Castle Hook Partners LP lifted its stake in Natera, Inc. (NASDAQ:NTRA - Free Report) by 27.4% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 1,140,090 shares of the medical research company's stock after acquiring an additional 245,505 shares during the period. Natera accounts for approximately 2.7% of Castle Hook Partners LP's holdings, making the stock its 11th biggest position. Castle Hook Partners LP owned approximately 0.92% of Natera worth $144,734,000 at the end of the most recent reporting period.

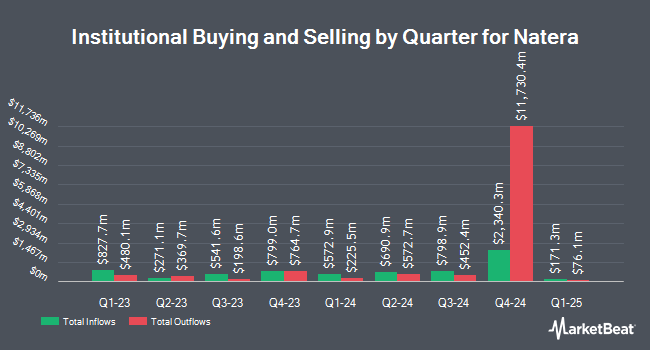

Other institutional investors and hedge funds have also made changes to their positions in the company. Farallon Capital Management LLC grew its holdings in Natera by 13.6% during the second quarter. Farallon Capital Management LLC now owns 4,460,557 shares of the medical research company's stock worth $483,034,000 after acquiring an additional 532,874 shares during the period. Massachusetts Financial Services Co. MA boosted its position in shares of Natera by 3.6% during the 3rd quarter. Massachusetts Financial Services Co. MA now owns 2,482,818 shares of the medical research company's stock valued at $315,194,000 after purchasing an additional 85,236 shares in the last quarter. Duquesne Family Office LLC grew its stake in shares of Natera by 2.4% in the 2nd quarter. Duquesne Family Office LLC now owns 1,974,880 shares of the medical research company's stock worth $213,860,000 after purchasing an additional 45,500 shares during the last quarter. Allspring Global Investments Holdings LLC raised its holdings in shares of Natera by 25.0% in the 3rd quarter. Allspring Global Investments Holdings LLC now owns 1,229,558 shares of the medical research company's stock worth $156,092,000 after purchasing an additional 246,246 shares in the last quarter. Finally, Driehaus Capital Management LLC lifted its stake in Natera by 14.6% during the second quarter. Driehaus Capital Management LLC now owns 1,220,768 shares of the medical research company's stock valued at $132,197,000 after purchasing an additional 155,802 shares during the last quarter. 99.90% of the stock is currently owned by institutional investors.

Insider Activity at Natera

In other news, CFO Michael Burkes Brophy sold 608 shares of the company's stock in a transaction dated Monday, October 21st. The stock was sold at an average price of $120.76, for a total transaction of $73,422.08. Following the completion of the sale, the chief financial officer now owns 74,014 shares in the company, valued at approximately $8,937,930.64. This represents a 0.81 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Also, CEO Steven Leonard Chapman sold 5,024 shares of the stock in a transaction dated Monday, September 16th. The shares were sold at an average price of $128.48, for a total value of $645,483.52. Following the transaction, the chief executive officer now directly owns 195,686 shares in the company, valued at approximately $25,141,737.28. This represents a 2.50 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 46,503 shares of company stock valued at $6,325,804. 7.60% of the stock is currently owned by corporate insiders.

Natera Stock Up 0.1 %

Shares of Natera stock traded up $0.13 on Thursday, hitting $168.45. 943,121 shares of the company traded hands, compared to its average volume of 1,347,435. Natera, Inc. has a 12-month low of $53.88 and a 12-month high of $171.95. The company has a quick ratio of 4.23, a current ratio of 4.39 and a debt-to-equity ratio of 0.33. The company has a market cap of $22.24 billion, a PE ratio of -95.71 and a beta of 1.53. The company has a 50-day moving average price of $133.88 and a 200 day moving average price of $119.43.

Natera (NASDAQ:NTRA - Get Free Report) last issued its earnings results on Tuesday, November 12th. The medical research company reported ($0.26) EPS for the quarter, beating analysts' consensus estimates of ($0.57) by $0.31. Natera had a negative return on equity of 26.23% and a negative net margin of 14.01%. The firm had revenue of $439.80 million for the quarter, compared to the consensus estimate of $361.43 million. During the same quarter in the previous year, the company posted ($0.95) earnings per share. The business's quarterly revenue was up 63.9% compared to the same quarter last year. Sell-side analysts predict that Natera, Inc. will post -1.66 earnings per share for the current year.

Wall Street Analyst Weigh In

Several research analysts have issued reports on the stock. Craig Hallum lifted their price target on shares of Natera from $121.00 to $157.00 and gave the stock a "buy" rating in a research report on Wednesday, November 13th. UBS Group decreased their target price on Natera from $160.00 to $145.00 and set a "buy" rating on the stock in a report on Friday, August 9th. Sanford C. Bernstein upped their target price on Natera from $125.00 to $135.00 and gave the company an "outperform" rating in a report on Wednesday, October 30th. TD Cowen lifted their price target on Natera from $155.00 to $175.00 and gave the stock a "buy" rating in a research note on Wednesday, November 13th. Finally, Piper Sandler upped their price objective on shares of Natera from $150.00 to $200.00 and gave the company an "overweight" rating in a research note on Monday, November 18th. One analyst has rated the stock with a sell rating and seventeen have issued a buy rating to the company. Based on data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $140.59.

Check Out Our Latest Report on NTRA

About Natera

(

Free Report)

Natera, Inc, a diagnostics company, develops and commercializes molecular testing services worldwide. Its products include Panorama, a non-invasive prenatal test that screens for chromosomal abnormalities of a fetus, as well as in twin pregnancies; Horizon carrier screening test for individuals and couples determine if they are carriers of genetic variations that cause certain genetic conditions; Vistara single-gene NIPT screens for 25 single-gene disorders that cause severe skeletal, cardiac, and neurological conditions; Spectrum, preimplantation genetic tests for couples undergoing IVF; Anora that analyzes miscarriage tissue from women; Empower, a hereditary cancer screening test; and non-invasive prenatal paternity product, which allows a couple to establish paternity without waiting for the child to be born.

Read More

Before you consider Natera, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Natera wasn't on the list.

While Natera currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.