Zions Bancorporation, National Association (NASDAQ:ZION - Get Free Report) had its target price increased by Barclays from $47.00 to $52.00 in a note issued to investors on Tuesday, Benzinga reports. The brokerage currently has an "underweight" rating on the bank's stock. Barclays's price objective indicates a potential downside of 0.97% from the company's current price.

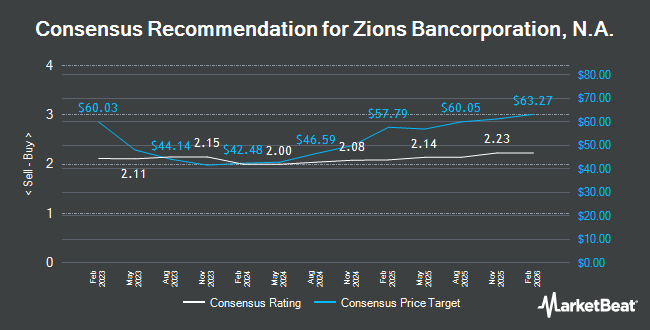

Several other research firms have also recently commented on ZION. Truist Financial lowered their price target on Zions Bancorporation, National Association from $54.00 to $52.00 and set a "hold" rating for the company in a report on Friday, September 20th. Robert W. Baird upped their price target on shares of Zions Bancorporation, National Association from $52.00 to $55.00 and gave the stock a "neutral" rating in a research report on Tuesday. JPMorgan Chase & Co. decreased their price target on shares of Zions Bancorporation, National Association from $58.00 to $54.00 and set a "neutral" rating on the stock in a report on Wednesday, October 9th. Wedbush increased their target price on Zions Bancorporation, National Association from $52.00 to $55.00 and gave the stock a "neutral" rating in a research report on Tuesday. Finally, The Goldman Sachs Group lifted their target price on Zions Bancorporation, National Association from $52.00 to $59.00 and gave the company a "neutral" rating in a report on Tuesday. One investment analyst has rated the stock with a sell rating, nineteen have given a hold rating and one has assigned a buy rating to the stock. According to data from MarketBeat, the company presently has a consensus rating of "Hold" and an average price target of $51.11.

View Our Latest Analysis on Zions Bancorporation, National Association

Zions Bancorporation, National Association Price Performance

ZION stock traded up $3.07 during trading on Tuesday, hitting $52.51. The stock had a trading volume of 4,249,043 shares, compared to its average volume of 2,125,467. The stock has a market cap of $7.75 billion, a price-to-earnings ratio of 13.19, a price-to-earnings-growth ratio of 1.91 and a beta of 1.09. The company has a debt-to-equity ratio of 1.11, a quick ratio of 0.84 and a current ratio of 0.84. The company's 50 day moving average price is $47.59 and its two-hundred day moving average price is $45.26. Zions Bancorporation, National Association has a 1-year low of $28.90 and a 1-year high of $53.32.

Zions Bancorporation, National Association (NASDAQ:ZION - Get Free Report) last posted its quarterly earnings data on Monday, October 21st. The bank reported $1.37 earnings per share for the quarter, beating analysts' consensus estimates of $1.16 by $0.21. Zions Bancorporation, National Association had a net margin of 13.53% and a return on equity of 13.85%. The business had revenue of $1.28 billion during the quarter, compared to analyst estimates of $781.63 million. During the same quarter in the previous year, the business posted $1.13 earnings per share. On average, sell-side analysts forecast that Zions Bancorporation, National Association will post 4.53 EPS for the current fiscal year.

Insider Buying and Selling at Zions Bancorporation, National Association

In related news, VP Bruce K. Alexander sold 5,156 shares of the business's stock in a transaction dated Monday, July 29th. The stock was sold at an average price of $51.83, for a total value of $267,235.48. Following the transaction, the vice president now owns 17,857 shares in the company, valued at approximately $925,528.31. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. In other Zions Bancorporation, National Association news, President Scott J. Mclean sold 60,000 shares of the firm's stock in a transaction on Thursday, July 25th. The shares were sold at an average price of $51.83, for a total transaction of $3,109,800.00. Following the completion of the transaction, the president now directly owns 74,286 shares of the company's stock, valued at $3,850,243.38. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, VP Bruce K. Alexander sold 5,156 shares of the company's stock in a transaction dated Monday, July 29th. The shares were sold at an average price of $51.83, for a total transaction of $267,235.48. Following the completion of the sale, the vice president now owns 17,857 shares in the company, valued at approximately $925,528.31. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 67,073 shares of company stock valued at $3,476,298 in the last ninety days. Insiders own 2.22% of the company's stock.

Institutional Trading of Zions Bancorporation, National Association

Hedge funds and other institutional investors have recently bought and sold shares of the company. International Assets Investment Management LLC grew its position in shares of Zions Bancorporation, National Association by 4,621.0% in the 3rd quarter. International Assets Investment Management LLC now owns 37,485 shares of the bank's stock worth $1,770,000 after acquiring an additional 36,691 shares in the last quarter. Leo Wealth LLC bought a new position in Zions Bancorporation, National Association during the third quarter worth $687,000. Sequoia Financial Advisors LLC lifted its stake in Zions Bancorporation, National Association by 1.9% during the third quarter. Sequoia Financial Advisors LLC now owns 27,569 shares of the bank's stock worth $1,302,000 after purchasing an additional 506 shares during the last quarter. WJ Interests LLC acquired a new position in Zions Bancorporation, National Association in the third quarter worth $210,000. Finally, Vest Financial LLC increased its stake in Zions Bancorporation, National Association by 16.4% during the third quarter. Vest Financial LLC now owns 31,333 shares of the bank's stock valued at $1,480,000 after purchasing an additional 4,411 shares during the last quarter. 76.84% of the stock is owned by institutional investors.

About Zions Bancorporation, National Association

(

Get Free Report)

Zions Bancorporation, National Association provides various banking products and related services primarily in the states of Arizona, California, Colorado, Idaho, Nevada, New Mexico, Oregon, Texas, Utah, Washington, and Wyoming. It operates through Zions Bank, California Bank & Trust, Amegy Bank, National Bank of Arizona, Nevada State Bank, Vectra Bank Colorado, and The Commerce Bank of Washington segments.

Further Reading

Before you consider Zions Bancorporation, National Association, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zions Bancorporation, National Association wasn't on the list.

While Zions Bancorporation, National Association currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report