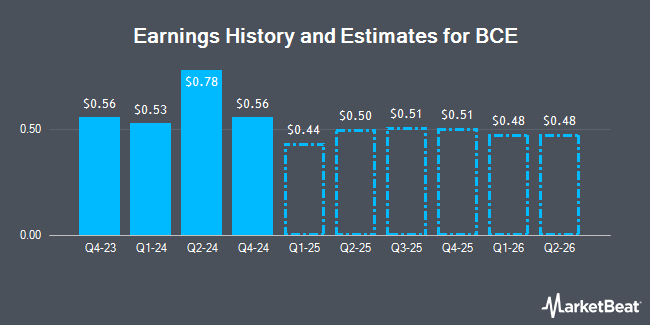

BCE Inc. (NYSE:BCE - Free Report) TSE: BCE - Analysts at National Bank Financial dropped their FY2024 earnings estimates for BCE in a report released on Thursday, November 7th. National Bank Financial analyst A. Shine now anticipates that the utilities provider will post earnings of $2.08 per share for the year, down from their previous forecast of $2.21. National Bank Financial currently has a "Hold" rating on the stock. The consensus estimate for BCE's current full-year earnings is $2.19 per share. National Bank Financial also issued estimates for BCE's FY2025 earnings at $1.89 EPS.

Several other brokerages also recently commented on BCE. BMO Capital Markets upped their price target on shares of BCE from $48.00 to $51.00 and gave the company a "market perform" rating in a report on Thursday, September 19th. Barclays reduced their price target on shares of BCE from $34.00 to $30.00 and set an "equal weight" rating for the company in a research report on Monday. Cibc World Mkts raised BCE from a "hold" rating to a "strong-buy" rating in a report on Friday, August 2nd. Edward Jones downgraded BCE from a "buy" rating to a "hold" rating in a research note on Tuesday, November 5th. Finally, Canaccord Genuity Group cut BCE from a "buy" rating to a "hold" rating in a research note on Tuesday, November 5th. Nine research analysts have rated the stock with a hold rating, one has assigned a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat.com, BCE currently has a consensus rating of "Hold" and an average target price of $45.00.

Read Our Latest Report on BCE

BCE Stock Performance

BCE stock traded down $0.36 during midday trading on Monday, hitting $28.01. The stock had a trading volume of 1,472,755 shares, compared to its average volume of 2,283,233. The firm's fifty day moving average is $33.60 and its two-hundred day moving average is $33.58. The company has a market capitalization of $25.55 billion, a PE ratio of 406.71, a P/E/G ratio of 4.37 and a beta of 0.59. BCE has a 52-week low of $27.29 and a 52-week high of $41.77. The company has a current ratio of 0.65, a quick ratio of 0.62 and a debt-to-equity ratio of 2.00.

BCE Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, January 15th. Stockholders of record on Monday, December 16th will be paid a $0.737 dividend. This is a boost from BCE's previous quarterly dividend of $0.73. The ex-dividend date is Monday, December 16th. This represents a $2.95 annualized dividend and a dividend yield of 10.52%. BCE's dividend payout ratio is presently 4,214.29%.

Institutional Investors Weigh In On BCE

A number of institutional investors have recently modified their holdings of the stock. ESL Trust Services LLC bought a new stake in shares of BCE in the first quarter worth about $31,000. Massmutual Trust Co. FSB ADV grew its position in shares of BCE by 3,480.0% in the 2nd quarter. Massmutual Trust Co. FSB ADV now owns 1,074 shares of the utilities provider's stock valued at $35,000 after acquiring an additional 1,044 shares during the period. Hexagon Capital Partners LLC grew its holdings in BCE by 121.2% during the third quarter. Hexagon Capital Partners LLC now owns 1,232 shares of the utilities provider's stock worth $43,000 after purchasing an additional 675 shares during the period. Brown Lisle Cummings Inc. grew its holdings in BCE by 60.0% in the 2nd quarter. Brown Lisle Cummings Inc. now owns 1,600 shares of the utilities provider's stock valued at $52,000 after buying an additional 600 shares in the last quarter. Finally, Bruce G. Allen Investments LLC raised its stake in BCE by 321.0% in the third quarter. Bruce G. Allen Investments LLC now owns 1,663 shares of the utilities provider's stock valued at $58,000 after purchasing an additional 1,268 shares in the last quarter. Institutional investors and hedge funds own 41.46% of the company's stock.

About BCE

(

Get Free Report)

BCE Inc, a communications company, provides wireless, wireline, Internet, and television (TV) services to residential, business, and wholesale customers in Canada. The company operates through two segments, Bell Communication and Technology Services, and Bell Media. The Bell Communication and Technology Services segment provides wireless products and services including mobile data and voice plans and devices; wireline products and services comprising data, including internet access, internet protocol television, cloud-based services, and business solutions, as well as voice, and other communication services and products; and satellite TV and connectivity services for residential, small and medium-sized business, government, and large enterprise customers.

Featured Stories

Before you consider BCE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BCE wasn't on the list.

While BCE currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.