Moody Aldrich Partners LLC raised its position in Wave Life Sciences Ltd. (NASDAQ:WVE - Free Report) by 69.0% in the 3rd quarter, according to its most recent filing with the SEC. The firm owned 303,062 shares of the company's stock after acquiring an additional 123,703 shares during the period. Moody Aldrich Partners LLC owned approximately 0.25% of Wave Life Sciences worth $2,485,000 at the end of the most recent reporting period.

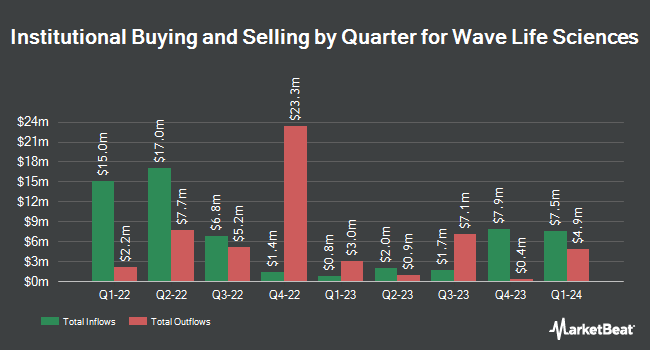

Several other hedge funds and other institutional investors have also made changes to their positions in WVE. Emerald Advisers LLC acquired a new position in Wave Life Sciences during the second quarter worth $12,441,000. Emerald Mutual Fund Advisers Trust acquired a new stake in shares of Wave Life Sciences in the second quarter valued at about $9,086,000. Artal Group S.A. boosted its holdings in Wave Life Sciences by 34.7% during the first quarter. Artal Group S.A. now owns 4,051,400 shares of the company's stock worth $24,997,000 after buying an additional 1,044,000 shares in the last quarter. Ikarian Capital LLC purchased a new stake in Wave Life Sciences during the first quarter worth about $3,641,000. Finally, Vanguard Group Inc. grew its position in Wave Life Sciences by 39.7% during the first quarter. Vanguard Group Inc. now owns 1,834,090 shares of the company's stock worth $11,316,000 after buying an additional 521,665 shares during the period. Hedge funds and other institutional investors own 89.73% of the company's stock.

Wave Life Sciences Stock Up 1.0 %

Shares of NASDAQ:WVE traded up $0.15 during trading on Thursday, reaching $14.82. The stock had a trading volume of 1,220,529 shares, compared to its average volume of 1,097,767. The stock has a market cap of $1.82 billion, a P/E ratio of -28.50 and a beta of -1.10. The business has a fifty day moving average price of $7.84 and a 200-day moving average price of $6.47. Wave Life Sciences Ltd. has a fifty-two week low of $3.50 and a fifty-two week high of $15.92.

Wave Life Sciences (NASDAQ:WVE - Get Free Report) last issued its quarterly earnings results on Thursday, August 8th. The company reported ($0.25) earnings per share for the quarter, missing the consensus estimate of ($0.16) by ($0.09). Wave Life Sciences had a negative net margin of 66.50% and a negative return on equity of 1,395.99%. The business had revenue of $19.69 million during the quarter, compared to analyst estimates of $24.80 million. During the same quarter last year, the firm posted ($0.20) earnings per share. As a group, equities analysts forecast that Wave Life Sciences Ltd. will post -1.01 EPS for the current year.

Insider Buying and Selling

In other news, CEO Paul Bolno sold 90,474 shares of the stock in a transaction dated Wednesday, October 16th. The shares were sold at an average price of $15.00, for a total transaction of $1,357,110.00. Following the transaction, the chief executive officer now directly owns 268,585 shares in the company, valued at $4,028,775. This represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available at this link. In related news, CFO Kyle Moran sold 17,146 shares of Wave Life Sciences stock in a transaction on Wednesday, September 25th. The stock was sold at an average price of $9.00, for a total value of $154,314.00. Following the transaction, the chief financial officer now owns 19,777 shares in the company, valued at approximately $177,993. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CEO Paul Bolno sold 90,474 shares of the business's stock in a transaction dated Wednesday, October 16th. The shares were sold at an average price of $15.00, for a total value of $1,357,110.00. Following the sale, the chief executive officer now directly owns 268,585 shares of the company's stock, valued at approximately $4,028,775. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 364,822 shares of company stock worth $4,645,768. 29.10% of the stock is owned by company insiders.

Analysts Set New Price Targets

A number of research firms have commented on WVE. Wells Fargo & Company boosted their target price on Wave Life Sciences from $11.00 to $22.00 and gave the stock an "overweight" rating in a research report on Wednesday, October 16th. Leerink Partners boosted their price objective on shares of Wave Life Sciences from $20.00 to $22.00 and gave the stock an "outperform" rating in a research report on Wednesday, October 16th. B. Riley raised their target price on shares of Wave Life Sciences from $11.00 to $19.00 and gave the company a "buy" rating in a report on Thursday, October 3rd. JPMorgan Chase & Co. lifted their target price on shares of Wave Life Sciences from $13.00 to $17.00 and gave the stock an "overweight" rating in a research report on Thursday, October 17th. Finally, HC Wainwright reiterated a "buy" rating and issued a $22.00 price target on shares of Wave Life Sciences in a research report on Thursday, October 17th. Two equities research analysts have rated the stock with a hold rating, eight have issued a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat, Wave Life Sciences presently has a consensus rating of "Moderate Buy" and a consensus target price of $19.44.

Check Out Our Latest Stock Report on WVE

Wave Life Sciences Company Profile

(

Free Report)

Wave Life Sciences Ltd., a clinical-stage biotechnology company, designs, develops, and commercializes ribonucleic acid (RNA) medicines through PRISM, a discovery and drug development platform. The company's RNA medicines platform, PRISM, combines multiple modalities, chemistry innovation, and deep insights into human genetics to deliver scientific breakthroughs that treat both rare and prevalent disorders.

Further Reading

Before you consider Wave Life Sciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wave Life Sciences wasn't on the list.

While Wave Life Sciences currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.