Assenagon Asset Management S.A. cut its position in shares of ZoomInfo Technologies Inc. (NASDAQ:ZI - Free Report) by 57.1% in the 3rd quarter, according to the company in its most recent disclosure with the SEC. The fund owned 552,161 shares of the company's stock after selling 734,676 shares during the quarter. Assenagon Asset Management S.A. owned 0.15% of ZoomInfo Technologies worth $5,698,000 as of its most recent filing with the SEC.

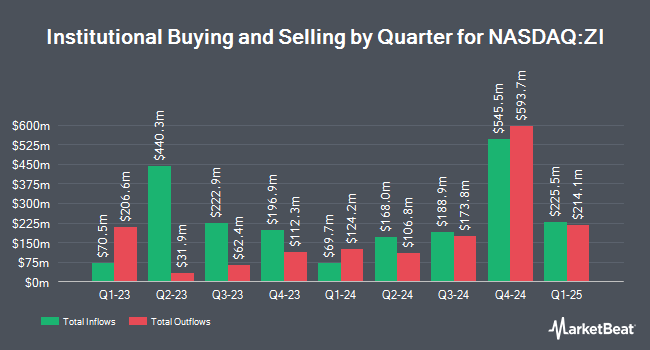

A number of other institutional investors also recently bought and sold shares of the company. Retirement Systems of Alabama grew its position in shares of ZoomInfo Technologies by 0.3% in the first quarter. Retirement Systems of Alabama now owns 371,995 shares of the company's stock valued at $5,963,000 after purchasing an additional 976 shares during the last quarter. 49 Wealth Management LLC increased its position in ZoomInfo Technologies by 11.3% during the first quarter. 49 Wealth Management LLC now owns 13,345 shares of the company's stock worth $214,000 after buying an additional 1,360 shares in the last quarter. Advisors Asset Management Inc. raised its holdings in shares of ZoomInfo Technologies by 45.3% in the first quarter. Advisors Asset Management Inc. now owns 4,964 shares of the company's stock worth $80,000 after acquiring an additional 1,547 shares during the last quarter. State of Michigan Retirement System lifted its position in shares of ZoomInfo Technologies by 2.3% in the first quarter. State of Michigan Retirement System now owns 72,700 shares of the company's stock valued at $1,165,000 after acquiring an additional 1,600 shares in the last quarter. Finally, GAMMA Investing LLC lifted its position in shares of ZoomInfo Technologies by 114.9% in the third quarter. GAMMA Investing LLC now owns 3,992 shares of the company's stock valued at $41,000 after acquiring an additional 2,134 shares in the last quarter. 95.47% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

Several equities analysts recently issued reports on the stock. Mizuho reduced their price objective on shares of ZoomInfo Technologies from $14.00 to $9.00 and set a "neutral" rating on the stock in a research note on Tuesday, August 6th. Royal Bank of Canada decreased their price objective on ZoomInfo Technologies from $9.00 to $7.00 and set an "underperform" rating on the stock in a report on Tuesday, August 6th. Raymond James lowered ZoomInfo Technologies from an "outperform" rating to a "market perform" rating in a research note on Tuesday, August 6th. Wells Fargo & Company decreased their price target on ZoomInfo Technologies from $19.00 to $14.00 and set an "overweight" rating on the stock in a research note on Tuesday, August 6th. Finally, Barclays lowered their price target on ZoomInfo Technologies from $15.00 to $11.00 and set an "equal weight" rating for the company in a report on Tuesday, August 6th. Four analysts have rated the stock with a sell rating, twelve have assigned a hold rating and six have given a buy rating to the company. Based on data from MarketBeat, the company presently has a consensus rating of "Hold" and a consensus target price of $13.40.

View Our Latest Analysis on ZI

Insider Buying and Selling at ZoomInfo Technologies

In related news, CEO Henry Schuck purchased 1,500,000 shares of ZoomInfo Technologies stock in a transaction dated Wednesday, August 7th. The shares were acquired at an average price of $8.49 per share, with a total value of $12,735,000.00. Following the completion of the transaction, the chief executive officer now owns 11,788,001 shares of the company's stock, valued at approximately $100,080,128.49. This trade represents a 0.00 % increase in their position. The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. 8.20% of the stock is currently owned by corporate insiders.

ZoomInfo Technologies Stock Down 1.7 %

Shares of ZI stock traded down $0.18 during trading hours on Wednesday, reaching $10.60. The company had a trading volume of 2,464,297 shares, compared to its average volume of 6,588,899. The stock's fifty day simple moving average is $10.12 and its 200 day simple moving average is $11.64. The company has a market capitalization of $3.87 billion, a P/E ratio of 265.00, a price-to-earnings-growth ratio of 6.42 and a beta of 1.06. The company has a debt-to-equity ratio of 0.66, a quick ratio of 0.97 and a current ratio of 0.97. ZoomInfo Technologies Inc. has a twelve month low of $7.65 and a twelve month high of $19.39.

ZoomInfo Technologies (NASDAQ:ZI - Get Free Report) last posted its quarterly earnings data on Monday, August 5th. The company reported $0.17 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.24 by ($0.07). The firm had revenue of $291.50 million for the quarter, compared to analysts' expectations of $307.68 million. ZoomInfo Technologies had a net margin of 1.25% and a return on equity of 10.96%. The company's revenue for the quarter was down 5.5% on a year-over-year basis. During the same quarter in the prior year, the business earned $0.16 EPS. As a group, sell-side analysts expect that ZoomInfo Technologies Inc. will post 0.55 earnings per share for the current fiscal year.

About ZoomInfo Technologies

(

Free Report)

ZoomInfo Technologies Inc, together with its subsidiaries, provides go-to-market intelligence and engagement platform for sales and marketing teams in the United States and internationally. The company's cloud-based platform provides information on organizations and professionals to help users identify target customers and decision makers, obtain continually updated predictive lead and company scoring, monitor buying signals and other attributes of target companies, craft messages, engage through automated sales tools, and track progress through the deal cycle.

Further Reading

Before you consider ZoomInfo Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ZoomInfo Technologies wasn't on the list.

While ZoomInfo Technologies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.