National Bank of Canada FI cut its stake in shares of Osisko Gold Royalties Ltd (NYSE:OR - Free Report) by 2.8% in the 3rd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 1,294,555 shares of the basic materials company's stock after selling 37,614 shares during the period. National Bank of Canada FI owned 0.69% of Osisko Gold Royalties worth $23,972,000 at the end of the most recent quarter.

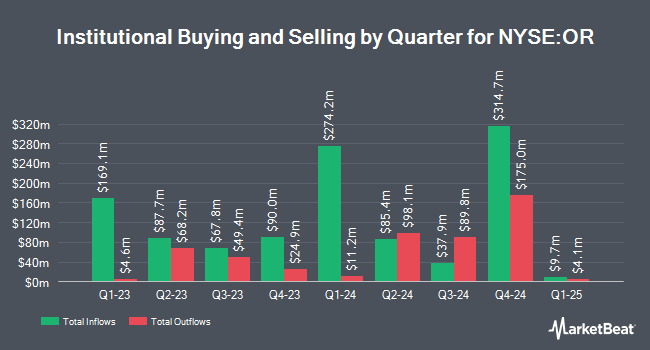

A number of other institutional investors also recently made changes to their positions in OR. Renaissance Technologies LLC boosted its holdings in Osisko Gold Royalties by 12.9% in the 2nd quarter. Renaissance Technologies LLC now owns 239,800 shares of the basic materials company's stock valued at $3,736,000 after purchasing an additional 27,400 shares during the period. Fiera Capital Corp increased its holdings in Osisko Gold Royalties by 3.7% in the 3rd quarter. Fiera Capital Corp now owns 762,075 shares of the basic materials company's stock valued at $14,133,000 after buying an additional 26,917 shares during the period. Mackenzie Financial Corp lifted its holdings in shares of Osisko Gold Royalties by 237.0% during the 2nd quarter. Mackenzie Financial Corp now owns 1,977,895 shares of the basic materials company's stock worth $30,827,000 after acquiring an additional 1,391,005 shares during the period. Principal Financial Group Inc. increased its stake in Osisko Gold Royalties by 5.7% in the third quarter. Principal Financial Group Inc. now owns 1,527,110 shares of the basic materials company's stock valued at $28,316,000 after acquiring an additional 82,150 shares during the last quarter. Finally, The Manufacturers Life Insurance Company raised its holdings in shares of Osisko Gold Royalties by 81.1% during the 2nd quarter. The Manufacturers Life Insurance Company now owns 274,253 shares of the basic materials company's stock worth $4,268,000 after buying an additional 122,827 shares in the last quarter. Institutional investors own 68.52% of the company's stock.

Wall Street Analysts Forecast Growth

Several brokerages recently commented on OR. Jefferies Financial Group increased their price objective on shares of Osisko Gold Royalties from $19.00 to $22.00 and gave the company a "buy" rating in a research note on Friday, October 4th. TD Securities lowered Osisko Gold Royalties from a "strong-buy" rating to a "hold" rating in a research note on Monday, November 11th. TD Cowen downgraded Osisko Gold Royalties from a "buy" rating to a "hold" rating in a research note on Monday, November 11th. Finally, Royal Bank of Canada cut their target price on shares of Osisko Gold Royalties from $21.00 to $20.00 and set an "outperform" rating on the stock in a research report on Tuesday, September 10th.

Check Out Our Latest Stock Analysis on OR

Osisko Gold Royalties Trading Down 0.1 %

Shares of OR traded down $0.03 during mid-day trading on Tuesday, reaching $19.58. 633,357 shares of the company were exchanged, compared to its average volume of 730,959. The business has a 50 day simple moving average of $19.67 and a two-hundred day simple moving average of $17.95. Osisko Gold Royalties Ltd has a 52 week low of $12.77 and a 52 week high of $21.29. The stock has a market capitalization of $3.65 billion, a PE ratio of -93.10 and a beta of 1.02. The company has a debt-to-equity ratio of 0.05, a quick ratio of 4.40 and a current ratio of 4.40.

Osisko Gold Royalties Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, January 15th. Investors of record on Tuesday, December 31st will be paid a dividend of $0.048 per share. The ex-dividend date of this dividend is Tuesday, December 31st. This represents a $0.19 annualized dividend and a yield of 0.98%. This is a boost from Osisko Gold Royalties's previous quarterly dividend of $0.05. Osisko Gold Royalties's dividend payout ratio (DPR) is currently -90.48%.

Osisko Gold Royalties Company Profile

(

Free Report)

Osisko Gold Royalties Ltd acquires and manages precious metal and other royalties, streams, and other interests in Canada and internationally. It also owns options on offtake; royalty/stream financings; and exclusive rights to participate in future royalty/stream financings on various projects. The company's primary asset is a 3-5% net smelter return royalty on the Canadian Malartic complex located in Canada.

Featured Articles

Before you consider Osisko Gold Royalties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Osisko Gold Royalties wasn't on the list.

While Osisko Gold Royalties currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.