Zillow Group (NASDAQ:ZG - Get Free Report) is scheduled to be issuing its quarterly earnings data after the market closes on Wednesday, November 6th. Analysts expect the company to announce earnings of $0.32 per share for the quarter. Zillow Group has set its Q3 2024 guidance at EPS.Parties interested in participating in the company's conference call can do so using this link.

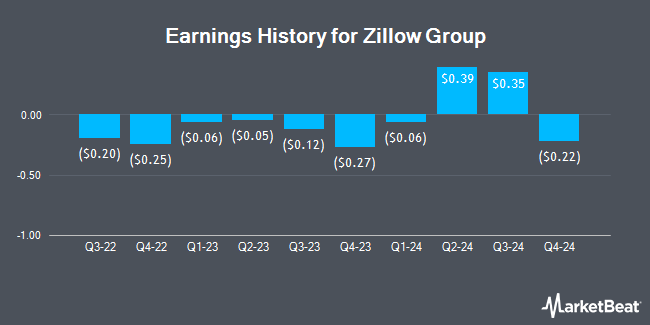

Zillow Group (NASDAQ:ZG - Get Free Report) last issued its quarterly earnings data on Wednesday, August 7th. The technology company reported $0.39 earnings per share for the quarter, beating analysts' consensus estimates of $0.31 by $0.08. Zillow Group had a negative net margin of 6.81% and a negative return on equity of 2.50%. The business had revenue of $572.00 million for the quarter, compared to analysts' expectations of $538.36 million. During the same period in the previous year, the business earned ($0.05) earnings per share. The company's revenue was up 13.0% on a year-over-year basis. On average, analysts expect Zillow Group to post $0 EPS for the current fiscal year and $0 EPS for the next fiscal year.

Zillow Group Stock Performance

Shares of NASDAQ ZG traded up $1.25 during midday trading on Wednesday, reaching $57.73. 346,200 shares of the company traded hands, compared to its average volume of 617,904. Zillow Group has a 52 week low of $33.23 and a 52 week high of $66.75. The stock has a 50-day moving average price of $58.55 and a 200 day moving average price of $49.59. The company has a debt-to-equity ratio of 0.11, a current ratio of 2.12 and a quick ratio of 2.12. The company has a market cap of $13.64 billion, a price-to-earnings ratio of -83.67 and a beta of 2.01.

Analyst Upgrades and Downgrades

ZG has been the topic of several research reports. Royal Bank of Canada reiterated an "outperform" rating and issued a $66.00 price target on shares of Zillow Group in a research report on Tuesday, October 22nd. Barclays lifted their price target on Zillow Group from $35.00 to $36.00 and gave the stock an "underweight" rating in a research note on Thursday, August 8th. Susquehanna lifted their price target on Zillow Group from $42.00 to $55.00 and gave the stock a "neutral" rating in a research note on Monday, August 12th. DA Davidson lifted their price target on Zillow Group from $52.00 to $71.00 and gave the stock a "buy" rating in a research note on Wednesday, September 25th. Finally, JMP Securities reissued a "market outperform" rating and issued a $62.00 price target on shares of Zillow Group in a research note on Wednesday, October 9th. One research analyst has rated the stock with a sell rating, four have issued a hold rating and thirteen have assigned a buy rating to the stock. Based on data from MarketBeat.com, Zillow Group presently has a consensus rating of "Moderate Buy" and a consensus target price of $61.53.

View Our Latest Report on Zillow Group

Insider Buying and Selling

In related news, Director Amy Bohutinsky sold 20,625 shares of the business's stock in a transaction that occurred on Wednesday, September 18th. The stock was sold at an average price of $67.23, for a total value of $1,386,618.75. Following the completion of the sale, the director now directly owns 5,652 shares in the company, valued at approximately $379,983.96. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. In other news, Director Amy Bohutinsky sold 20,625 shares of the company's stock in a transaction that occurred on Wednesday, September 18th. The stock was sold at an average price of $67.23, for a total transaction of $1,386,618.75. Following the completion of the transaction, the director now directly owns 5,652 shares in the company, valued at $379,983.96. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CAO Jennifer Rock sold 4,050 shares of the company's stock in a transaction that occurred on Thursday, August 8th. The stock was sold at an average price of $49.23, for a total value of $199,381.50. Following the transaction, the chief accounting officer now owns 79,694 shares of the company's stock, valued at approximately $3,923,335.62. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 221,999 shares of company stock worth $11,780,363. 17.14% of the stock is currently owned by insiders.

About Zillow Group

(

Get Free Report)

Zillow Group, Inc operates real estate brands in mobile applications and Websites in the United States. The company offers premier agent and rentals marketplaces, new construction marketplaces, advertising, display advertising, and business technology solutions, as well as dotloop and floor plans. It also provides mortgage originations and the sale of mortgages, and advertising to mortgage lenders and other mortgage professionals; and title and escrow services.

See Also

Before you consider Zillow Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zillow Group wasn't on the list.

While Zillow Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.