The Bank of Nova Scotia (NYSE:BNS - Free Report) TSE: BNS - Equities research analysts at National Bank Financial issued their FY2026 earnings per share (EPS) estimates for Bank of Nova Scotia in a research report issued to clients and investors on Tuesday, November 19th. National Bank Financial analyst G. Dechaine forecasts that the bank will post earnings per share of $5.86 for the year. The consensus estimate for Bank of Nova Scotia's current full-year earnings is $4.75 per share.

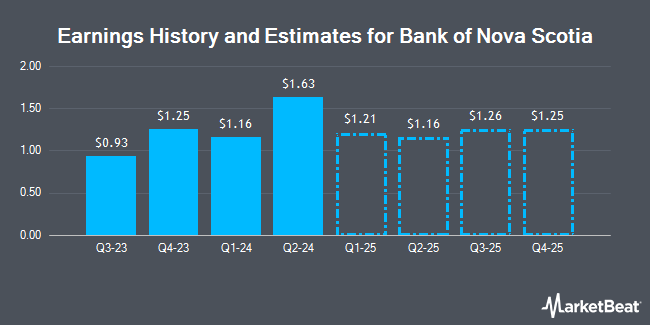

Bank of Nova Scotia (NYSE:BNS - Get Free Report) TSE: BNS last issued its earnings results on Tuesday, August 27th. The bank reported $1.63 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.62 by $0.01. The business had revenue of $8.36 billion for the quarter, compared to analyst estimates of $8.53 billion. Bank of Nova Scotia had a net margin of 9.84% and a return on equity of 11.14%. The company's revenue for the quarter was up 3.7% on a year-over-year basis. During the same quarter in the prior year, the business posted $1.30 EPS.

Other research analysts have also issued research reports about the company. Canaccord Genuity Group upgraded Bank of Nova Scotia from a "hold" rating to a "buy" rating in a research report on Tuesday. TD Securities raised Bank of Nova Scotia from a "hold" rating to a "buy" rating in a report on Monday, November 4th. Bank of America upgraded Bank of Nova Scotia from a "neutral" rating to a "buy" rating in a research report on Tuesday. Canaccord Genuity Group raised Bank of Nova Scotia from a "hold" rating to a "buy" rating in a research note on Tuesday. Finally, Barclays upgraded shares of Bank of Nova Scotia from an "underweight" rating to an "equal weight" rating in a research report on Thursday. One research analyst has rated the stock with a sell rating, three have issued a hold rating, five have issued a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat.com, Bank of Nova Scotia has a consensus rating of "Moderate Buy" and an average target price of $69.00.

View Our Latest Report on Bank of Nova Scotia

Bank of Nova Scotia Stock Performance

Bank of Nova Scotia stock opened at $56.30 on Thursday. The company has a market cap of $70.06 billion, a PE ratio of 13.47, a P/E/G ratio of 1.67 and a beta of 1.05. Bank of Nova Scotia has a 12 month low of $41.80 and a 12 month high of $56.44. The company has a fifty day moving average price of $53.24 and a two-hundred day moving average price of $49.29. The company has a debt-to-equity ratio of 0.61, a current ratio of 1.02 and a quick ratio of 1.02.

Institutional Trading of Bank of Nova Scotia

Hedge funds and other institutional investors have recently made changes to their positions in the business. Rathbones Group PLC grew its position in Bank of Nova Scotia by 11.8% in the second quarter. Rathbones Group PLC now owns 136,337 shares of the bank's stock worth $6,235,000 after buying an additional 14,379 shares during the last quarter. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp boosted its stake in shares of Bank of Nova Scotia by 2,455.8% during the 2nd quarter. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp now owns 1,521,906 shares of the bank's stock worth $69,627,000 after acquiring an additional 1,462,360 shares in the last quarter. Intact Investment Management Inc. grew its holdings in shares of Bank of Nova Scotia by 48.3% in the 3rd quarter. Intact Investment Management Inc. now owns 1,563,594 shares of the bank's stock worth $85,201,000 after acquiring an additional 509,120 shares during the last quarter. Mackenzie Financial Corp lifted its holdings in shares of Bank of Nova Scotia by 4.7% during the second quarter. Mackenzie Financial Corp now owns 15,091,880 shares of the bank's stock valued at $690,438,000 after purchasing an additional 683,946 shares during the last quarter. Finally, Pathway Financial Advisers LLC boosted its position in shares of Bank of Nova Scotia by 5,380.9% in the 3rd quarter. Pathway Financial Advisers LLC now owns 3,972,234 shares of the bank's stock valued at $216,447,000 after purchasing an additional 3,899,760 shares during the period. 49.13% of the stock is currently owned by institutional investors.

Bank of Nova Scotia Cuts Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Tuesday, October 29th. Stockholders of record on Wednesday, October 2nd were given a dividend of $0.768 per share. The ex-dividend date was Wednesday, October 2nd. This represents a $3.07 annualized dividend and a dividend yield of 5.46%. Bank of Nova Scotia's dividend payout ratio (DPR) is 74.88%.

Bank of Nova Scotia Company Profile

(

Get Free Report)

The Bank of Nova Scotia provides various banking products and services in Canada, the United States, Mexico, Peru, Chile, Colombia, the Caribbean and Central America, and internationally. It operates through Canadian Banking, International Banking, Global Wealth Management, and Global Banking and Markets segments.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Bank of Nova Scotia, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bank of Nova Scotia wasn't on the list.

While Bank of Nova Scotia currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.