National Bank of Canada FI lifted its stake in Fortuna Silver Mines Inc. (NYSE:FSM - Free Report) TSE: FVI by 34.6% in the fourth quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 878,019 shares of the basic materials company's stock after acquiring an additional 225,480 shares during the quarter. National Bank of Canada FI owned 0.29% of Fortuna Silver Mines worth $3,769,000 as of its most recent filing with the Securities & Exchange Commission.

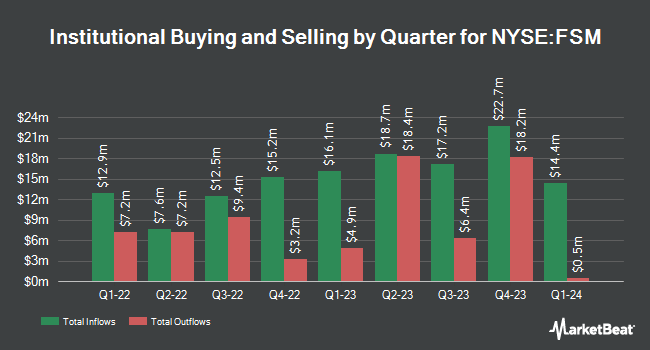

A number of other large investors have also recently made changes to their positions in the stock. Generali Investments CEE investicni spolecnost a.s. bought a new position in Fortuna Silver Mines in the fourth quarter valued at about $34,000. SeaCrest Wealth Management LLC bought a new position in shares of Fortuna Silver Mines in the 4th quarter worth approximately $45,000. Y Intercept Hong Kong Ltd purchased a new position in shares of Fortuna Silver Mines in the fourth quarter worth approximately $67,000. Kingswood Wealth Advisors LLC purchased a new stake in Fortuna Silver Mines during the fourth quarter valued at approximately $68,000. Finally, Commonwealth Equity Services LLC raised its position in Fortuna Silver Mines by 10.8% in the fourth quarter. Commonwealth Equity Services LLC now owns 20,456 shares of the basic materials company's stock worth $88,000 after acquiring an additional 2,000 shares during the period. 33.80% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

Several equities research analysts have recently commented on FSM shares. Scotiabank reduced their price objective on Fortuna Silver Mines from $6.75 to $6.00 and set a "sector perform" rating for the company in a research note on Wednesday, January 15th. National Bank Financial raised Fortuna Silver Mines to a "hold" rating in a research note on Friday, March 21st. CIBC downgraded Fortuna Silver Mines from a "neutral" rating to a "sector underperform" rating in a research note on Tuesday, February 18th. Finally, Cibc World Mkts downgraded Fortuna Silver Mines from a "hold" rating to a "strong sell" rating in a research note on Tuesday, February 18th. Two investment analysts have rated the stock with a sell rating, two have issued a hold rating and one has assigned a buy rating to the stock. According to MarketBeat.com, the stock currently has an average rating of "Hold" and an average price target of $6.00.

Get Our Latest Stock Report on FSM

Fortuna Silver Mines Price Performance

Shares of Fortuna Silver Mines stock traded up $0.25 during trading on Friday, reaching $6.48. 16,870,023 shares of the stock traded hands, compared to its average volume of 9,251,263. The company has a debt-to-equity ratio of 0.12, a current ratio of 1.94 and a quick ratio of 1.37. Fortuna Silver Mines Inc. has a 52-week low of $3.86 and a 52-week high of $6.61. The business has a fifty day simple moving average of $5.34 and a two-hundred day simple moving average of $4.93. The company has a market capitalization of $1.99 billion, a price-to-earnings ratio of 80.95 and a beta of 1.22.

Fortuna Silver Mines (NYSE:FSM - Get Free Report) TSE: FVI last announced its quarterly earnings results on Wednesday, March 5th. The basic materials company reported $0.11 EPS for the quarter, missing analysts' consensus estimates of $0.20 by ($0.09). The business had revenue of $302.20 million during the quarter, compared to the consensus estimate of $301.65 million. Fortuna Silver Mines had a net margin of 2.45% and a return on equity of 10.08%. Sell-side analysts expect that Fortuna Silver Mines Inc. will post 0.51 EPS for the current year.

Fortuna Silver Mines Profile

(

Free Report)

Fortuna Mining Corp. engages in the precious and base metal mining in Argentina, Burkina Faso, Mexico, Peru, and Côte d'Ivoire. It operates through Mansfield, Sanu, Sango, Cuzcatlan, Bateas, and Corporate segments. The company primarily explores for silver, lead, zinc, and gold. Its flagship project is the Séguéla gold mine, which consists of approximately 62,000 hectares and is located in the Worodougou Region of the Woroba District, Côte d'Ivoire.

Featured Articles

Before you consider Fortuna Silver Mines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fortuna Silver Mines wasn't on the list.

While Fortuna Silver Mines currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.