemistry innovation, and deep insights into human genetics to deliver scientific breakthroughs that treat both rare and prevalent disorders.

Further Reading

Before you consider Wave Life Sciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wave Life Sciences wasn't on the list.

While Wave Life Sciences currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.