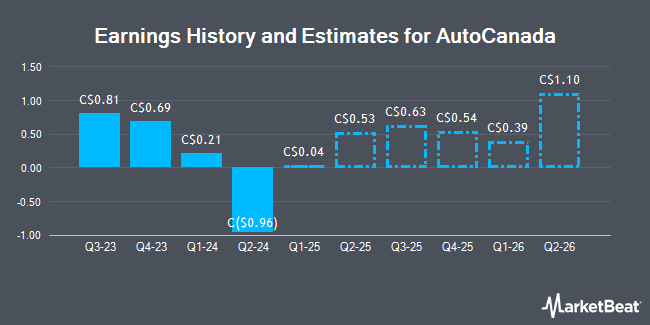

AutoCanada Inc. (TSE:ACQ - Free Report) - National Bank Financial lifted their Q2 2025 EPS estimates for shares of AutoCanada in a report released on Wednesday, March 19th. National Bank Financial analyst M. Sytchev now forecasts that the company will earn $0.71 per share for the quarter, up from their previous forecast of $0.61. The consensus estimate for AutoCanada's current full-year earnings is $2.43 per share. National Bank Financial also issued estimates for AutoCanada's FY2025 earnings at $1.87 EPS and FY2026 earnings at $4.02 EPS.

A number of other equities research analysts also recently issued reports on the company. Acumen Capital upgraded AutoCanada from a "hold" rating to a "speculative buy" rating and upped their price objective for the company from C$20.00 to C$22.50 in a research report on Friday. CIBC decreased their price target on AutoCanada from C$17.00 to C$15.00 and set an "underperform" rating on the stock in a report on Thursday, March 20th. Finally, Canaccord Genuity Group lifted their price objective on shares of AutoCanada from C$17.00 to C$22.00 and gave the stock a "strong-buy" rating in a research note on Thursday, March 20th. One analyst has rated the stock with a sell rating, five have given a hold rating, three have given a buy rating and two have issued a strong buy rating to the company's stock. According to data from MarketBeat, the company presently has an average rating of "Moderate Buy" and an average target price of C$19.98.

Read Our Latest Report on ACQ

AutoCanada Price Performance

Shares of AutoCanada stock traded down C$0.13 during trading hours on Friday, reaching C$17.40. The company's stock had a trading volume of 8,388 shares, compared to its average volume of 18,769. The company has a debt-to-equity ratio of 451.54, a current ratio of 1.03 and a quick ratio of 0.25. AutoCanada has a one year low of C$13.75 and a one year high of C$27.44. The firm has a 50 day moving average price of C$17.96 and a 200-day moving average price of C$17.15. The stock has a market cap of C$404.93 million, a P/E ratio of -8.03, a P/E/G ratio of 0.30 and a beta of 2.54.

About AutoCanada

(

Get Free Report)

AutoCanada Inc, through its subsidiaries, operates franchised automobile dealerships and related business. The company offers a range of automotive products and services, including new and used vehicles, vehicle leasing, vehicle parts, vehicle maintenance and collision repair services, and extended service contracts; and vehicle protection, after-market products, and auction services.

See Also

Before you consider AutoCanada, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AutoCanada wasn't on the list.

While AutoCanada currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.