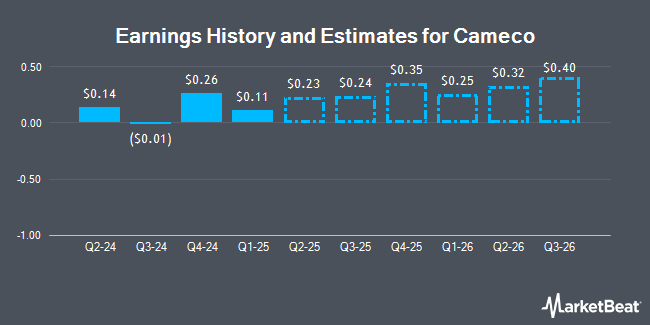

Cameco Co. (NYSE:CCJ - Free Report) TSE: CCO - Equities researchers at National Bank Financial raised their FY2025 earnings estimates for shares of Cameco in a research report issued on Wednesday, February 12th. National Bank Financial analyst M. Sidibe now expects that the basic materials company will post earnings per share of $1.12 for the year, up from their previous estimate of $1.07. The consensus estimate for Cameco's current full-year earnings is $0.42 per share. National Bank Financial also issued estimates for Cameco's FY2026 earnings at $1.30 EPS and FY2027 earnings at $1.58 EPS.

Cameco Stock Down 0.5 %

CCJ stock traded down $0.21 during midday trading on Monday, hitting $46.34. The stock had a trading volume of 5,160,361 shares, compared to its average volume of 4,605,019. The company has a debt-to-equity ratio of 0.20, a current ratio of 2.88 and a quick ratio of 1.26. The firm has a market cap of $20.17 billion, a price-to-earnings ratio of 243.89 and a beta of 0.94. The business has a 50-day moving average of $51.19 and a two-hundred day moving average of $49.64. Cameco has a 52-week low of $35.43 and a 52-week high of $62.55.

Cameco (NYSE:CCJ - Get Free Report) TSE: CCO last posted its earnings results on Thursday, February 20th. The basic materials company reported $0.26 earnings per share for the quarter, hitting analysts' consensus estimates of $0.26. Cameco had a return on equity of 3.33% and a net margin of 4.15%.

Institutional Inflows and Outflows

Several institutional investors have recently modified their holdings of the business. Sierra Ocean LLC purchased a new position in Cameco in the 4th quarter worth approximately $25,000. Hurley Capital LLC purchased a new position in shares of Cameco during the 4th quarter worth $27,000. Bank Julius Baer & Co. Ltd Zurich bought a new stake in Cameco during the fourth quarter valued at about $28,000. Pingora Partners LLC bought a new position in shares of Cameco during the 3rd quarter valued at approximately $33,000. Finally, Whipplewood Advisors LLC bought a new stake in shares of Cameco during the 4th quarter valued at $33,000. 70.21% of the stock is currently owned by institutional investors.

About Cameco

(

Get Free Report)

Cameco Corporation provides uranium for the generation of electricity. It operates through Uranium, Fuel Services, Westinghouse segments. The Uranium segment is involved in the exploration for, mining, and milling, purchase, and sale of uranium concentrate. The Fuel Services segment engages in the refining, conversion, and fabrication of uranium concentrate, as well as the purchase and sale of conversion services.

Read More

Before you consider Cameco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cameco wasn't on the list.

While Cameco currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.