Lmcg Investments LLC raised its stake in Zscaler, Inc. (NASDAQ:ZS - Free Report) by 76.8% in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 13,229 shares of the company's stock after acquiring an additional 5,748 shares during the quarter. Lmcg Investments LLC's holdings in Zscaler were worth $2,261,000 as of its most recent SEC filing.

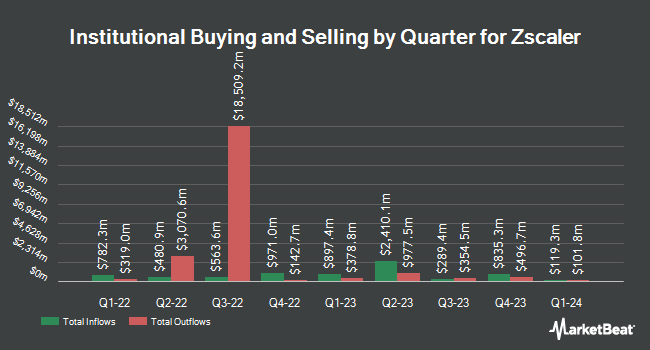

A number of other institutional investors and hedge funds have also recently made changes to their positions in ZS. Vanguard Group Inc. increased its holdings in Zscaler by 1.3% in the 1st quarter. Vanguard Group Inc. now owns 8,961,774 shares of the company's stock worth $1,726,307,000 after purchasing an additional 118,002 shares in the last quarter. Bank of New York Mellon Corp increased its stake in shares of Zscaler by 5.3% in the second quarter. Bank of New York Mellon Corp now owns 496,047 shares of the company's stock valued at $95,335,000 after buying an additional 25,181 shares during the period. Federated Hermes Inc. boosted its position in Zscaler by 18.3% during the 2nd quarter. Federated Hermes Inc. now owns 394,698 shares of the company's stock worth $75,857,000 after buying an additional 61,037 shares during the period. Acadian Asset Management LLC boosted its position in Zscaler by 0.9% during the 1st quarter. Acadian Asset Management LLC now owns 336,197 shares of the company's stock worth $64,744,000 after buying an additional 2,937 shares during the period. Finally, Ensign Peak Advisors Inc grew its holdings in Zscaler by 14.4% during the 2nd quarter. Ensign Peak Advisors Inc now owns 295,525 shares of the company's stock worth $56,797,000 after acquiring an additional 37,137 shares during the last quarter. Institutional investors own 46.45% of the company's stock.

Insider Buying and Selling

In related news, insider Robert Schlossman sold 1,435 shares of the stock in a transaction that occurred on Wednesday, October 9th. The stock was sold at an average price of $181.70, for a total transaction of $260,739.50. Following the completion of the sale, the insider now directly owns 105,806 shares of the company's stock, valued at approximately $19,224,950.20. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. In related news, insider Robert Schlossman sold 1,435 shares of the stock in a transaction dated Wednesday, October 9th. The shares were sold at an average price of $181.70, for a total transaction of $260,739.50. Following the completion of the transaction, the insider now owns 105,806 shares in the company, valued at approximately $19,224,950.20. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, CEO Jagtar Singh Chaudhry sold 2,852 shares of the firm's stock in a transaction dated Tuesday, September 17th. The stock was sold at an average price of $171.28, for a total transaction of $488,490.56. Following the sale, the chief executive officer now owns 361,432 shares of the company's stock, valued at $61,906,072.96. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 30,502 shares of company stock worth $5,256,651. 19.20% of the stock is owned by insiders.

Analysts Set New Price Targets

ZS has been the topic of a number of recent research reports. Needham & Company LLC cut their price target on shares of Zscaler from $290.00 to $235.00 and set a "strong-buy" rating on the stock in a report on Wednesday, September 4th. BNP Paribas started coverage on Zscaler in a report on Tuesday, October 8th. They set a "neutral" rating and a $180.00 target price on the stock. Royal Bank of Canada reissued an "outperform" rating and issued a $230.00 price target on shares of Zscaler in a research note on Wednesday, September 4th. Robert W. Baird lowered their price objective on Zscaler from $260.00 to $225.00 and set an "outperform" rating for the company in a research report on Wednesday, September 4th. Finally, JMP Securities reiterated a "market outperform" rating and issued a $270.00 target price on shares of Zscaler in a report on Wednesday, September 4th. Ten equities research analysts have rated the stock with a hold rating, twenty-three have given a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $216.73.

Check Out Our Latest Stock Analysis on Zscaler

Zscaler Stock Up 1.0 %

ZS stock traded up $1.80 during mid-day trading on Friday, reaching $182.59. 1,239,157 shares of the company traded hands, compared to its average volume of 1,548,996. The firm's 50 day moving average price is $179.63 and its 200 day moving average price is $180.85. The stock has a market cap of $27.84 billion, a price-to-earnings ratio of -456.46 and a beta of 0.82. Zscaler, Inc. has a fifty-two week low of $153.45 and a fifty-two week high of $259.61.

Zscaler (NASDAQ:ZS - Get Free Report) last announced its earnings results on Tuesday, September 3rd. The company reported ($0.05) earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.14) by $0.09. Zscaler had a negative return on equity of 3.46% and a negative net margin of 2.66%. The company had revenue of $592.90 million for the quarter, compared to analysts' expectations of $567.46 million. During the same quarter in the previous year, the firm earned ($0.17) earnings per share. Zscaler's quarterly revenue was up 30.3% on a year-over-year basis. On average, analysts anticipate that Zscaler, Inc. will post -0.95 EPS for the current fiscal year.

Zscaler Profile

(

Free Report)

Zscaler, Inc operates as a cloud security company worldwide. The company offers Zscaler Internet Access solution that provides users, workloads, IoT, and OT devices secure access to externally managed applications, including software-as-a-service (SaaS) applications and internet destinations; and Zscaler Private Access solution, which is designed to provide access to managed applications hosted internally in data centers, and private or public clouds.

Recommended Stories

Before you consider Zscaler, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zscaler wasn't on the list.

While Zscaler currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report