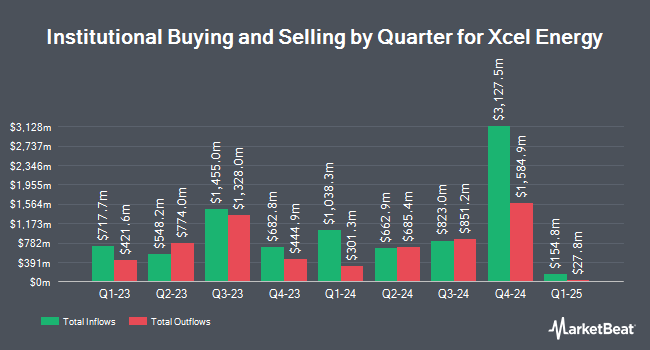

New York State Teachers Retirement System lessened its holdings in Xcel Energy Inc. (NASDAQ:XEL - Free Report) by 5.8% in the third quarter, according to its most recent filing with the SEC. The institutional investor owned 494,060 shares of the company's stock after selling 30,660 shares during the period. New York State Teachers Retirement System owned 0.09% of Xcel Energy worth $32,262,000 as of its most recent SEC filing.

A number of other institutional investors have also bought and sold shares of XEL. Price T Rowe Associates Inc. MD grew its position in shares of Xcel Energy by 770.0% during the first quarter. Price T Rowe Associates Inc. MD now owns 7,552,625 shares of the company's stock worth $405,955,000 after purchasing an additional 6,684,499 shares in the last quarter. Jupiter Asset Management Ltd. purchased a new stake in Xcel Energy during the 1st quarter valued at approximately $80,283,000. Federated Hermes Inc. lifted its holdings in shares of Xcel Energy by 120.2% in the second quarter. Federated Hermes Inc. now owns 2,379,615 shares of the company's stock worth $127,095,000 after buying an additional 1,299,025 shares in the last quarter. American Century Companies Inc. boosted its position in shares of Xcel Energy by 130.4% during the second quarter. American Century Companies Inc. now owns 2,084,345 shares of the company's stock worth $111,325,000 after acquiring an additional 1,179,823 shares during the last quarter. Finally, Zimmer Partners LP increased its holdings in Xcel Energy by 1,765.0% in the 1st quarter. Zimmer Partners LP now owns 932,505 shares of the company's stock valued at $50,122,000 after acquiring an additional 882,505 shares during the last quarter. Hedge funds and other institutional investors own 78.38% of the company's stock.

Xcel Energy Trading Down 0.1 %

Shares of XEL stock traded down $0.10 on Friday, reaching $66.71. 6,808,586 shares of the company's stock were exchanged, compared to its average volume of 4,168,878. The company has a current ratio of 0.97, a quick ratio of 0.86 and a debt-to-equity ratio of 1.54. The company's fifty day simple moving average is $63.48 and its 200 day simple moving average is $58.16. Xcel Energy Inc. has a 52 week low of $46.79 and a 52 week high of $68.29. The stock has a market capitalization of $37.19 billion, a PE ratio of 20.11, a P/E/G ratio of 2.77 and a beta of 0.39.

Xcel Energy (NASDAQ:XEL - Get Free Report) last posted its quarterly earnings results on Thursday, October 31st. The company reported $1.25 EPS for the quarter, missing analysts' consensus estimates of $1.31 by ($0.06). Xcel Energy had a return on equity of 10.94% and a net margin of 13.46%. The company had revenue of $3.64 billion during the quarter, compared to the consensus estimate of $3.93 billion. During the same quarter in the previous year, the company posted $1.23 earnings per share. The company's revenue for the quarter was down .5% on a year-over-year basis. As a group, analysts forecast that Xcel Energy Inc. will post 3.55 EPS for the current year.

Wall Street Analyst Weigh In

A number of research analysts have recently weighed in on XEL shares. UBS Group raised their price objective on Xcel Energy from $66.00 to $67.00 and gave the company a "neutral" rating in a research report on Friday, September 20th. Jefferies Financial Group raised Xcel Energy from a "hold" rating to a "buy" rating and lifted their price objective for the stock from $71.00 to $76.00 in a research note on Friday. Barclays increased their target price on Xcel Energy from $57.00 to $67.00 and gave the company an "overweight" rating in a research report on Monday, October 21st. KeyCorp raised their target price on shares of Xcel Energy from $69.00 to $74.00 and gave the company an "overweight" rating in a report on Friday. Finally, Morgan Stanley increased their price objective on shares of Xcel Energy from $68.00 to $73.00 and gave the company an "equal weight" rating in a research report on Wednesday, September 25th. Seven research analysts have rated the stock with a hold rating and seven have assigned a buy rating to the stock. According to MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average target price of $66.38.

View Our Latest Report on XEL

About Xcel Energy

(

Free Report)

Xcel Energy Inc, through its subsidiaries, engages in the generation, purchasing, transmission, distribution, and sale of electricity. It operates through Regulated Electric Utility, Regulated Natural Gas Utility, and All Other segments. The company generates electricity through wind, nuclear, hydroelectric, biomass, and solar energy sources, as well as coal, natural gas, oil, wood, and refuse-derived fuels.

Further Reading

Before you consider Xcel Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Xcel Energy wasn't on the list.

While Xcel Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.