National Bank of Canada FI boosted its position in Nordson Co. (NASDAQ:NDSN - Free Report) by 86.3% in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 27,794 shares of the industrial products company's stock after purchasing an additional 12,873 shares during the quarter. National Bank of Canada FI's holdings in Nordson were worth $7,300,000 as of its most recent filing with the Securities and Exchange Commission.

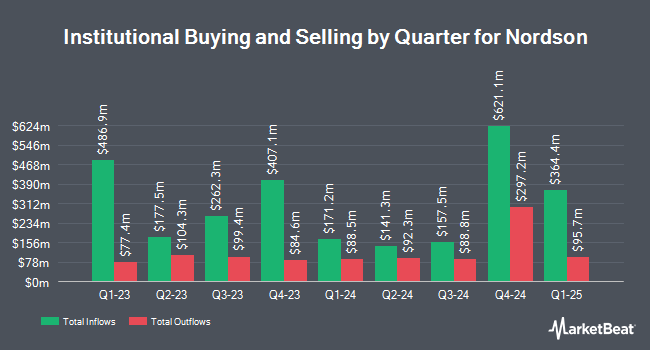

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Massachusetts Financial Services Co. MA lifted its stake in shares of Nordson by 289.2% during the second quarter. Massachusetts Financial Services Co. MA now owns 260,312 shares of the industrial products company's stock valued at $60,377,000 after buying an additional 193,421 shares during the period. State Street Corp lifted its stake in shares of Nordson by 7.2% during the 3rd quarter. State Street Corp now owns 2,638,375 shares of the industrial products company's stock worth $692,916,000 after purchasing an additional 177,282 shares during the period. International Assets Investment Management LLC boosted its holdings in shares of Nordson by 26,109.1% during the third quarter. International Assets Investment Management LLC now owns 104,050 shares of the industrial products company's stock worth $27,327,000 after purchasing an additional 103,653 shares during the last quarter. Kayne Anderson Rudnick Investment Management LLC grew its position in shares of Nordson by 2.7% in the second quarter. Kayne Anderson Rudnick Investment Management LLC now owns 2,591,323 shares of the industrial products company's stock valued at $601,032,000 after purchasing an additional 68,810 shares during the period. Finally, Natixis Advisors LLC increased its stake in Nordson by 71.0% in the third quarter. Natixis Advisors LLC now owns 157,582 shares of the industrial products company's stock valued at $41,386,000 after purchasing an additional 65,436 shares during the last quarter. 72.11% of the stock is currently owned by hedge funds and other institutional investors.

Nordson Trading Down 8.2 %

Nordson stock traded down $20.44 during midday trading on Thursday, reaching $229.11. The stock had a trading volume of 1,049,072 shares, compared to its average volume of 236,969. The stock has a market capitalization of $13.10 billion, a PE ratio of 28.02, a price-to-earnings-growth ratio of 1.89 and a beta of 0.90. The company has a debt-to-equity ratio of 0.49, a quick ratio of 1.52 and a current ratio of 2.36. The stock's 50-day simple moving average is $255.03 and its 200 day simple moving average is $245.93. Nordson Co. has a twelve month low of $222.18 and a twelve month high of $279.38.

Nordson (NASDAQ:NDSN - Get Free Report) last posted its earnings results on Wednesday, December 11th. The industrial products company reported $2.78 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $2.59 by $0.19. The firm had revenue of $744.00 million during the quarter, compared to the consensus estimate of $736.83 million. Nordson had a net margin of 17.75% and a return on equity of 19.80%. The company's revenue was up 3.5% on a year-over-year basis. During the same quarter in the prior year, the company earned $2.46 EPS. Analysts expect that Nordson Co. will post 9.55 EPS for the current year.

Insider Activity at Nordson

In related news, EVP Jennifer L. Mcdonough sold 225 shares of the business's stock in a transaction that occurred on Monday, November 11th. The stock was sold at an average price of $262.27, for a total transaction of $59,010.75. Following the transaction, the executive vice president now directly owns 3,287 shares of the company's stock, valued at approximately $862,081.49. The trade was a 6.41 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through the SEC website. Also, EVP Stephen Lovass sold 317 shares of the stock in a transaction that occurred on Monday, December 2nd. The shares were sold at an average price of $260.75, for a total transaction of $82,657.75. Following the completion of the sale, the executive vice president now directly owns 6,666 shares of the company's stock, valued at $1,738,159.50. This trade represents a 4.54 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 3,629 shares of company stock worth $914,400. 0.86% of the stock is currently owned by corporate insiders.

Analyst Ratings Changes

Separately, Robert W. Baird raised their price target on Nordson from $272.00 to $287.00 and gave the stock an "outperform" rating in a research note on Friday, August 23rd. Two investment analysts have rated the stock with a hold rating and three have issued a buy rating to the company's stock. According to MarketBeat, Nordson currently has a consensus rating of "Moderate Buy" and an average price target of $299.00.

Get Our Latest Research Report on Nordson

About Nordson

(

Free Report)

Nordson Corporation engineers, manufactures, and markets products and systems to dispense, apply, and control adhesives, coatings, polymers, sealants, biomaterials, and other fluids worldwide. It operates through three segments: Industrial Precision Solutions; Medical and Fluid Solutions; and Advanced Technology Solutions.

Featured Articles

Before you consider Nordson, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nordson wasn't on the list.

While Nordson currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.