National Bank of Canada FI grew its position in shares of Brookfield Business Partners L.P. (NYSE:BBU - Free Report) by 63.8% in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 159,883 shares of the business services provider's stock after acquiring an additional 62,299 shares during the period. National Bank of Canada FI owned about 0.22% of Brookfield Business Partners worth $3,775,000 as of its most recent SEC filing.

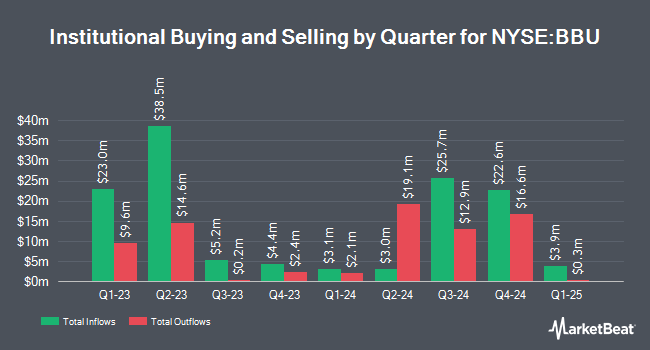

Other institutional investors also recently modified their holdings of the company. Principal Financial Group Inc. increased its position in Brookfield Business Partners by 29.9% during the 3rd quarter. Principal Financial Group Inc. now owns 117,189 shares of the business services provider's stock valued at $2,731,000 after purchasing an additional 26,947 shares during the period. Caldwell Investment Management Ltd. bought a new position in Brookfield Business Partners in the fourth quarter worth about $1,731,000. Toronto Dominion Bank raised its stake in Brookfield Business Partners by 12,276.3% in the third quarter. Toronto Dominion Bank now owns 260,769 shares of the business services provider's stock worth $6,076,000 after buying an additional 258,662 shares in the last quarter. PCJ Investment Counsel Ltd. lifted its holdings in Brookfield Business Partners by 6.6% in the fourth quarter. PCJ Investment Counsel Ltd. now owns 1,618,655 shares of the business services provider's stock worth $38,041,000 after buying an additional 99,763 shares during the period. Finally, Bank of New York Mellon Corp boosted its position in Brookfield Business Partners by 8.9% during the 4th quarter. Bank of New York Mellon Corp now owns 17,724 shares of the business services provider's stock valued at $415,000 after acquiring an additional 1,448 shares in the last quarter. 85.04% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

A number of research firms have recently commented on BBU. Royal Bank of Canada lowered their target price on Brookfield Business Partners from $32.00 to $30.00 and set an "outperform" rating for the company in a research note on Monday, February 3rd. BMO Capital Markets boosted their target price on shares of Brookfield Business Partners from $32.00 to $34.00 and gave the company an "outperform" rating in a report on Friday, January 10th. Finally, Scotiabank reiterated an "outperform" rating on shares of Brookfield Business Partners in a research note on Monday, February 3rd.

Get Our Latest Analysis on Brookfield Business Partners

Brookfield Business Partners Stock Down 1.2 %

NYSE:BBU traded down $0.24 during trading hours on Friday, reaching $20.34. 9,573 shares of the company traded hands, compared to its average volume of 15,108. The company has a current ratio of 0.50, a quick ratio of 0.39 and a debt-to-equity ratio of 2.12. The business's 50-day moving average price is $23.27 and its two-hundred day moving average price is $23.33. Brookfield Business Partners L.P. has a 1 year low of $16.85 and a 1 year high of $26.75. The stock has a market capitalization of $1.85 billion, a P/E ratio of -41.51 and a beta of 1.34.

Brookfield Business Partners (NYSE:BBU - Get Free Report) last issued its quarterly earnings results on Friday, January 31st. The business services provider reported $1.47 earnings per share for the quarter, beating the consensus estimate of $0.14 by $1.33. Brookfield Business Partners had a return on equity of 5.09% and a net margin of 2.20%. Analysts predict that Brookfield Business Partners L.P. will post 5.25 earnings per share for the current year.

Brookfield Business Partners Cuts Dividend

The company also recently announced a quarterly dividend, which was paid on Monday, March 31st. Stockholders of record on Friday, February 28th were paid a $0.0625 dividend. The ex-dividend date of this dividend was Friday, February 28th. This represents a $0.25 annualized dividend and a dividend yield of 1.23%. Brookfield Business Partners's dividend payout ratio is presently -51.02%.

Brookfield Business Partners Profile

(

Free Report)

Brookfield Business Partners L.P. is a private equity firm specializing in acquisition. The firm typically invests in business services, infrastructure services, construction, energy, and industrials sector. It prefers to take majority stake in companies. The firm seeks returns of at least 15% on its investments.

Featured Articles

Before you consider Brookfield Business Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brookfield Business Partners wasn't on the list.

While Brookfield Business Partners currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.