National Bank of Canada FI increased its stake in Consolidated Edison, Inc. (NYSE:ED - Free Report) by 350.6% during the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 620,705 shares of the utilities provider's stock after buying an additional 482,953 shares during the period. National Bank of Canada FI owned 0.18% of Consolidated Edison worth $64,634,000 as of its most recent filing with the Securities & Exchange Commission.

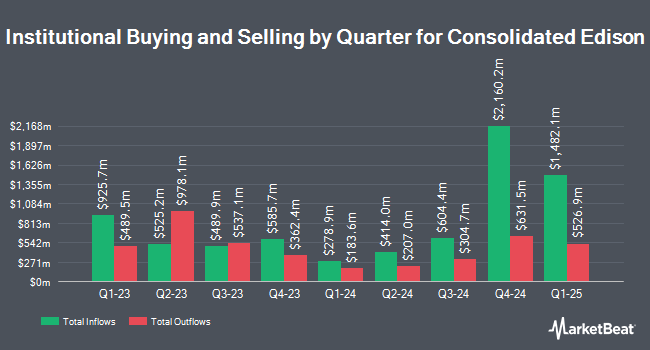

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Pathway Financial Advisers LLC grew its stake in shares of Consolidated Edison by 10,302.6% in the third quarter. Pathway Financial Advisers LLC now owns 24,446 shares of the utilities provider's stock worth $2,546,000 after acquiring an additional 24,211 shares during the last quarter. National Pension Service grew its position in Consolidated Edison by 7.0% during the 3rd quarter. National Pension Service now owns 468,572 shares of the utilities provider's stock valued at $48,792,000 after purchasing an additional 30,838 shares during the last quarter. Czech National Bank increased its stake in Consolidated Edison by 8.5% during the 2nd quarter. Czech National Bank now owns 65,902 shares of the utilities provider's stock valued at $5,893,000 after purchasing an additional 5,161 shares in the last quarter. Parallel Advisors LLC raised its holdings in Consolidated Edison by 12.1% in the second quarter. Parallel Advisors LLC now owns 8,032 shares of the utilities provider's stock worth $718,000 after buying an additional 869 shares during the last quarter. Finally, Cambridge Investment Research Advisors Inc. lifted its stake in shares of Consolidated Edison by 28.4% in the second quarter. Cambridge Investment Research Advisors Inc. now owns 110,391 shares of the utilities provider's stock worth $9,871,000 after buying an additional 24,432 shares in the last quarter. Institutional investors own 66.29% of the company's stock.

Analyst Upgrades and Downgrades

Several equities research analysts recently weighed in on the stock. UBS Group raised their price target on shares of Consolidated Edison from $105.00 to $106.00 and gave the company a "neutral" rating in a research report on Friday, September 20th. Evercore ISI raised Consolidated Edison from a "hold" rating to a "strong-buy" rating in a report on Friday, November 8th. Morgan Stanley lowered their price target on Consolidated Edison from $88.00 to $85.00 and set an "underweight" rating on the stock in a report on Friday, November 22nd. Barclays reduced their price objective on Consolidated Edison from $104.00 to $99.00 and set an "underweight" rating for the company in a report on Friday, November 8th. Finally, Jefferies Financial Group started coverage on shares of Consolidated Edison in a research note on Wednesday, October 9th. They set a "hold" rating and a $108.00 target price on the stock. Three analysts have rated the stock with a sell rating, eight have assigned a hold rating, two have given a buy rating and two have given a strong buy rating to the stock. According to MarketBeat.com, Consolidated Edison currently has an average rating of "Hold" and a consensus price target of $99.13.

Get Our Latest Report on ED

Consolidated Edison Stock Performance

Shares of Consolidated Edison stock traded down $1.68 on Friday, hitting $94.82. 2,813,515 shares of the company's stock were exchanged, compared to its average volume of 2,141,924. Consolidated Edison, Inc. has a 1 year low of $85.85 and a 1 year high of $107.75. The company has a 50-day simple moving average of $101.08 and a 200-day simple moving average of $98.22. The company has a debt-to-equity ratio of 1.07, a quick ratio of 0.93 and a current ratio of 1.01. The stock has a market capitalization of $32.85 billion, a PE ratio of 17.86, a PEG ratio of 3.24 and a beta of 0.36.

Consolidated Edison (NYSE:ED - Get Free Report) last released its earnings results on Thursday, November 7th. The utilities provider reported $1.68 earnings per share for the quarter, beating the consensus estimate of $1.56 by $0.12. The company had revenue of $4.09 billion for the quarter, compared to the consensus estimate of $4.02 billion. Consolidated Edison had a return on equity of 8.70% and a net margin of 12.27%. As a group, equities analysts anticipate that Consolidated Edison, Inc. will post 5.34 EPS for the current year.

Consolidated Edison Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Monday, December 16th. Shareholders of record on Wednesday, November 13th will be paid a dividend of $0.83 per share. This represents a $3.32 dividend on an annualized basis and a yield of 3.50%. The ex-dividend date of this dividend is Wednesday, November 13th. Consolidated Edison's payout ratio is 62.52%.

About Consolidated Edison

(

Free Report)

Consolidated Edison, Inc, through its subsidiaries, engages in the regulated electric, gas, and steam delivery businesses in the United States. It offers electric services to approximately 3.7 million customers in New York City and Westchester County; gas to approximately 1.1 million customers in Manhattan, the Bronx, parts of Queens, and Westchester County; and steam to approximately 1,530 customers in parts of Manhattan.

Further Reading

Before you consider Consolidated Edison, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Consolidated Edison wasn't on the list.

While Consolidated Edison currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.