Xcel Energy (NASDAQ:XEL - Get Free Report) issued an update on its FY25 earnings guidance on Thursday morning. The company provided earnings per share (EPS) guidance of $3.75-3.85 for the period, compared to the consensus estimate of $3.83. Xcel Energy also updated its FY 2025 guidance to 3.750-3.850 EPS.

Xcel Energy Trading Up 6.0 %

XEL traded up $3.76 during trading on Thursday, reaching $66.81. The company had a trading volume of 6,805,260 shares, compared to its average volume of 4,156,368. The company has a quick ratio of 0.86, a current ratio of 0.97 and a debt-to-equity ratio of 1.54. The business has a 50 day simple moving average of $63.34 and a 200-day simple moving average of $58.10. The stock has a market cap of $37.25 billion, a P/E ratio of 18.82, a PEG ratio of 2.83 and a beta of 0.39. Xcel Energy has a 52 week low of $46.79 and a 52 week high of $67.73.

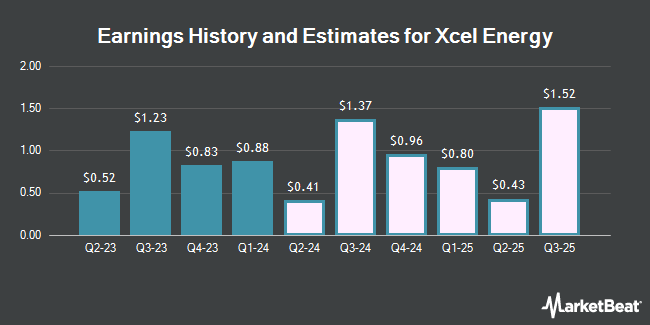

Xcel Energy (NASDAQ:XEL - Get Free Report) last announced its quarterly earnings data on Thursday, August 1st. The company reported $0.54 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.57 by ($0.03). The firm had revenue of $3.03 billion during the quarter, compared to the consensus estimate of $3.29 billion. Xcel Energy had a return on equity of 10.94% and a net margin of 13.46%. The firm's revenue for the quarter was up .2% on a year-over-year basis. During the same period in the previous year, the business earned $0.52 EPS. On average, equities analysts anticipate that Xcel Energy will post 3.56 EPS for the current fiscal year.

Analyst Ratings Changes

A number of brokerages have weighed in on XEL. Barclays lifted their target price on Xcel Energy from $57.00 to $67.00 and gave the company an "overweight" rating in a research report on Monday, October 21st. Wells Fargo & Company lifted their price objective on Xcel Energy from $63.00 to $66.00 and gave the company an "equal weight" rating in a report on Wednesday, October 16th. Jefferies Financial Group began coverage on shares of Xcel Energy in a report on Thursday, September 19th. They set a "hold" rating and a $70.00 target price on the stock. UBS Group lifted their price objective on shares of Xcel Energy from $66.00 to $67.00 and gave the company a "neutral" rating in a report on Friday, September 20th. Finally, Morgan Stanley lifted their price target on Xcel Energy from $68.00 to $73.00 and gave the company an "equal weight" rating in a report on Wednesday, September 25th. Eight research analysts have rated the stock with a hold rating and six have issued a buy rating to the company's stock. Based on data from MarketBeat, the company currently has a consensus rating of "Hold" and a consensus target price of $65.54.

Get Our Latest Stock Report on Xcel Energy

About Xcel Energy

(

Get Free Report)

Xcel Energy Inc, through its subsidiaries, engages in the generation, purchasing, transmission, distribution, and sale of electricity. It operates through Regulated Electric Utility, Regulated Natural Gas Utility, and All Other segments. The company generates electricity through wind, nuclear, hydroelectric, biomass, and solar energy sources, as well as coal, natural gas, oil, wood, and refuse-derived fuels.

Recommended Stories

Before you consider Xcel Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Xcel Energy wasn't on the list.

While Xcel Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.