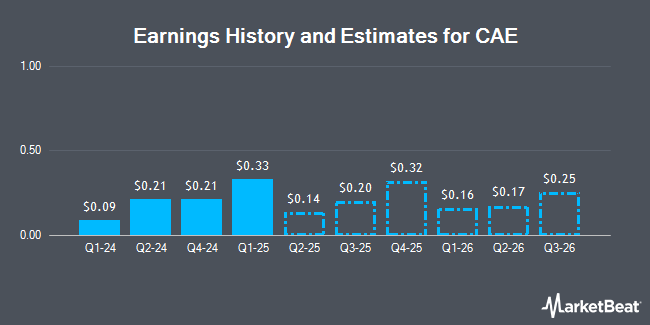

CAE Inc. (NYSE:CAE - Free Report) TSE: CAE - Stock analysts at National Bank Financial lifted their Q3 2025 earnings per share (EPS) estimates for CAE in a report issued on Tuesday, January 21st. National Bank Financial analyst C. Doerksen now forecasts that the aerospace company will post earnings of $0.18 per share for the quarter, up from their prior estimate of $0.17. National Bank Financial currently has a "Sector Perform" rating on the stock. The consensus estimate for CAE's current full-year earnings is $0.84 per share. National Bank Financial also issued estimates for CAE's FY2025 earnings at $0.83 EPS and FY2026 earnings at $0.98 EPS.

A number of other equities research analysts have also issued reports on the stock. Cibc World Mkts lowered shares of CAE from a "strong-buy" rating to a "hold" rating in a research note on Wednesday, December 4th. StockNews.com upgraded CAE from a "hold" rating to a "buy" rating in a research note on Thursday, November 14th. Desjardins raised CAE from a "hold" rating to a "buy" rating in a research note on Monday, December 23rd. Finally, TD Securities downgraded CAE from a "buy" rating to a "hold" rating in a report on Monday, January 6th. Seven analysts have rated the stock with a hold rating and three have assigned a buy rating to the stock. According to MarketBeat, the company has an average rating of "Hold" and an average target price of $25.00.

Check Out Our Latest Analysis on CAE

CAE Trading Down 0.2 %

Shares of CAE stock traded down $0.06 during trading on Friday, hitting $24.31. The stock had a trading volume of 300,507 shares, compared to its average volume of 428,534. The company has a quick ratio of 0.59, a current ratio of 0.84 and a debt-to-equity ratio of 0.62. The company has a market capitalization of $7.77 billion, a PE ratio of -31.56, a P/E/G ratio of 1.81 and a beta of 1.72. CAE has a 1 year low of $15.95 and a 1 year high of $25.53. The stock has a 50 day simple moving average of $23.80 and a 200 day simple moving average of $20.16.

Institutional Investors Weigh In On CAE

Hedge funds have recently bought and sold shares of the stock. Cromwell Holdings LLC increased its position in shares of CAE by 103.4% in the third quarter. Cromwell Holdings LLC now owns 1,800 shares of the aerospace company's stock worth $34,000 after purchasing an additional 915 shares during the period. Venturi Wealth Management LLC acquired a new position in shares of CAE during the 3rd quarter worth $74,000. Allworth Financial LP boosted its stake in CAE by 26.1% in the third quarter. Allworth Financial LP now owns 6,408 shares of the aerospace company's stock valued at $120,000 after buying an additional 1,327 shares in the last quarter. US Bancorp DE grew its stake in shares of CAE by 28.9% in the third quarter. US Bancorp DE now owns 8,052 shares of the aerospace company's stock worth $151,000 after purchasing an additional 1,803 shares during the last quarter. Finally, Centiva Capital LP acquired a new position in CAE during the 3rd quarter worth about $197,000. 67.36% of the stock is currently owned by institutional investors and hedge funds.

CAE Company Profile

(

Get Free Report)

CAE Inc, together with its subsidiaries, provides simulation training and critical operations support solutions in Canada, the United States, the United Kingdom, Europe, Asia, the Oceania, Africa, and Rest of the Americas. It operates through two segments, Civil Aviation; and Defense and Security. The Civil Aviation segment offers training solutions for flight, cabin, maintenance, and ground personnel in commercial, business, and helicopter aviation; a range of flight simulation training devices; and ab initio pilot training and crew sourcing services, as well as aircraft flight operations solutions.

See Also

Before you consider CAE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CAE wasn't on the list.

While CAE currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.