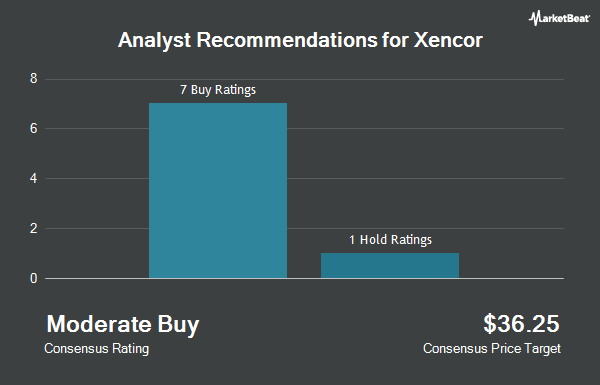

Shares of Xencor, Inc. (NASDAQ:XNCR - Get Free Report) have been given a consensus recommendation of "Buy" by the nine brokerages that are presently covering the firm, MarketBeat Ratings reports. One research analyst has rated the stock with a hold rating, seven have given a buy rating and one has assigned a strong buy rating to the company. The average 1 year price target among brokers that have covered the stock in the last year is $34.78.

A number of research firms recently commented on XNCR. Wedbush restated an "outperform" rating and issued a $34.00 price objective on shares of Xencor in a report on Monday, September 9th. JPMorgan Chase & Co. lowered their price objective on Xencor from $30.00 to $27.00 and set an "overweight" rating on the stock in a research report on Wednesday, July 31st. Raymond James reduced their target price on Xencor from $58.00 to $40.00 and set a "strong-buy" rating for the company in a research report on Friday, June 14th. Royal Bank of Canada boosted their price target on shares of Xencor from $31.00 to $34.00 and gave the company an "outperform" rating in a report on Thursday, September 26th. Finally, BMO Capital Markets restated an "outperform" rating and set a $32.00 target price on shares of Xencor in a research report on Tuesday, August 6th.

Read Our Latest Stock Analysis on Xencor

Insider Buying and Selling at Xencor

In related news, VP John R. Desjarlais sold 36,329 shares of the stock in a transaction that occurred on Tuesday, July 9th. The stock was sold at an average price of $18.32, for a total transaction of $665,547.28. Following the completion of the sale, the vice president now directly owns 192,319 shares of the company's stock, valued at approximately $3,523,284.08. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. Insiders own 5.23% of the company's stock.

Institutional Trading of Xencor

A number of large investors have recently added to or reduced their stakes in XNCR. Parallel Advisors LLC lifted its holdings in Xencor by 303.9% during the 4th quarter. Parallel Advisors LLC now owns 1,349 shares of the biopharmaceutical company's stock valued at $29,000 after purchasing an additional 1,015 shares during the last quarter. Quarry LP acquired a new position in shares of Xencor in the second quarter valued at approximately $36,000. GAMMA Investing LLC increased its stake in shares of Xencor by 153.7% during the first quarter. GAMMA Investing LLC now owns 2,172 shares of the biopharmaceutical company's stock worth $48,000 after purchasing an additional 1,316 shares during the period. SG Americas Securities LLC acquired a new position in Xencor in the 2nd quarter valued at $154,000. Finally, XTX Topco Ltd bought a new position in Xencor during the second quarter worth about $196,000.

Xencor Stock Performance

Shares of NASDAQ XNCR traded down $0.68 during midday trading on Tuesday, reaching $19.43. 317,680 shares of the company traded hands, compared to its average volume of 628,479. The company has a market cap of $1.51 billion, a price-to-earnings ratio of -9.18 and a beta of 0.66. The company has a debt-to-equity ratio of 0.02, a current ratio of 6.92 and a quick ratio of 6.92. The stock has a 50-day moving average price of $18.64 and a 200 day moving average price of $20.28. Xencor has a 52 week low of $15.31 and a 52 week high of $26.84.

Xencor (NASDAQ:XNCR - Get Free Report) last issued its quarterly earnings results on Monday, August 5th. The biopharmaceutical company reported ($1.07) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.82) by ($0.25). The firm had revenue of $16.96 million for the quarter, compared to analyst estimates of $21.13 million. Xencor had a negative net margin of 132.74% and a negative return on equity of 28.23%. The firm's revenue for the quarter was down 62.7% compared to the same quarter last year. During the same quarter last year, the business posted ($0.37) earnings per share. Sell-side analysts anticipate that Xencor will post -4.15 earnings per share for the current fiscal year.

Xencor Company Profile

(

Get Free ReportXencor, Inc, a clinical stage biopharmaceutical company, focuses on the discovery and development of engineered monoclonal antibody and cytokine therapeutics to treat patients with cancer and autoimmune diseases. The company provides Sotrovimab that targets the SARS-CoV-2 virus; Ultomiris for the treatment of patients with paroxysmal nocturnal hemoglobinuria and atypical hemolytic uremic syndrome; and Monjuvi for the treatment of patients with relapsed or refractory diffuse large B-cell lymphoma.

Recommended Stories

Before you consider Xencor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Xencor wasn't on the list.

While Xencor currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.