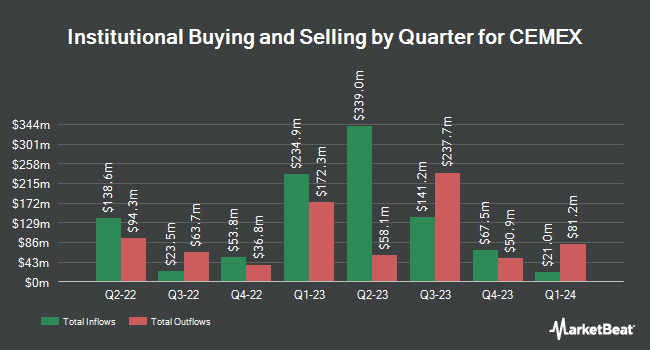

National Bank of Canada FI cut its holdings in CEMEX, S.A.B. de C.V. (NYSE:CX - Free Report) by 78.0% during the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 199,355 shares of the construction company's stock after selling 708,845 shares during the quarter. National Bank of Canada FI's holdings in CEMEX were worth $1,216,000 at the end of the most recent quarter.

Several other institutional investors have also added to or reduced their stakes in CX. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC bought a new position in CEMEX during the third quarter valued at approximately $190,346,000. Principal Financial Group Inc. lifted its holdings in shares of CEMEX by 0.6% during the 2nd quarter. Principal Financial Group Inc. now owns 19,983,888 shares of the construction company's stock valued at $127,697,000 after buying an additional 112,479 shares during the period. AQR Capital Management LLC boosted its stake in shares of CEMEX by 28.4% in the 2nd quarter. AQR Capital Management LLC now owns 19,057,965 shares of the construction company's stock worth $121,113,000 after buying an additional 4,217,562 shares during the last quarter. RWC Asset Advisors US LLC grew its holdings in shares of CEMEX by 32.3% in the second quarter. RWC Asset Advisors US LLC now owns 15,555,171 shares of the construction company's stock worth $99,398,000 after acquiring an additional 3,796,262 shares during the period. Finally, Perpetual Ltd increased its position in CEMEX by 12.6% during the third quarter. Perpetual Ltd now owns 10,014,640 shares of the construction company's stock valued at $61,089,000 after acquiring an additional 1,117,379 shares during the last quarter. 82.97% of the stock is currently owned by hedge funds and other institutional investors.

CEMEX Price Performance

CX stock traded up $0.02 during trading on Friday, reaching $5.60. The company's stock had a trading volume of 8,161,043 shares, compared to its average volume of 8,766,903. The company's fifty day moving average is $5.67 and its 200-day moving average is $6.11. The company has a quick ratio of 0.73, a current ratio of 0.98 and a debt-to-equity ratio of 0.49. CEMEX, S.A.B. de C.V. has a 1 year low of $5.00 and a 1 year high of $9.27. The company has a market capitalization of $8.11 billion, a P/E ratio of 18.67 and a beta of 1.50.

CEMEX Announces Dividend

The business also recently announced a dividend, which will be paid on Wednesday, December 18th. Stockholders of record on Tuesday, December 10th will be issued a $0.0207 dividend. The ex-dividend date is Tuesday, December 10th. CEMEX's dividend payout ratio (DPR) is presently 20.00%.

Analysts Set New Price Targets

Several brokerages have issued reports on CX. Royal Bank of Canada cut CEMEX from a "sector perform" rating to an "underperform" rating and dropped their target price for the stock from $6.00 to $5.00 in a research report on Wednesday. Barclays cut their target price on shares of CEMEX from $9.00 to $8.00 and set an "overweight" rating for the company in a research report on Tuesday, October 29th. StockNews.com cut shares of CEMEX from a "strong-buy" rating to a "buy" rating in a research note on Friday, October 11th. Scotiabank reduced their price objective on CEMEX from $10.00 to $8.90 and set a "sector outperform" rating for the company in a research note on Tuesday, October 29th. Finally, JPMorgan Chase & Co. downgraded CEMEX from an "overweight" rating to a "neutral" rating and decreased their price objective for the stock from $7.00 to $6.00 in a research note on Tuesday, October 29th. One analyst has rated the stock with a sell rating, two have issued a hold rating and four have issued a buy rating to the company. Based on data from MarketBeat, CEMEX presently has an average rating of "Hold" and a consensus target price of $7.65.

View Our Latest Stock Report on CEMEX

About CEMEX

(

Free Report)

CEMEX, SAB. de C.V., together with its subsidiaries, produces, markets, distributes, and sells cement, ready-mix concrete, aggregates, urbanization solutions, and other construction materials and services worldwide. The company offers gray ordinary portland, white portland, oil-well, and blended cement products; mortar; and standard ready-mix, architectural and decorative, rapid-setting, fiber-reinforced, fluid-fill, roller-compacted, self-consolidating, pervious, and antibacterial, and other concrete products.

Recommended Stories

Before you consider CEMEX, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CEMEX wasn't on the list.

While CEMEX currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.