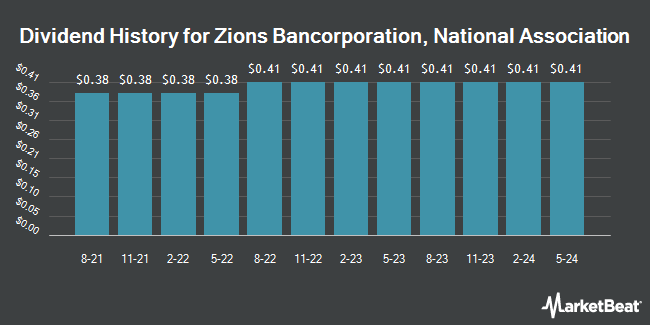

Zions Bancorporation, National Association (NASDAQ:ZION - Get Free Report) announced a quarterly dividend on Friday, November 1st, RTT News reports. Shareholders of record on Thursday, November 14th will be paid a dividend of 0.43 per share by the bank on Thursday, November 21st. This represents a $1.72 dividend on an annualized basis and a yield of 3.34%. This is a boost from Zions Bancorporation, National Association's previous quarterly dividend of $0.41.

Zions Bancorporation, National Association has increased its dividend payment by an average of 6.4% per year over the last three years and has raised its dividend annually for the last 11 consecutive years. Zions Bancorporation, National Association has a payout ratio of 33.6% meaning its dividend is sufficiently covered by earnings. Analysts expect Zions Bancorporation, National Association to earn $4.87 per share next year, which means the company should continue to be able to cover its $1.64 annual dividend with an expected future payout ratio of 33.7%.

Zions Bancorporation, National Association Stock Performance

ZION traded down $0.62 on Friday, reaching $51.44. 938,480 shares of the stock were exchanged, compared to its average volume of 2,089,483. The company's 50-day moving average price is $48.50 and its 200 day moving average price is $45.78. The firm has a market capitalization of $7.60 billion, a PE ratio of 11.86, a PEG ratio of 1.87 and a beta of 1.09. Zions Bancorporation, National Association has a fifty-two week low of $31.63 and a fifty-two week high of $53.85. The company has a debt-to-equity ratio of 0.09, a current ratio of 0.78 and a quick ratio of 0.78.

Zions Bancorporation, National Association (NASDAQ:ZION - Get Free Report) last released its quarterly earnings data on Monday, October 21st. The bank reported $1.37 earnings per share for the quarter, beating analysts' consensus estimates of $1.16 by $0.21. Zions Bancorporation, National Association had a return on equity of 13.89% and a net margin of 14.09%. The business had revenue of $1.28 billion during the quarter, compared to analyst estimates of $781.63 million. During the same quarter last year, the business posted $1.13 EPS. As a group, sell-side analysts forecast that Zions Bancorporation, National Association will post 4.79 EPS for the current fiscal year.

Insider Buying and Selling at Zions Bancorporation, National Association

In other Zions Bancorporation, National Association news, EVP Jennifer Anne Smith sold 4,385 shares of Zions Bancorporation, National Association stock in a transaction that occurred on Wednesday, October 30th. The stock was sold at an average price of $53.46, for a total value of $234,422.10. Following the sale, the executive vice president now owns 24,714 shares of the company's stock, valued at approximately $1,321,210.44. The trade was a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. 2.22% of the stock is owned by corporate insiders.

Wall Street Analyst Weigh In

Several brokerages recently weighed in on ZION. Compass Point increased their price objective on Zions Bancorporation, National Association from $49.00 to $54.00 and gave the stock a "neutral" rating in a research report on Wednesday, October 23rd. Argus lowered Zions Bancorporation, National Association from a "buy" rating to a "hold" rating in a research report on Thursday, July 25th. Morgan Stanley increased their price objective on Zions Bancorporation, National Association from $54.00 to $56.00 and gave the stock an "equal weight" rating in a research report on Tuesday, October 22nd. Royal Bank of Canada increased their price objective on Zions Bancorporation, National Association from $55.00 to $57.00 and gave the stock a "sector perform" rating in a research report on Tuesday, October 22nd. Finally, JPMorgan Chase & Co. lowered their price objective on Zions Bancorporation, National Association from $58.00 to $54.00 and set a "neutral" rating for the company in a research report on Wednesday, October 9th. One investment analyst has rated the stock with a sell rating, eighteen have issued a hold rating and one has given a buy rating to the company's stock. According to MarketBeat.com, the stock presently has a consensus rating of "Hold" and an average target price of $53.12.

View Our Latest Stock Report on Zions Bancorporation, National Association

About Zions Bancorporation, National Association

(

Get Free Report)

Zions Bancorporation, National Association provides various banking products and related services primarily in the states of Arizona, California, Colorado, Idaho, Nevada, New Mexico, Oregon, Texas, Utah, Washington, and Wyoming. It operates through Zions Bank, California Bank & Trust, Amegy Bank, National Bank of Arizona, Nevada State Bank, Vectra Bank Colorado, and The Commerce Bank of Washington segments.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Zions Bancorporation, National Association, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zions Bancorporation, National Association wasn't on the list.

While Zions Bancorporation, National Association currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.