National Bank of Canada FI increased its holdings in shares of Arm Holdings plc (NASDAQ:ARM - Free Report) by 194.3% during the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 27,080 shares of the company's stock after buying an additional 17,877 shares during the quarter. National Bank of Canada FI's holdings in ARM were worth $3,341,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

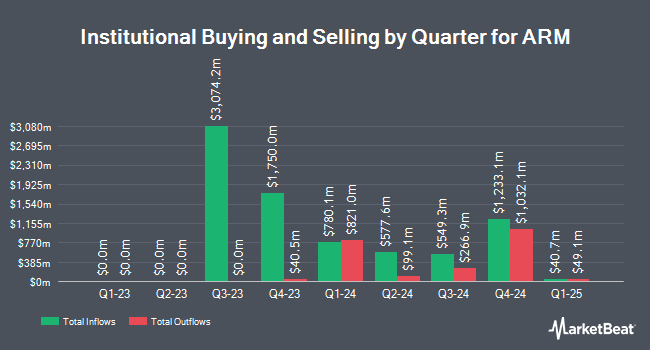

Several other hedge funds also recently added to or reduced their stakes in the business. Berbice Capital Management LLC purchased a new stake in shares of ARM during the fourth quarter valued at $49,000. Valley National Advisers Inc. grew its stake in ARM by 13.3% during the 4th quarter. Valley National Advisers Inc. now owns 613 shares of the company's stock valued at $75,000 after purchasing an additional 72 shares during the last quarter. MCF Advisors LLC acquired a new position in shares of ARM in the fourth quarter valued at about $83,000. Farther Finance Advisors LLC raised its stake in shares of ARM by 108.6% in the fourth quarter. Farther Finance Advisors LLC now owns 870 shares of the company's stock worth $107,000 after purchasing an additional 453 shares during the last quarter. Finally, Harbour Investments Inc. boosted its position in ARM by 40.1% in the fourth quarter. Harbour Investments Inc. now owns 902 shares of the company's stock valued at $111,000 after buying an additional 258 shares during the last quarter. 7.53% of the stock is owned by institutional investors and hedge funds.

ARM Price Performance

NASDAQ ARM traded up $3.53 during trading hours on Friday, hitting $103.99. 6,475,258 shares of the company's stock traded hands, compared to its average volume of 7,551,767. The company has a market capitalization of $108.96 billion, a PE ratio of 136.83, a PEG ratio of 6.33 and a beta of 4.48. Arm Holdings plc has a 52-week low of $80.00 and a 52-week high of $188.75. The firm's 50-day moving average is $125.98 and its 200-day moving average is $137.14.

Analyst Upgrades and Downgrades

ARM has been the subject of several research reports. Raymond James lifted their price objective on shares of ARM from $160.00 to $175.00 and gave the company an "outperform" rating in a research note on Thursday, February 6th. Needham & Company LLC restated a "hold" rating on shares of ARM in a research report on Thursday, February 6th. Jefferies Financial Group lifted their price objective on ARM from $170.00 to $195.00 and gave the company a "buy" rating in a research note on Thursday, February 6th. JPMorgan Chase & Co. upped their target price on ARM from $160.00 to $175.00 and gave the stock an "overweight" rating in a research note on Thursday, February 6th. Finally, The Goldman Sachs Group lifted their price target on ARM from $159.00 to $174.00 and gave the company a "buy" rating in a research report on Thursday, February 6th. Two research analysts have rated the stock with a sell rating, six have issued a hold rating, eighteen have issued a buy rating and one has issued a strong buy rating to the company. According to MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average price target of $164.76.

Read Our Latest Analysis on ARM

ARM Company Profile

(

Free Report)

Arm Holdings Plc engages in the licensing, marketing, research, and development of microprocessors, systems IP, graphics processing units, physical IP and associated systems IP, software, and tools. It operates through the following geographical segments: United Kingdom, United States, and Other Countries.

Further Reading

Before you consider ARM, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ARM wasn't on the list.

While ARM currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for April 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.